Apple shares dropped 1.34% on Monday but recovered on the news at the end of the session that the company must halt sales of its Series 9 smartwatch.

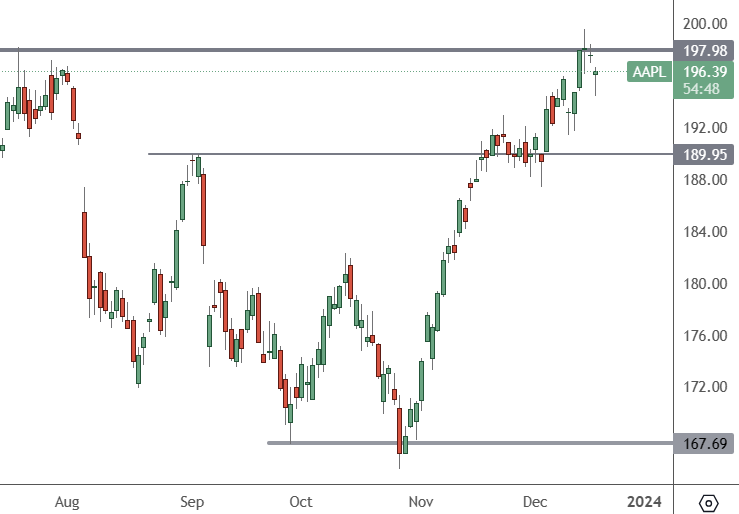

AAPL – Daily Chart

AAPL trades at $196.39 after being rejected at the recent highs near $200. The level aligns with the July highs in Apple, and a significant top cannot be ruled out.

In a blow to its Christmas sales, Apple must stop selling its Apple Watch Ultra 2 and Apple Watch Series 9 in the United States later this week.

The reason for the ban relates to a long-running dispute with the medical technology company Masimo around the Apple Watch’s blood oxygen sensor technology. The US International Trade Commission held up a judge’s ruling from October, and a Presidential review is in place until December 25.

That means the Biden administration can jump in and veto the ruling, but that is not ensured. In a statement to The Verge, Apple “strongly disagrees” with the order and is “pursuing a range of legal and technical options to ensure that Apple Watch is available to customers.”

The situation is difficult for Apple because its wearables division delivered $9.32 billion in the most recent quarter, 10% of overall net sales. The muted reaction may mean that investors expect the Biden veto. After the 25th, Apple shares could drop further to represent a more considerable sales loss over 2024.

US stocks rose again on Monday, with the S&P 500 1.1% shy of its record close in January 2022, as euphoria over the Fed’s potential rate cuts remained.