Bitcoin has rallied further after Bloomberg gave it a 90% chance that a spot exchange-traded fund (ETF) would soon be approved.

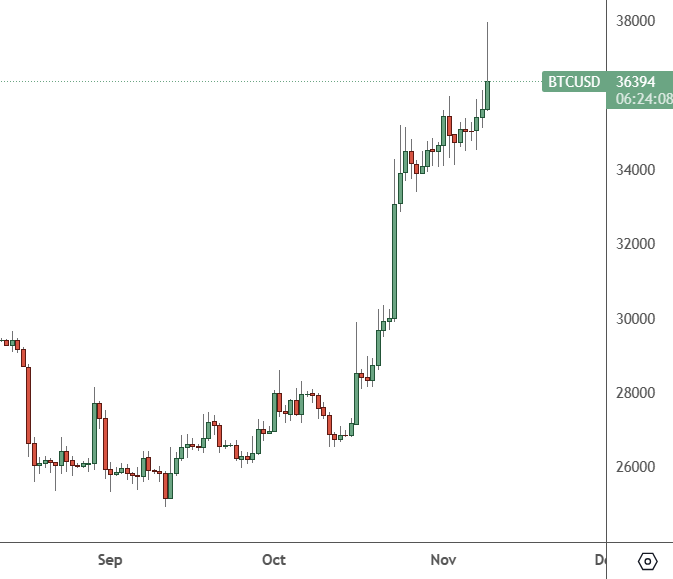

BTCUSD – Daily Chart

BTCUSD rallied as high as $37,000 on news of the ETF approval, with the price mounting an impressive surge from the levels near $25,000 in September.

Crypto has been at its highest level since May 5, 2022, just before the TerraUSD stablecoin collapsed and started a string of failures that hurt the decentralised finance industry. The highest-profile of those was the failure of the FTX crypto exchange, which went to trial last week, resulting in a long impending prison sentence for its founder over multiple counts, including money laundering and misuse of client funds.

“With Bitcoin trading back above the level when the Terra stablecoin imploded, crypto traders have officially moved on from those psychological scars,” said Markus Thielen at Matrixport research.

The Securities and Exchange Commission will soon vote on an ETF approval, including one from asset management giant BlackRock. A window of around eight days opened on Thursday for the SEC to “theoretically issue approval orders,” according to a note by Bloomberg Intelligence analysts.

“Even if approvals don’t arrive this month, we still believe there’s a 90% chance of approval by Jan. 10,” they wrote.

“The ETF expectation is the top of a growing list of catalysts, which gives the current rally further legs,” said Josh Gilbert, market analyst at social trading firm eToro. Besides the ETF, bets that the US Federal Reserve is done with rate hikes for now and next year’s Bitcoin-halving are also fueling the rally.

However, JPMorgan analyst Nikolaos Panigirtzoglou said the crypto rally “looks overdone.” He believes that even if ETFs are approved, the likely scenario is that existing capital will shift from existing products such as the Grayscale trust and Bitcoin futures ETFs.

The price of Ethereum also surged after rumours that BlackRock was planning an ETF for the second-largest cryptocurrency. The Wall Street titan registered paperwork in Delaware for the iShares Ethereum Trust.