Bitcoin saw a sharp rally after a court ruling paved the way for a healthier environment for bitcoin exchange-traded funds.

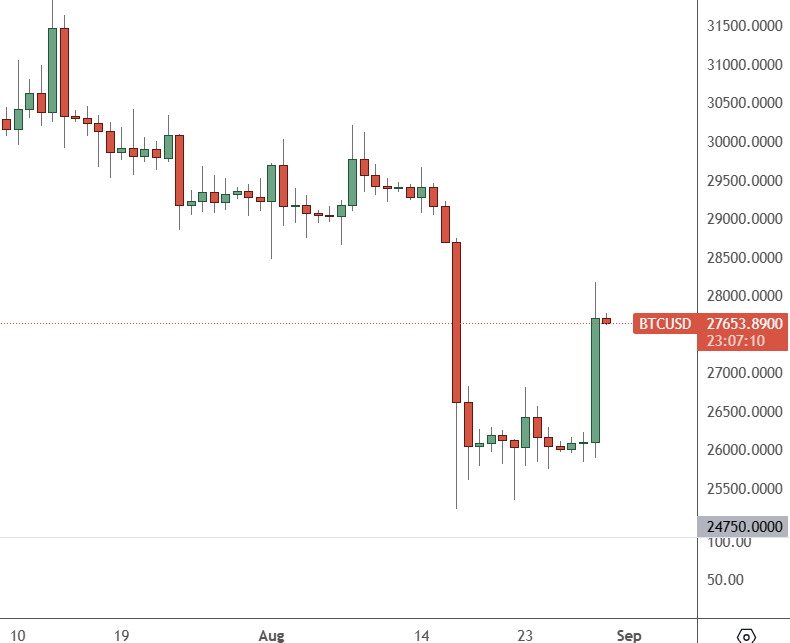

Bitcoin: Daily Chart

The price of BTC found support this week and rallied, but the coin is still lower on a weekly basis.

The Securities and Exchange Commission’s denial of Grayscale Investments’ proposal was “arbitrary and capricious”, a federal court said on Tuesday. The decision was a big victory for the digital asset manager and could open the door to the first spot-based Bitcoin ETF.

The win for Grayscale will now likely be a factor in the SEC’s future decisions for spot bitcoin ETFs filed by financial firms this year, including one from the world’s largest asset manager, BlackRock.

The market for Bitcoin trading has seen volumes at record lows recently, and the news hit the wires in a thin market, causing a surge in the world’s largest crypto.

The US regulator denied Grayscale’s application to convert its spot Grayscale Bitcoin Trust GBTC.PK into an ETF last year. While the agency has rejected spot bitcoin ETFs, it has already approved bitcoin futures ETFs. The argument from the SEC is that the futures market is better regulated and less prone to manipulation.

Other firms were denied an ETF application, but Grayscale sued the SEC, and that led to the case going straight to the appeals court.

Grayscale’s lead counsel, Donald Verrilli Jr., remarked in court back in March that a spot market bitcoin ETF would “better protect investors” because it would give them the benefit of CME regulation. Access to Bitcoin and other cryptocurrencies has also largely been available on unregulated exchanges. The addition of a bellwether ETF could see investors park money into crypto in the coming months, and the Grayscale news should see Blackrock facing a favourable ruling near ear-end.

After a rough August, Bitcoin has found some energy with the rally, but investors should be careful of the low volumes. Bitcoin should remain strong if the US stock market remains strong.