Bitcoin is trading around the $90,000 level and bulls remain in control at this level.

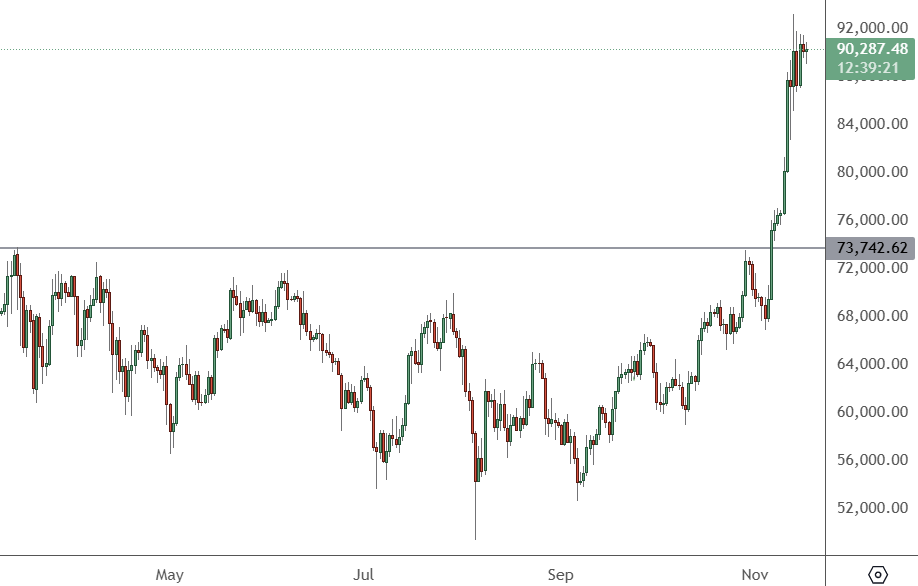

BTCUSD – Daily Chart

The price of BTC surged through the resistance at the all-time high of $73,742 and now trades around $90,000. No major selling has appeared at this level, but without any change in sentiment, sellers would be fearful of taking a major position against the trend.

Some major investment firms have been adding Bitcoin to their portfolios. Millennium Management, Capula Management, and Tudor Investment have increased their exposure to US spot bitcoin exchange-traded funds in the third quarter, according to securities filings.

The big driver of the recent rally has been Donald Trump’s election win and his ally Elon Musk has been showing his support for a crypto-friendly Treasury secretary in Howard Lutnick.

Following the election, some hedge funds have been taking advantage of a price difference between spot bitcoin and its derivatives in the futures market in a leveraged trade, according to analysts.

“Hedge funds are harvesting that spread. It creates a very tactical, opportunistic trade,” said Gabe Selby, head of research at Kraken’s CF Benchmarks. “It has an uncorrelated return”.

The so-called bitcoin basis trade, is where investors buy spot bitcoin or ETFs, and short the cryptocurrency futures, which have been trading at higher prices this year. The gap widened after the election result and reached 17%. That has since reduced to 12% but it is a big reason why BTC has ramped up in recent weeks and is a risk for any negative news.

Millennium more than doubled its number of shares in iShares Bitcoin Trust to 23.5 million shares, worth $849 million. The fund also increased its positions in ARK 21Shares Bitcoin and Bitwise Bitcoin. The New York-based hedge fund ended September with $1.7 billion in crypto ETFs, including spot bitcoin and ethereum funds.

Hedge fund legend and billionaire, Paul Tudor Jones, has been a BTC supporter and his fund increased its exposure to iShares Bitcoin Trust fund, increasing its number of shares by five times, to 4.4 million.

Bitcoin’s rally has been impressive but there is a big risk overhanging the current price level if investment funds back away. Much of the Trump-related price surge is also speculation as no official announcement has been made on using the cryptocurrency.