Bitcoin has finally had a spot ETF approved after years of applications.

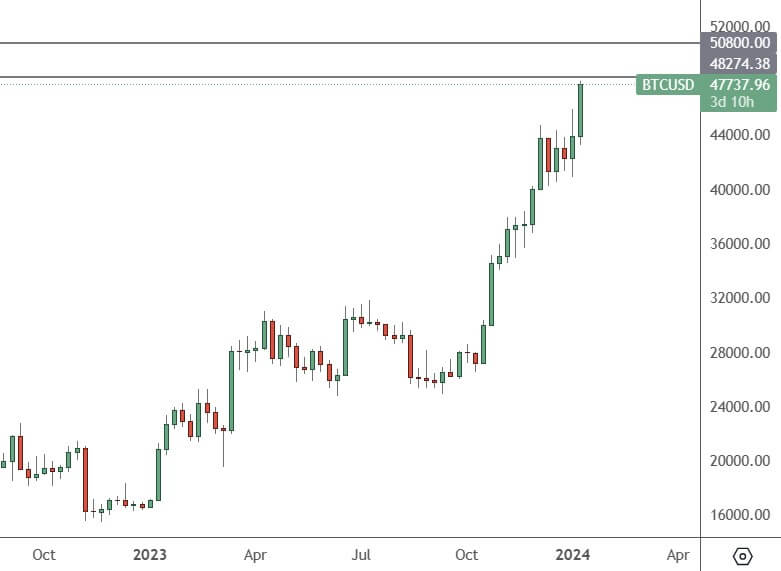

BTCUSD – Daily Chart

BTC rallied this week to $47,730 on the news, and the market will take a keen interest in adopting these ETFs. Resistance comes in first at $ 48,270 and $50,800, approx.

The SEC was moved to approve eleven new ETFs by companies including Ark Invest, BlackRock and Grayscale. The regulator had previously been slow to approve the funds over fears that the spot market in BTC is unregulated and prone to manipulation.

SEC Chair Gary Gensler was also quick to point out that it was not a support of the .

“While we approved the listing and trading of certain spot Bitcoin ETP shares today, we did not approve or endorse Bitcoin,” Gensler said.

Ark Invest’s founder, Cathie Wood, was not happy with that statement, although her fund now owns one of the new ETFs seeking to attract investors. “He just denigrated the whole space. I couldn’t believe it,” she said.

The TEFs have been causing hype in BTC since BlackRock’s listing application in September, and BTC is up more than 50% since then. One of the problems for the new funds is that it can take up to 90 days for institutions to approve new ETF investments. That could leave Bitcoin at risk of a pullback over the next three months.

Before that happens, BTC could see a blow-off toward the $50k level as speculative investment continues in a thinly-shorted market.