The Shanghai Composite Index is looking for support after the ISM Manufacturing results.

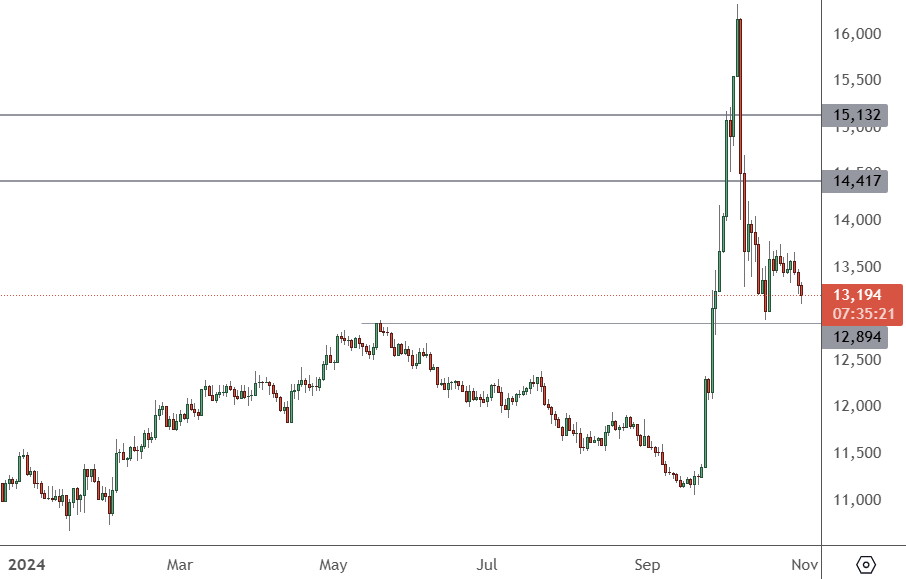

CHINA 50 – Daily Chart

The price of the CHINA 50 has bounced near 13,000 and now is looking to confirm a double bottom pattern. That level will be critical in the week ahead.

China’s manufacturing activity in October expanded for the first time in six months, according to official data on Thursday, supporting policymakers’ optimism that recent stimulus will get the world’s number two economy back on track.

The official purchasing managers’ index (PMI) rose to 50.1 in October from 49.8 in September, just above the 50 level, which marks expansion, ahead of a median forecast of 49.9 in a Reuters poll.

“The 50.1 level is the smallest possible expansion for the PMI but nonetheless bucks expectations for continued contraction, and is a positive sign that the small bounce back of industrial production that we saw in September could continue,” said Lynn Song of ING Economics.

Song added that subindices showed signs there could be a “gradual improvement” in the economy. The production subindex hit a six-month high of 52, and new orders returned to a reading of 50 after five months of contraction.

The data offers some hope that the Chinese government stimulus is making its way into the right places and boosting confidence.

Andres Rincon, Head of ETF Sales and Strategy at TD Securities, said China could be set for further ETF investment flows.

“We’ve seen, just since the announcement, about $6 billion go into this space,” he said.

“We’re seeing a lot more money going to this space. And I think it’s more about people that have been underweight in this space because of the risks in this space. They’ve taken this as an opportunity to basically go probably market weight. And this is obviously what’s driving a big part of the flows”.