The China blue chip stock index is looking for support at a key level that could avert further losses.

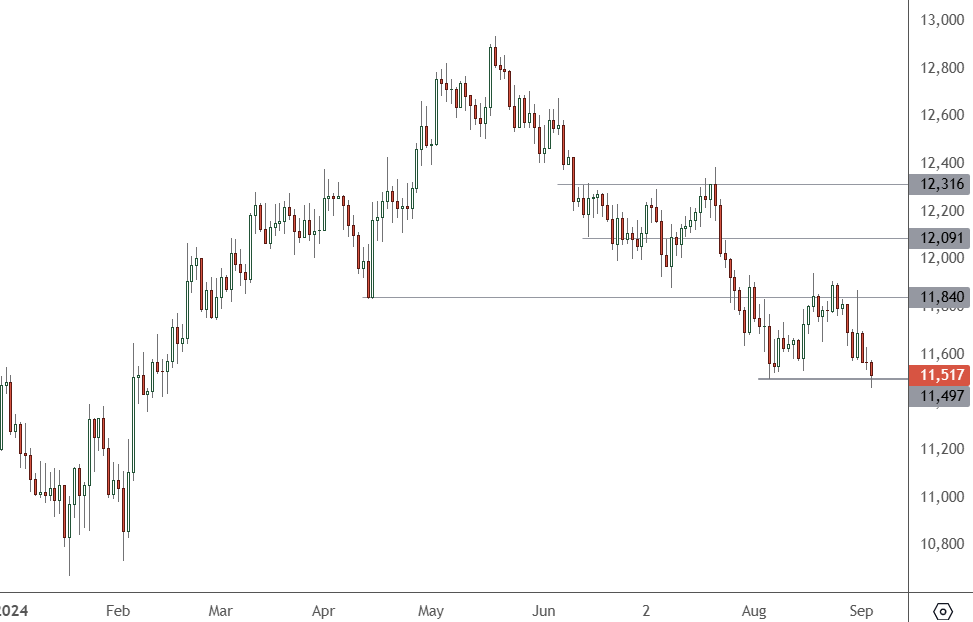

CH 50 – Daily Chart

The China 50 index is trading at 11,517 and that level created a bounce in early-August. Buyers need to emerge or a larger downturn could take prices to 11,300 and 10,800.

Chinese markets have been declining as foreign capital dries up in the country. Stock investment, private equity and FDI have all slowed.

China’s stock exchanges have halted daily data sharing on overseas fund flows and the country is said to be on course for its first yearly outflow from equities since 2016. After a resurgence of government stimulus early in the year, investors have been pulling back again.

Dealmaking is also drying up as the world’s largest private equity firms, such as Blackstone and KKR have put the brakes on deals as geopolitical tensions rise and Beijing tightens business regulations. Private equity firms that bought up more than $1.5 trillion of assets in China over the last two decades are now struggling to offload those investments, Bloomberg said last year.

China has also recently made investments in the government-debt market after a recent rally. The PBOC sold long-dated bonds and bought short-term securities in a move that resulted in a net purchase of 100 billion yuan ($14 billion) in August.

The trades may help to slow aggressive bond moves that pushed benchmark yields to a record low as investors bet on further monetary policy easing.

“It’s more about managing financial stability risks than the economy,” Win Thin, of Brown Brothers Harriman in New York said. “If they want to stimulate the economy, they’d be pushing both ends of the yield curve down. Instead, it seems they are worried about a huge pile of one-way bets on bonds”.

Rory Green of TS Lombard said the PBOC faces an uphill battle:

“The PBOC is trying to muddle through driving economic growth, but also achieving these political objectives of a stronger renminbi and higher long-end yields,” Green said. “It’s fighting economic gravity, as it were, and the flows into fixed income that aren’t likely to diminish”.”

“Given the macro weakness that flows into the market, it looks like a good time to buy any rise in yields,” he added.

Western stock markets have been able to prop up markets globally but cracks are appearing as investors start to doubt the AI-driven rally.