The European Central Bank (ECB) is not expected to raise interest rates at its meeting. While inflation levels remain elevated, there has been notable advancement in aligning them with the central bank’s desired target. Nevertheless, the Eurozone’s economic recovery is encountering difficulties in gaining traction. The recent decrease in both manufacturing and services PMIs suggests that despite the recession’s conclusion, growth remains sluggish. Given this subdued economic activity, it is probable that ECB policymakers will refrain from pursuing further tightening measures.

The European Central Bank (ECB) is not expected to raise interest rates at its meeting. While inflation levels remain elevated, there has been notable advancement in aligning them with the central bank’s desired target. Nevertheless, the Eurozone’s economic recovery is encountering difficulties in gaining traction. The recent decrease in both manufacturing and services PMIs suggests that despite the recession’s conclusion, growth remains sluggish. Given this subdued economic activity, it is probable that ECB policymakers will refrain from pursuing further tightening measures.

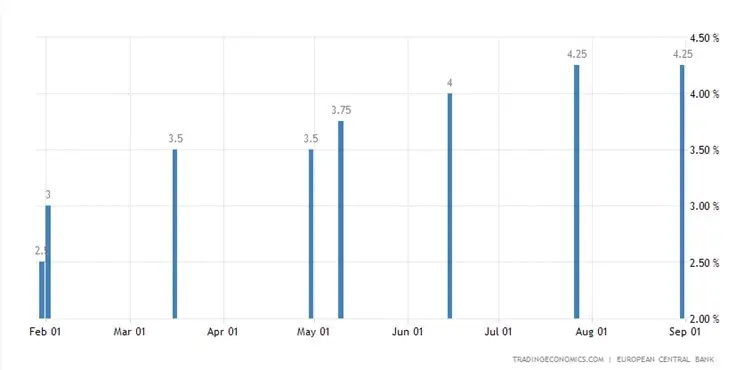

This week, analysts and economists anticipate that policymakers will maintain the deposit facility rate at 3.75%. Simultaneously, policymakers might grant themselves the option to increase rates in upcoming meetings based on evolving data, particularly core and super-core inflation. This somewhat hawkish stance is also likely to deter ECB policymakers from implementing monetary policy loosening prematurely.

European Central Bank’s Policy Impact on EUR/USD

The EUR/USD shows bearish price signals as it stays below the trend lines, 50 (EMA) and 200 (EMA). Nonetheless, in the event of an unforeseen interest rate increase by the European Central Bank (ECB) or a more aggressive stance during the ECB press conference, it may prompt bullish traders to challenge the resistance level situated at $1.0763, aligning with the 50-day EMA.

The EUR/USD shows bearish price signals as it stays below the trend lines, 50 (EMA) and 200 (EMA). Nonetheless, in the event of an unforeseen interest rate increase by the European Central Bank (ECB) or a more aggressive stance during the ECB press conference, it may prompt bullish traders to challenge the resistance level situated at $1.0763, aligning with the 50-day EMA.

Should the ECB adopt a dovish stance, it could potentially open the path toward $1.06342. While the primary focus remains on the ECB, it’s crucial to take into account US economic indicators as well. The potential for substantial shifts in monetary policy that support the dollar should not be overlooked ahead of Thursday’s session.