Ethereum surged this week on news that the asset management giant BlackRock had filed an ETF application for the world’s second-largest cryptocurrency.

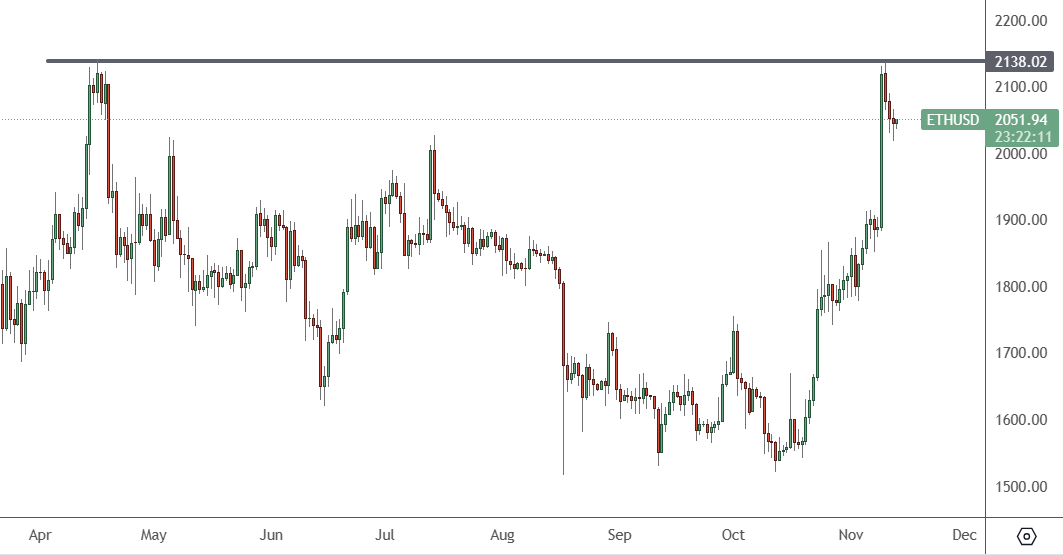

ETH – Daily Chart

ETH surged this week to $2,000 and followed the recent strength of Bitcoin.

“A massive short squeeze occurred overnight in Ethereum. The funding rate is the highest ever and signals total panic for shorts,” Matrixport’s head of crypto research, Markus Thielen, wrote in a report following BlackRock’s surprise application for an exchange-traded fund (ETF) application.

The asset management giant’s surprise filing came after the landmark June Bitcoin spot ETF application, which could spark a retail rush to crypto assets.

“This is nuclear winter for everybody who doubted ethereum,” Thielen said. “Market-neutral crypto hedge funds are making a killing with these funding rates. Inflows into crypto hedge funds will be high on the agenda for allocators.”

Investors are now awaiting the arrival of a BTC ETF where retail money could surge into crypto.

Ethereum has suffered price losses alongside the broader crypto market since its peak in late 2021. The collapse of the non-fungible token market and the decline of interest in the decentralised finance market blocked ETH.