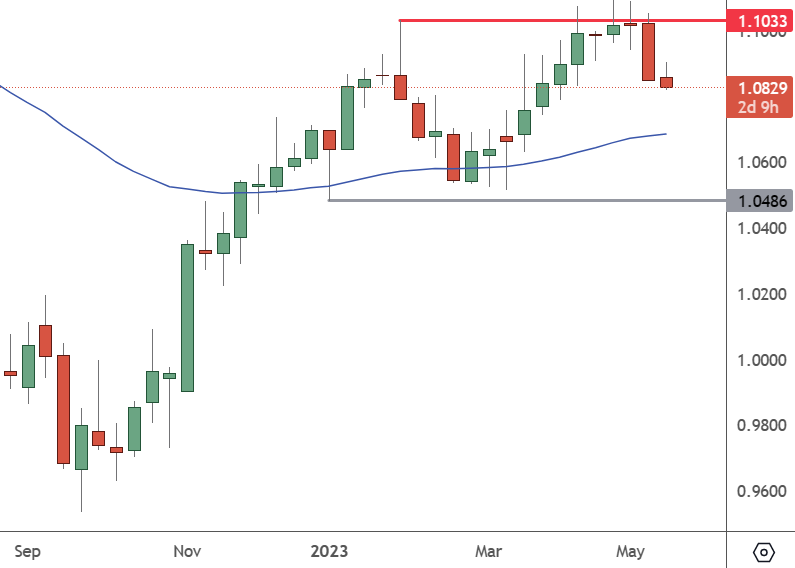

EURUSD may have seen a high as last week’s US dollar surge.

EURUSD – Weekly Chart

The price of EURUSD has slumped to 1.0830 after failing to get above the 1.1030 level. There is now the potential for the pair to move toward the 1.0500 support level, and traders will look to further economic data.

The weakness in the euro came despite inflation accelerating to 7% in April, up from 6.9% in the eurozone. The latest Eurostat figures showed increased headline prices driven by rising services and energy costs. However, underlying or core inflation, which removes volatile energy and food prices, slowed to 7.3% from 7.5%.

Inflation has been above the ECB’s 2% target for two years, and the bank has raised interest rates by a combined 375 basis points. Policymakers at the central bank have recently said they must do more.

Foreign exchange analysts at Credit Agricole have said this week that while uncertainty surrounding the US debt ceiling has been a critical factor in a recent bout of US dollar weakness, a resolution could improve the outlook for the currency.

EURUSD Forecast

The recent fears over the inability of the US to manage its debt have been a headwind for the dollar. Moreover, it is happening even as Congress works to resolve a sovereign default.

A sovereign debt default is a failure by the government to repay its debts, and the importance of the US dollar would trigger a financial crisis. Lawmakers are now seeking a solution to increase the debt ceiling while controlling the runaway spending leading to regular debt limit increases.

“The uncertainty surrounding the US debt ceiling has been a key drag on the USD in recent weeks even as attempts to avert a sovereign default continue in the US Congress,” said Valentin Marinov, Head of FX Strategy at Credit Agricole.

“We believe that a resolution – in the shape and form of either a debt ceiling extension or suspension – could be reached ahead of the ‘x-date’,” he adds.

Senator Kevin McCarthy has ruled out further tax increases on the rich to get a deal through but has also insisted on a 72-hour window to review the legislation before approval, which could bring the talks to the wire.

“I’m confident that we’ll get the agreement on the budget, that America will not default,” President Biden said.