EURUSD has a massive week of economic data from Germany and the US.

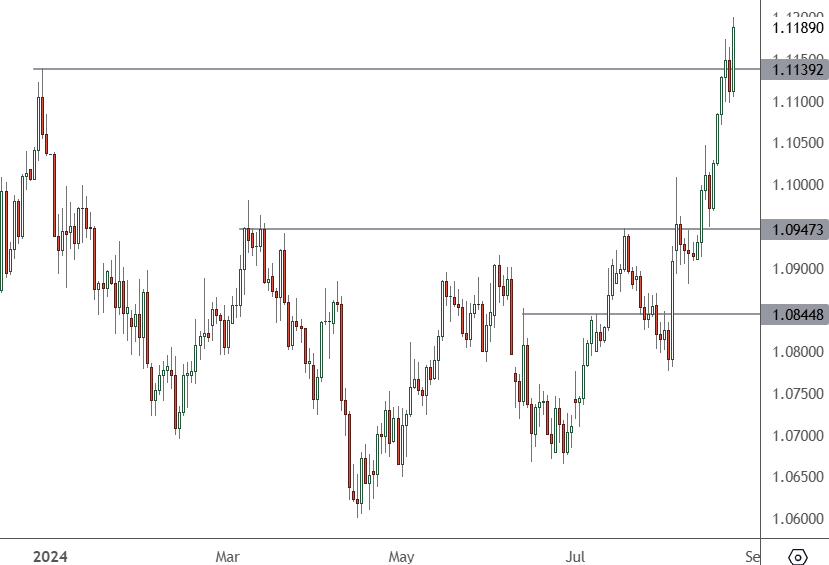

EURUSD – Daily Chart

The price of EURUSD has jumped above key resistance at 1.14, which is the critical level for the week.

Monday brings Ifo Business Climate data from the German economy at 16:00 HKT. The market is expecting a move from 87 to 86.5. That figure has slumped from 89.4 in April.

Later in the evening, there is a figure for durable goods orders from the US, which is expected to bounce from 6.6% to 4%. The next day, we will have a final GDP growth from Germany at 14:00 HKT. US consumer confidence closes out the day later in the evening.

The high-level data continues later in the week with a GfK consumer confidence number from Germany at 14:00 HKT. A slight improvement is expected from -18.4 to -17.5.

Inflation data from Germany comes on Thursday with another slip from 2.3% to 2.1% expected. And finally, Germany is back again on Friday with inflation data at 15:55 HKT unemployment data. That is expected to show a fall in unemployment from 18k to 16k.

A speech from Fed Chair Jerome Powell boosted the euro last week as he confirmed rate cuts are coming at a central banker conference.

“The time has come for policy to adjust,’ Powell said.

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”.