The EURGBP exchange rate has German inflation tomorrow, ahead of the UK’s growth update on Friday.

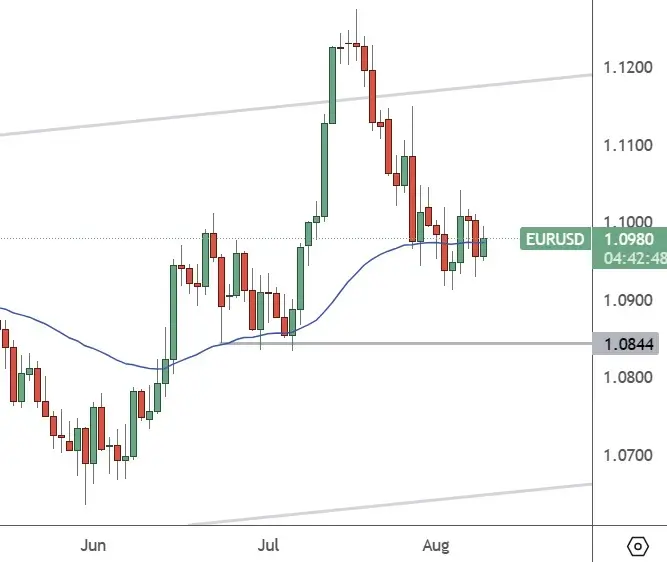

EURUSD – Daily Chart

EURUSD – Daily Chart

The EURUSD has been stuck in a range over the last two weeks, but the inflation reading could catalyse a break to 1.0844 or a move higher to 1.1200.

Global investors are positioning for a ‘soft landing’ in the US, with better-than-expected economic data lessening fears of a recession. The latest inflation data on Thursday is expected to show a slight increase in US consumer price inflation to 3.3% due to seasonal pressures. Still, there are hopes the figure will give the Federal Reserve more room to reduce interest rates.

However, some analysts are still cautious that the central bank’s interest rate hiking cycle could still drive the world’s biggest economy into a contraction. This week’s downgrade of regional banks by Moody’s is a warning that the follow-through effects of policy tightening will hurt certain sectors.

WeWork, the co-working company supported by Softbank, warned it may be unable to continue in business, adding fears over commercial real estate. That would be another stress for bank balance sheets.

The US has been more successful at lowering inflation than other developed markets, such as the Eurozone. According to CME Group, markets are currently pricing in an 86.5% chance of a pause at the Fed’s September meeting and a 13.5% 25 basis point rise.

In the Eurozone, ECB executive board member Fabio Panetta said last week that monetary policy “must be prudent” to reduce inflation without harming growth.

Both central banks are hesitant to announce the end of monetary tightening and are basing their decisions on economic data.

The ECB raised its interest rate for a ninth-consecutive time, and President Christine Lagarde warned that the economic situation had “deteriorated” with Germany in recession. Morgan Stanley said of the September meeting, “We expect still on balance a hike to 4% in September, but it’s a very close call.”