The EURUSD exchange rate has high-level afternoon figures in the form of Eurozone and German PMI data.

EURUSD is elevated above the highs from September-October with risk of a correction. 1.1225 is the support level now.

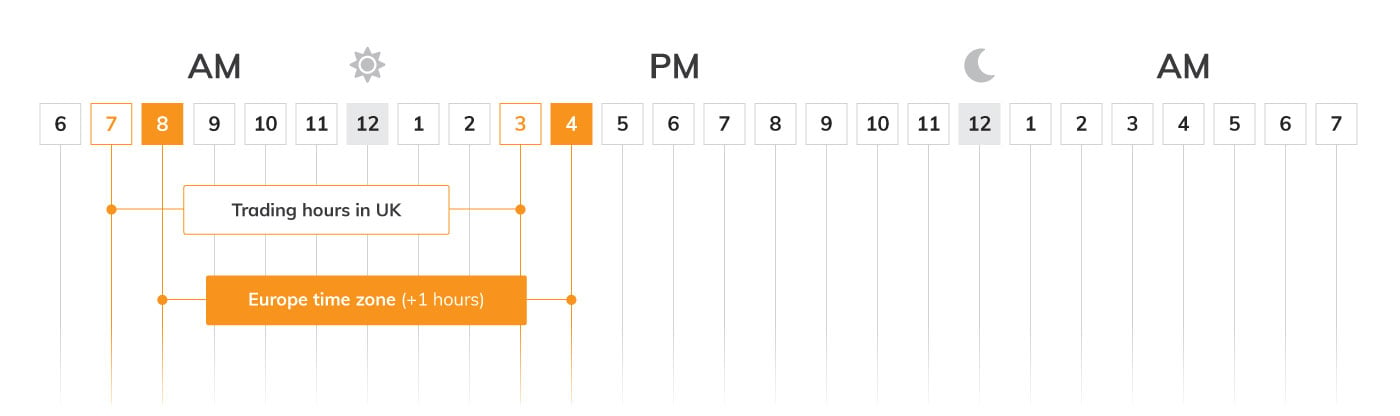

The European economy will have data at 3pm HKT in the form of services and manufacturing PMI for Germany and the Eurozone. Manufacturing data is still a drag on the composite figure which is expected to come in at 50.4 for Germany. A reading of 50.3 is expected for the eurozone.

A more positive figure may be ignored with a potential tariff-led hit in the weeks ahead. The US will release its own PMI data overnight at 9:45pm HKT.

The European Central Bank cut interest rates recently for the seventh time to counter worries about economic growth. ECB President Christine Lagarde said “the major escalation in global trade tensions and the associated uncertainty will likely lower euro area growth by dampening exports. “And it may drag down investment and consumption”.

Inflation has fallen with the rate cuts but economic growth is still a worry, with the 20 countries that use the euro growing only 0.2% in the last quarter of 2024. Inflation was still 2.2% in March, close to the bank’s target of 2%. The ECB said in its March 6 meeting that they will pause after recent rate cuts. But that was not possible after the US tariff plans raised questions over growth.

The US has been sold off since the tariffs began and recent talk of trade deals and a de-escalation with China could reverse the trend and see the EURUSD undergoing a technical correction. In the short-term, the PMI figures will be the guide.