The second election win for Donald Trump has powered the US dollar to its highest level since April.

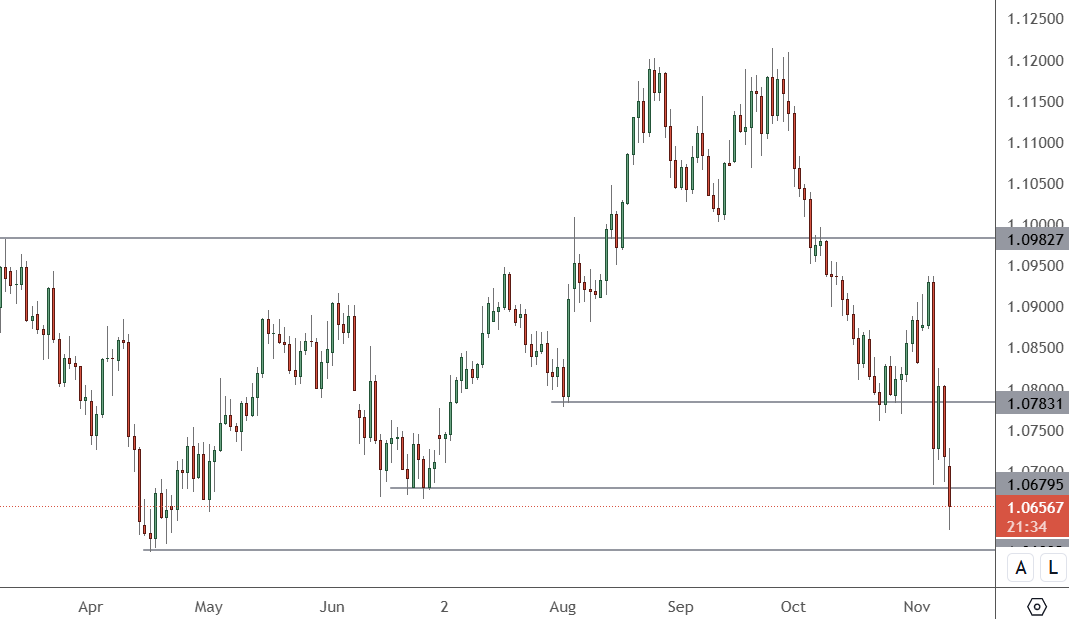

EURUSD – Daily Chart

The price of EURUSD has moved to test support at the 1.0700 level. The next support comes in at 1.0605.

EURUSD is in focus on Tuesday with European consumer price data at 3pm. That is expected to show inflation remaining and multi-month lows.

The European economy would suffer from Donald Trump’s tariffs and trade barriers, and this could impact European Central Bank policy, Greek Central Bank chief Yannis Stournaras said recently.

“It will have a negative impact on the European economy and it will also have an implication for the exchange rate… so this has certain implications for our monetary policy,” Stournaras told a conference.

Markets are also concerned about Trump’s decision on the Federal Reserve after previous criticism of Fed Chair Jerome Powell.

Asked by a reporter if he would resign, Powell simply said “no”. Another asked if a president could fire or demote him.

“Not permitted under the law,” Powell fired back. “Not what?” the reporter responded. “Not permitted under the law,” said Powell.

The tone of his answers was a shift from previous responses which were thoughtful.

Ultimately, the Supreme Court could have the final say on what merits a “for cause” firing of a Fed chair. But while that fight, which would probably be lengthy, plays out, Powell would likely still get to stay in his job until May 15, 2026, when his term expires.

“I feel the president should have at least a say in there. I feel that strongly,” Trump said in August. “I made a lot of money. I was very successful. And I think I have a better instinct than, in many cases, people that would be on the Federal Reserve — or the chairman,” he added.

The new President’s potential actions will be a key driver for the EURUSD ahead of his January appointment.