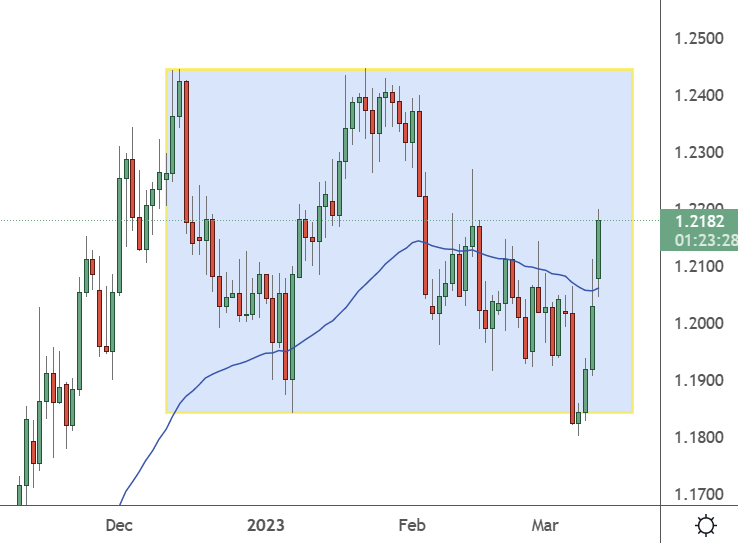

GBPUSD has rallied higher from the range support. Traders can use this pair to tap into further volatility in economic data.

GBPUSD – Weekly Chart

GBPUSD found support at the 1.1850 level and has rallied higher to the 1.2180 mark. The pound sterling could continue to revive as the US faces the banking heat.

The big story is that the US Federal Reserve is expected to slow or reverse its interest rate hikes.

“We emphasise ‘pause’ because we believe that the turmoil is likely to be contained in the coming weeks, especially following the backstops implemented over the weekend. We continue to believe that the Fed will see additional hikes as the baseline scenario, which it would carefully condition on an assumption that markets settle and that credit continues to flow from regional banks. Although recent distress will temper the appetite for additional aggressive hikes, we think that March’s dot plot will show the median dot peaking at 5.1% in 2023,” Barclays said.

Traders will look for further developments in the US banking system. Still, economic data will also be watched in the next two days.

GBPUSD Forecast

Tuesday sees the latest release of UK employment data with an expectation for 52k jobs versus 74k. The unemployment rate is expected to rise to 3.8% in the country.

The critical data will be US inflation later in the day, but that has less importance on recent developments. The core and headline are expected to slip, and that would fuel further losses in the greenback as investors expect the Federal Reserve to pause its rate hike cycle.