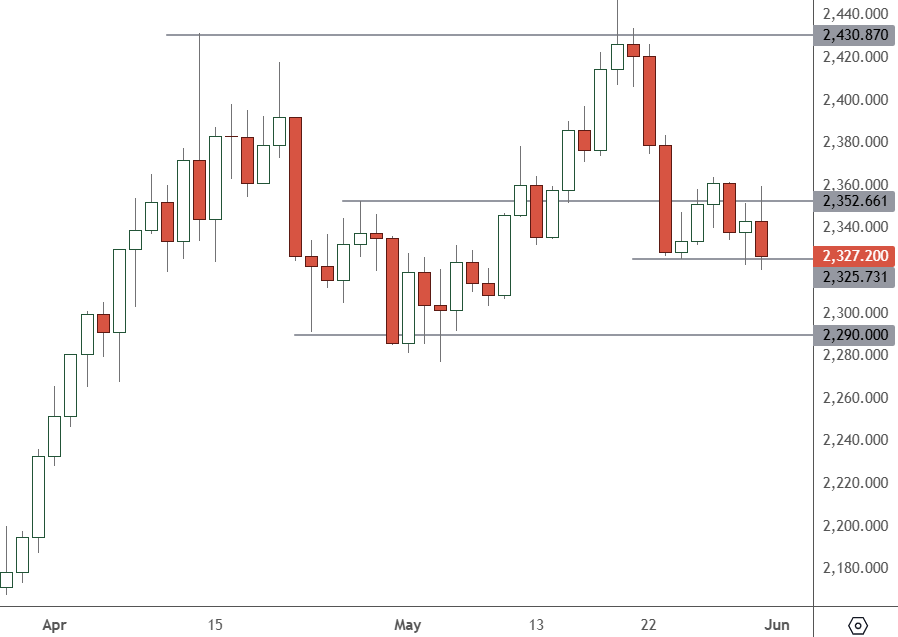

The price of gold closed at support after failing to hold onto early gains in the week.

GOLD – Daily Chart

Gold was rejected at the $2,350 level and has closed against support around the $2,325 level. If buyers do not emerge, there is support below $2,300.

Gold has cooled off but still posted its fourth monthly gain as investors anticipated a change in US monetary policy.

“Gold is down despite the friendly PCE report and softer consumer spending, which could suggest near-term exhaustion in what has been a remarkable rally in 2024,” metals trader Tai Wong told Reuters.

Central bank purchases have been substantial, and geopolitical tensions have been high. Friction between the United States and China has seen the latter reduce its vast holdings of US treasuries and park the money in gold. India has also been a big buyer, and it has helped to offset outflows from gold exchange-traded funds this year.

Less money has flowed to gold ETF funds because stocks remain near record highs in the US, and investors have been seeking to capitalise on that rally.

“Historically, changes in gold ETF holdings have often been triggered by major risk-off events (when the appetite for risk declines) and by cycles of easier monetary policy. Our analysts expect ETF holdings to climb once the Fed starts cutting rates,” an analysis from Goldman Sachs said.

The recent rise in the price of gold has affected the consumer market, with watchmaker Rolex raising the price of its watches as gold has soared. However, Goldman also expects support for gold to rise in India due to the “wealth effect” as consumers continue to get richer from a growing economy in a country with a significant domestic gold market.

For now, gold is on the backfoot after four months of gains, and this week’s support could determine the size of the correction.