The recent bull market in US stocks could be tested by the Nvidia earnings next week.

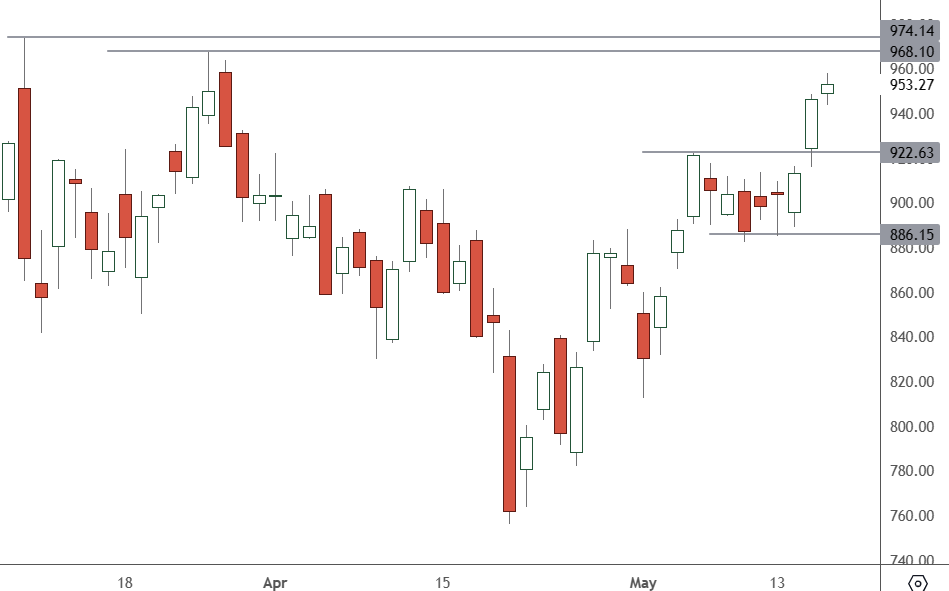

NVDA – Daily Chart

NVDA shares were trading at $953.27 on Friday, but due to the strength of US stocks, the stock could test all-time highs ahead of the earnings release.

US stocks have been surging on the potential for a reduction in US interest rates starting this year. Despite that, a considerable part of the bull market has been filled with hopes for AI growth.

Nvidia’s earnings drive those expectations because the company is at the forefront of AI-related product builds.

Any slowdown in chip orders at the company could hit the market hard and make the latest highs a potential double top. Stronger-than-expected growth at Nvidia would allow markets to push higher again.

Nvidia’s results for the first quarter of its fiscal year 2025 will come on May 22, and its massive $2.2 trillion valuation will be under threat. By year-end, Nvidia’s AI division, named Data Center, had grown its annual revenue by 217% from the prior year. Company-wide revenue was also higher by 126%. Despite an April pullback, the company’s shares are up 100% year-to-date.

KeyBanc Capital Markets sees limited signs of a demand pause for Nvidia, where it is expected to top Wall Street estimates again.

Nvidia is expected to post $24.5 billion in quarterly revenue, up 240% from a year before. However, UBS analyst Timothy Arcuri sees room for a higher number of $26 billion, with guidance for the current quarter in the $27 billion to $28 billion range.

On market fears for a stock sell-off, Arcuri said:

“While this probably doesn’t get answered/addressed on this earnings call, we think these concerns are generally overblown following recent customer discussions and supply-chain work suggesting Hopper (AI chip) remains sold out at least through the end of this year”.