Nvidia shares dropped sharply on Tuesday ahead of the company’s latest earnings, indicating AI valuation fears.

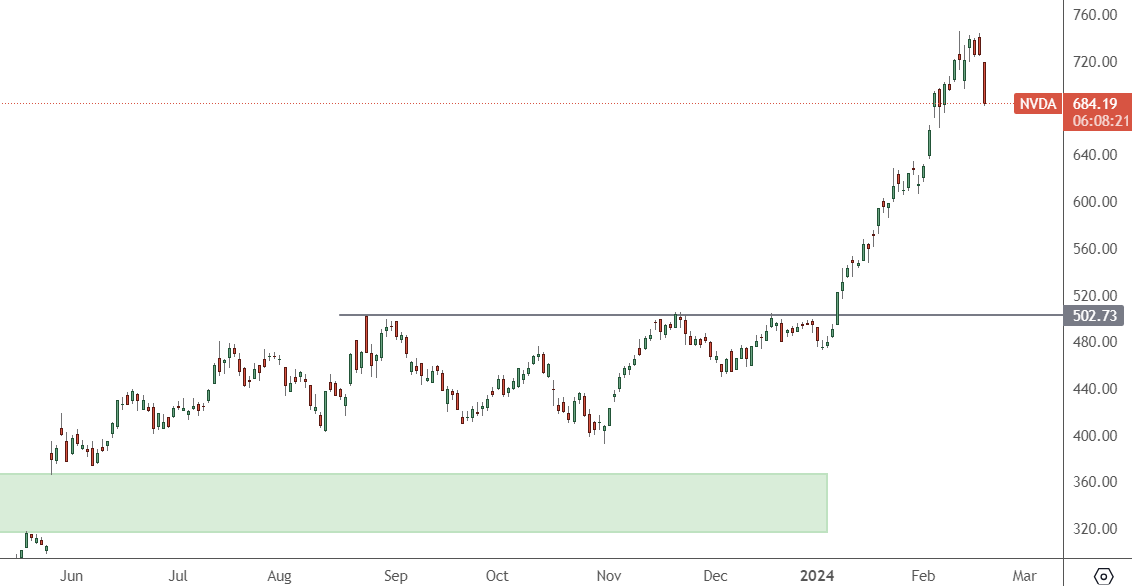

NVDA – Daily Chart

NVDA shares have surged to find resistance at $750, and the actual support is down at $500, which is 33% of the current valuation.

Nvidia may still further boost AI bets with a strong earnings release. However, the company’s losses ahead of earnings are a sign of nerves from investors. Nvidia has replaced Tesla in recent weeks as Wall Street’s most traded stock. At the same time, it also became the third-most valuable US company.

The latest quarterly report on Wednesday will be a highly watched event, and many analysts believe that anything less than a blowout report could reverse a rally that has sent Nvidia’s stock surging by 50% in 2024.

More than $30 billion worth of Nvidia shares have changed hands daily on average over the last 30 trading sessions, which beat Tesla’s $22 billion average. Friday saw that the combined trading in Nvidia and Super Micro Computer accounted for over 40% of all turnover of the 10 most traded US stocks. That is another sign of the enormous volatility building around these companies.

Bad earnings or an external event will eventually rattle those stocks with significant institutional selling followed by retail panic. That may not occur at this earnings session, but traders should be alert for the growing importance of a handful of stocks to the rally.

“There’s an argument here that this is the dawn of a new era of trading, like the dawn of the internet, with Nvidia in the pole position,” a representative of Triple D Trading in Canada said.

But they also highlighted the same warning that huge turnover in AI-related stocks suggests retail investors and algorithmic traders are driving share prices higher based on momentum rather than fundamentals, not unlike the meme stock frenzy of 2021.

The other issue is that Super Micro sells AI-related server components to Nvidia, and with both releasing earnings a day apart, there could be fireworks.

Nvidia controls around 80% of the high-end AI chip market and beat Amazon and Alphabet in its valuation last week.