Oil prices rose by 1% to a 2-week high on Friday as traders saw war fears returning.

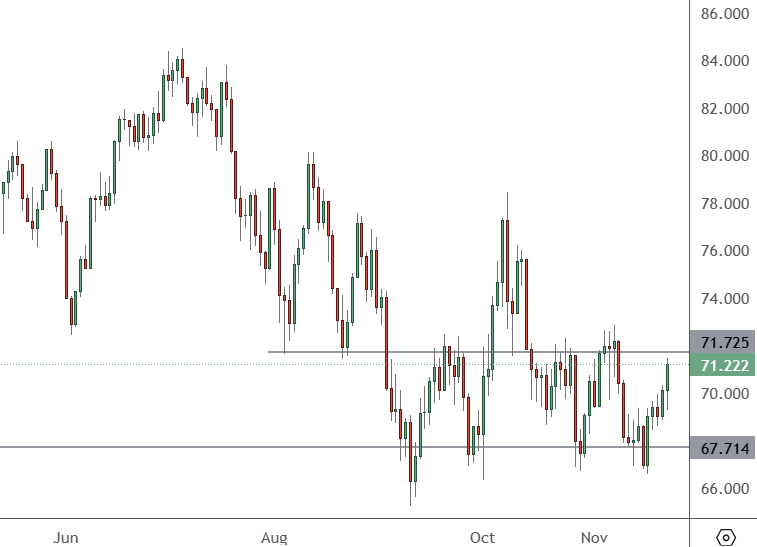

USOIL – Daily Chart

The price of USOIL has found support again around the $67 level and now looks ahead to the $71.75 level as resistance. Resistance above that could be as high as $78.

The Brent and WTI benchmarks were up around 6% for the week, their highest levels since November on Ukraine war escalation.

President Vladimir Putin said Russia would keep testing its new Oreshnik hypersonic missile in combat and that it had a stock ready for use. “What the market fears is accidental destruction in any part of oil, gas, and refining that not only causes long-term damage but accelerates a war spiral,” said PVM analyst John Evans.

The US also imposed new sanctions on Russia’s Gazprombank as President Joe Biden seeks to punish the country before he leaves office on January 20. The Kremlin said the latest sanctions were an attempt to slow the export of Russian gas, but noted that a solution would be found.

J.P. Morgan sees the price of Brent oil averaging $73 per barrel (/bbl) in 2025 but expects it to close the year firmly below $70/bbl, with US West Texas Intermediate at $64/bbl, the bank said in a note on Friday.

“Our view on 2025 has remained largely unchanged over the past year: we look for a large 1.3 mbd (million barrels per day)surplus and an average Brent of $73,” the note said.

The bank sees global oil demand growth decelerating from 1.3 mbd this year to 1.1 mbd next year, saying that China is expected to lead oil demand growth for the last time before India takes the lead in 2026.

“Trump’s energy agenda presents downside risks to oil prices from deregulation and increased US production, while also posing upside risks by exerting pressure on Iran, Venezuela, and possibly Russia to limit their oil exports and revenues,” the bank added.