Europe’s largest tech firm by market cap, ASML, fuelled a global stock rally after reporting record sales.

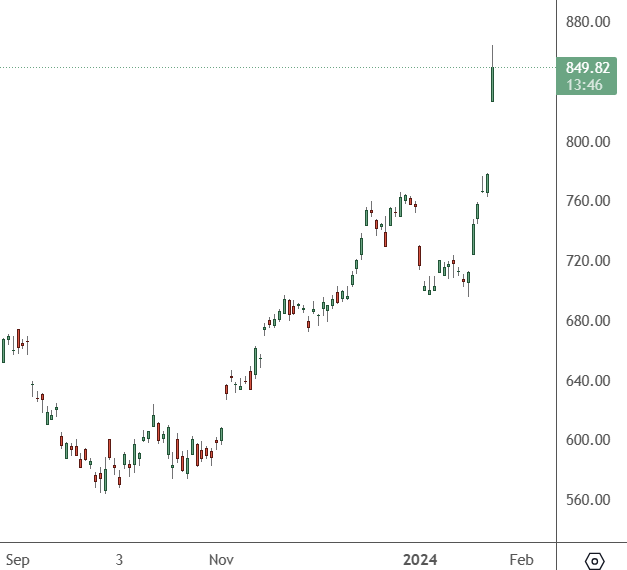

ASML – Daily Chart

ASML vaulted to a price of $850 after the company’s earnings surprised analysts.

The company manufactures chip equipment, and analysts are looking for any reason to be bullish on that sector.

The company’s net profits were 7.8 billion euros ($8.5 billion) for the year, the firm said in its annual results, compared to 5.6 billion euros in the previous year.

“The semiconductor industry continues to work through the bottom of the cycle,” CEO Peter Wennink said.

“Although our customers are still not certain about the shape of the semiconductor market recovery this year, there are some positive signs,” he added.

Traders celebrated the latest results, with ASML stock sparking a boost in European and US stocks. ASML is one of the world’s leading equipment manufacturers for making state-of-the-art mobile phone and car chips.

“Without high-end logic, there’s no AI. Without high-end memory, there’s no AI. Without ASML, there is no high-end logic or high-end memory,” said CFO Roger Dassen.

“It’s very very clear that AI development will have a very significant contribution to our business in 2025,” he added.

However, the semiconductor industry has become a battleground as Western nations seek to restrict tech access to China.

ASML announced earlier this month that it had been blocked from exporting “a small number” of its machines to China amid reports of US pressure on the Dutch government.

Beijing accused the US of “bullying behaviour”, adding that it “seriously violates international trade rules”.

China has described the restrictions placed on exports as “technological terrorism”.

Due to trade tensions with China, there are concerns that Beijing may introduce export controls on gallium and germanium- two rare earth minerals needed for semiconductor manufacturing.