Salesforce (NYSE:CRM) released its latest earnings ahead of the Asian open and a weak number could create a long-term high in the stock.

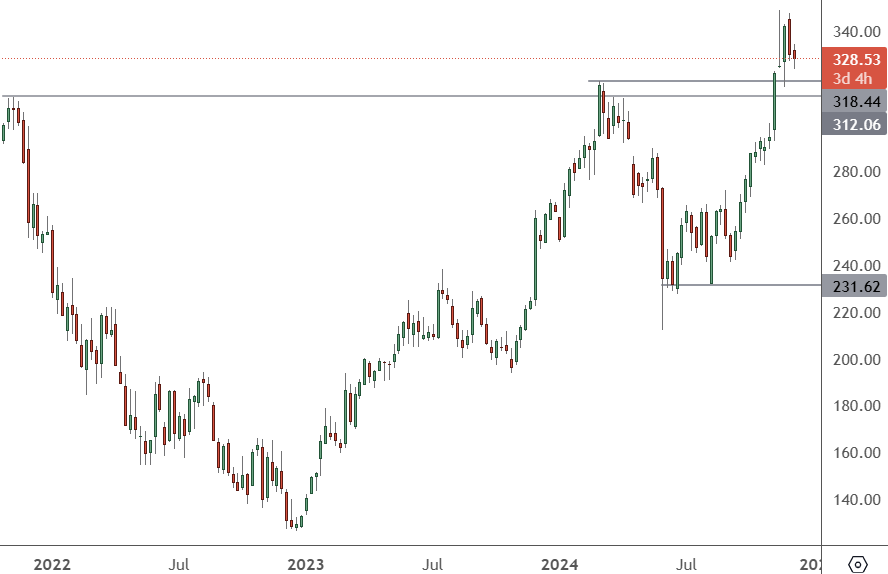

CRM Weekly Chart

The price of CRM has the potential to make a long-term high at this level. The 2024 highs are very close to the 2021 high and a disappointing earnings figure could see a correction.

Analysts expect Salesforce to report a 7% jump in year-over-year revenue during the quarter, boosted by demand for the company’s generative artificial intelligence (AI) product offerings. Analysts expect the company to post adjusted earnings of $2.44 a share on revenue of $9.35 billion.

Investors will likely be seeking clarification about demand for the company’s recently launched Agentforce platform, which enables customers to build and deploy AI agents for business functions.

Salesforce shares have gained 26% since the start of the year, in line with the S&P 500 over the same period. Piper Sandler equity research analyst Brent Bracelin gave some insight into what investors can expect.

Bracelin has an Overweight rating on CRM stock with a $395 price target. While he expects “more of the same” from the upcoming report, he notes that the “narrative is shifting.” The analyst pointed to the growing use of AI agents, which Bracelin believes “could really be a catalyst that could kickstart growth for the company” in the long term.

“But remember we’re coming from a point where people were negative on Salesforce for the last two years,” he added. Despite some challenges, Bracelin sees a “silver lining” coming from free cash flow growth.

Analyst Gil Luria at D.A. Davidson is concerned that potential clients may not be rushing to get on board.

“While we heard from numerous customers that there was strong interest in AI tools and the potential business use cases of Agentforce capabilities, budgets for AI are limited and organizations are still in the early stages of developing their AI business strategies,” Luria wrote in a research re.

Traders should be cautious will any long trades here as the stock hovers near its highs over the last three years.