Tonight, the market will be focused on the preliminary release of the US Markit PMI data for April. Judging from the March data, the U.S. economy has flourished after the gradual relaxation of pandemic prevention restrictions. As a result, the demand for goods and services is steadily rising, improving the overall production and volume of new orders amid rising employment levels. Therefore, many expect the PMI data to have rebounded from the plunge in January.

In April, the U.S. economy is still experiencing rising energy costs, commodities and food items. As a result, prices of assorted goods have been facing unprecedented inflationary pressures. In addition, market participants are generally worried about rising corporate costs. Therefore, the main agenda for the evening concerns the impact of inflation levels on the preliminary US April Markit Manufacturing PMI and the US April Markit Services PMI.

Unchanged Labor Conditions in the U.S. market

The Purchasing Managers’ Index is one of the critical indicators of the economy’s overall health because purchasing managers usually know of a company’s performance in advance. Generally speaking, 50 is the median mark of the index’s performance; when it exceeds 50, it represents the industry’s expansion, and figures below 50 represent the industry’s decline or contraction. For example, to shed light on April’s U.S. Preliminary Markit Manufacturing PMI, the current market expectation is 58.2, slightly lower than the previous value of 58.8. Yet, the figure still reflects intense demand for commodities and production growth despite rising commodity prices.

The market forecast for the preliminary Markit Services PMI for April was 58, unchanged from the previous value, while data from March was lower than expected. In addition, Markit’s consolidated PMI final value of 57.7 in March was lower than expected, reflecting the pressure on production from rising costs.

In terms of labor employment, the U.S. Department of Labor data on April 1 revealed that the U.S. unemployment rate fell to 3.6% month-on-month in March this year. The number of new jobs in the non-agricultural sector was recorded at 431,000, slightly lower than market expectations. The data indicated that the labor force is still tight and that the pace of growth would be affected, especially within the service industry, which had the most significant labor gap.

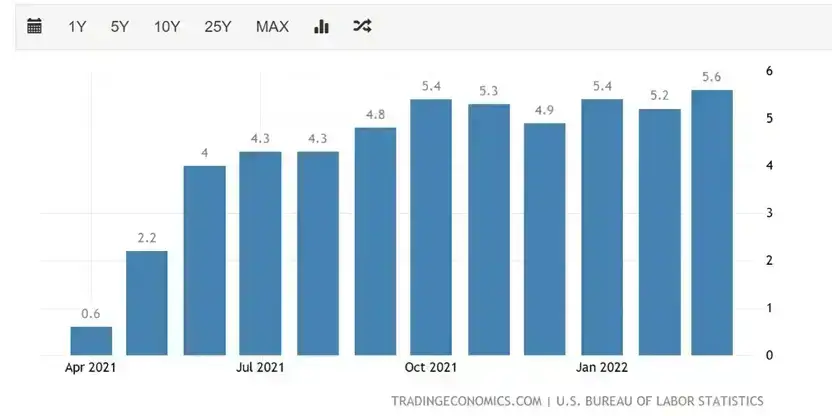

Average hourly earnings continued to rise in March and have increased 5.6% over the past 12 months, slightly above market expectations. Therefore, inflation forecasts remain very grim, with the rising costs expected to persist, affecting this month’s data.

(Source: TRADINGECONOMICS)

Downward pressure on The Markit Services PMI index

In March, strong demand in the U.S. manufacturing and service sectors drove the overall accumulated orders to the highest level since 2009. However, the March data shows that the issue of supply chain disruptions has been alleviated to some extent. As a result, the U.S. economy is growing at a relatively healthy rate. However, the current production capacity is still limited, and the imbalance between commodity supply and demand coupled with rising prices cannot be resolved for the time being.

In March, the U.S. PPI (producer price index) accelerated to 76.8, almost reaching a record high, further exacerbating inflationary pressures, increasing wages, and driving up the production costs incurred by firms, affecting businesses’ and consumers’ confidence in the country’s economic outlook.

The U.S. experienced an inflation explosion in March as analysts observed the yearly unadjusted CPI rising by 8.5%, causing the Fed to begin its interest rate hike cycle. Therefore, the market generally expects the Fed to adopt a more aggressive rate hike strategy to cope with soaring inflation. Suppose the interest rate hikes continue; as such, the downward pressures on the Markit PMI index in the coming months would increase, and supply chain capacity would shrink. Furthermore, due to the labor shortage, the long-overdue market correction would add pressure on the service industry’s production and delivery of new orders.

Another concern is the aftermath of the Russo-Ukrainian war on U.S. economic growth and recovery. The war’s impact is marginally offset by the more robust demand for goods and services and the relaxation of pandemic restrictions. Therefore, investors should pay close attention to the daily developments as the effects of the war continue to push up the prices of energy, raw materials, and food while disrupting supply chains.