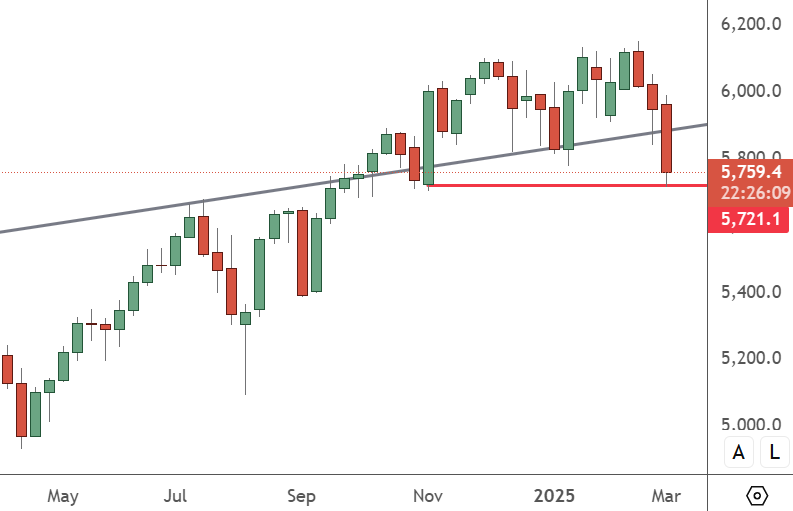

US stocks have reversed to test the level that marked the start of the Trump election win rally.

SPX500 – Weekly Chart

The SPX 500 has slumped from resistance above the 6,000 level and has moved below 5,800. The Trump election win started a rally at the 5,721 level and the uptrend resistance line goes back to the 2021 high.

Donald Trump’s election win in early November last year led to a surge in stocks and crypto as investors considered the potential for deregulation and pro-business policies. However, the tariff plans have been a negative for many business sectors and the US dollar.

A recent slump in the US dollar could have Trump’s critics pouncing on the recent stock and currency drop as a failure of his administration’s early plans.

The stock market had its worst day of the year despite Trump stating on Thursday that most goods imported from Mexico and some from Canada would be exempt from his controversial tariffs, at least for the next month. The President was asked if the tariffs are scaring markets, but he defended the plan:

“Well, a lot of them are globalist countries and companies that won’t be doing as well. Because we’re taking back things that have been taken from us many years ago”.

He also said that the recent pause in tariffs was not linked to the markets.

“Nothing to do with the market,” Trump said. “I’m not even looking at the market”.

“There’ll always be a little short-term interruption,” he added. “I don’t think it’s going to be big, but the countries and companies that have been ripping us aren’t particularly happy with what I’m doing”.

The US stock market now turns to the NFP jobs numbers late on Friday. The data comes too late for Asian traders but could be a key number for the first days of next week. Economists expect the US economy to add 160k jobs after last month’s 143k.

The recent slashing of Federal workers by the Trump administration could show up in later releases but a weaker number this time could add to recent market struggles.