The United States dollar and Canadian dollar pair have interest rate and service data ahead at a key resistance level.

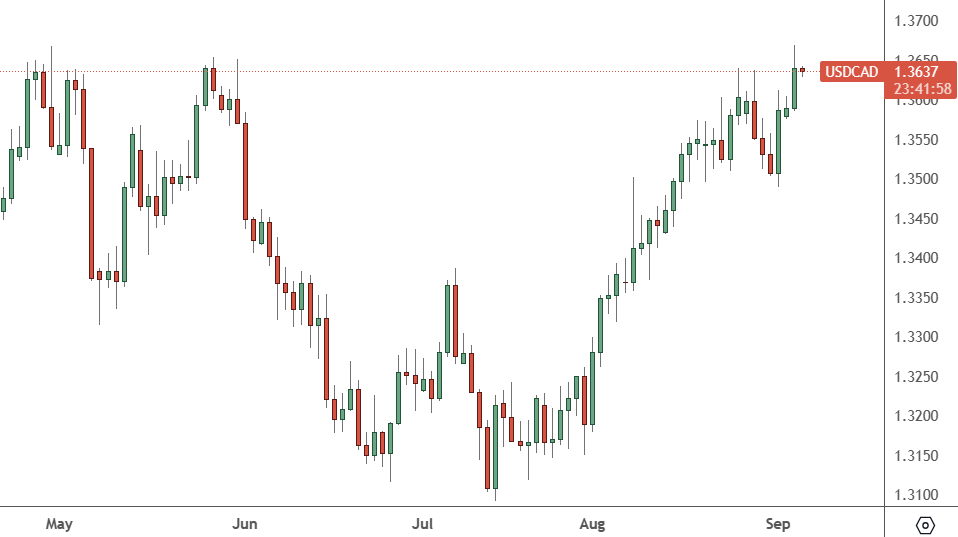

USDCAD: Daily Chart

USDCAD trades at resistance around the 1.3650 level ahead of the latest data. With markets sure they have the BOC’s plan worked out, the US ISM is likely to be the driver of near-term direction.

Analysts expect the services figure for the US to be 52.5, close to last month’s 52.7. However, ING believes recent figures are indicative of a GDP slowdown.

Manufacturing has dipped below the contraction level of 50 for ten consecutive months in the United States. Construction spending is performing strongly, while the ISM services index is expected to post a headline reading consistent with the economy growing at a rate closer to 1% year-on-year rather than the 2.5% rate seen in the second quarter. Just like the jobs report last week, the ISM indices predict that there will be little need for further interest rate hikes in the US to cool the economy.

For the Canadian economy, the Bank of Canada is highly expected to hold rates steady at 5% on Wednesday. The contraction in second-quarter GBP and the flat estimate for July were shocks that solidified expectations for a rate pause, while some say it will see the end of hiking rates completely.

GDP shrank 0.2% in the second quarter, well below the Bank of Canada’s forecast of 1.5%, while economists had expected 1.2%. First-quarter growth was also revised lower to 2.6%.

“We had anticipated to see signs of a slowdown in Canada, but these figures were shockingly weak,” wrote Jay Zhao-Murray, an analyst at Monex Canada.

“Virtually all remaining risk of a September hike was priced out by money markets, while the odds of a hike at any point by year-end were slashed to one in three.

With economists certain of an interest rate pause, the US services data will be the important measure, and a stronger number could push the USD through the resistance level.