Wall Street stocks had their best day since the start of 2023, helping to ease recent fears about the tech rally.

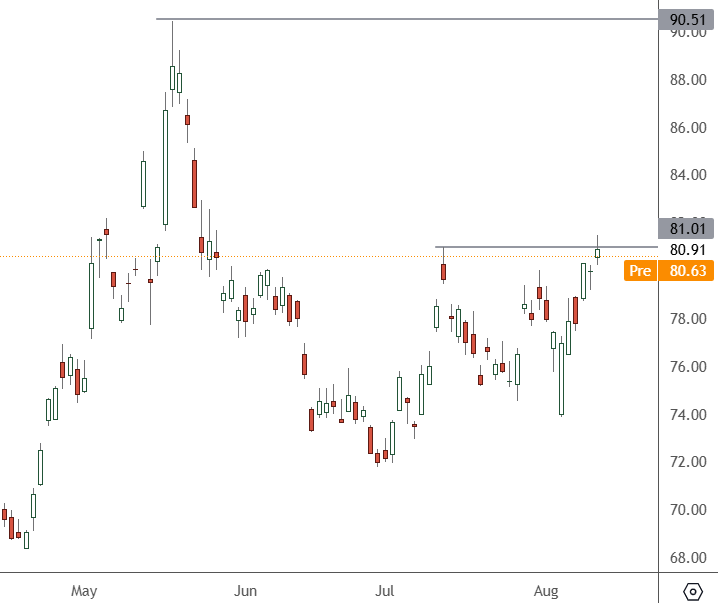

BABA – Daily Chart

The price of BABA has met some initial resistance at the $80.91 level on the NYSE. The coming earnings will determine whether the stock can return to the next resistance at $90.51 or retreat to $74.

The Chinese e-commerce giant is expected to show a net profit of 28.31 billion yuan ($3.95 billion) for the three months to the end of June. That would be lower than a profit of 34.33 billion yuan a year earlier.

First-quarter revenue is also expected to be higher at 247.5 billion yuan, compared to 234.16 billion yuan a year ago.

According to Citi analysts, Alibaba’s gross merchandise value is expected to rise well, thanks to slower-than-expected growth at its short-video competitors. Citi expects Alibaba’s merchant revenue growth to be slower than its GMV growth.

Jefferies analysts said in a research note that the retailer is expected to focus on operating metrics such as traffic, order volume, and GMV growth and will later focus on monetization and profitability. Their estimates say the company’s overall earnings before interest and taxes declined by 9% year-over-year to around 41 billion yuan in the current quarter.

Alibaba is expected to complete its dual primary listing in Hong Kong in mid-August. Analysts see their inclusion in Stock Connect as a potential price catalyst for the stock in September.

Share buybacks have been strong ahead of earnings, with the company buying 77 million ADRs for $5.8 billion, retiring 3.16% of its stock.