Why is gold valuable and expensive? Understanding the factors behind gold’s high value is crucial whether you’re new or experienced with the gold market. In this article, you will learn the 7 major reasons why gold is valued and remains a top investment choice.

Table of contents:

- Economic Factors

- Historical Significance

- Physical & Chemical Properties

- Scarcity & Extraction Costs

- Cultural & Symbolic Value<

- Investment & Reserve Asset

- Technological & Industrial Uses

- Top 10 Gold-Producing Countries in 2024 and Its Fun Fact!

- Why is Gold Popular for Trading?

- How to Start Gold Trading?

- What Affects the Price of Gold?

- Practice Gold Trading through a Demo Account

Economic Factors

Gold is a popular choice during tough economic times. When prices go up, or the market declines, people invest in gold because it’s stable—it keeps its value while other investments might drop. It’s especially good for guarding against rising costs (inflation) and money losing its strength (currency devaluation). This makes gold a reliable choice for protecting your investments during uncertain times.

Example: During the 2008 financial crisis, gold prices surged as investors sought stability. Similarly, during periods of high inflation, such as the 1970s, gold prices increased significantly as people sought ways to preserve their wealth.

Historical Significance

Gold has been treasured since ancient times. The Egyptians used it in their burial rituals, placing gold in pharaohs’ tombs as a sign of wealth and status for the afterlife. In ancient Rome, gold coins were used as money (known as currency), setting the standard for trade and wealth. Throughout history, gold has symbolised power and has been a reliable form of wealth across different cultures. Its long-standing role in global trade and as a trusted store of value highlights its importance today.

Example: The discovery of Tutankhamun’s tomb in 1922 revealed a wealth of gold artefacts, highlighting its importance in ancient Egyptian culture. Similarly, the Roman Empire’s use of gold coins established a robust trade network and stabilised their economy.

Physical & Chemical Properties

Gold’s unique characteristics greatly enhance its value. It’s solid yet easy to shape and doesn’t tarnish, making it ideal for jewellery and durable items. Gold’s excellent electrical conductivity is crucial in electronics, where it ensures reliability. Its resistance to corrosion adds to its longevity, making it perfect for long-lasting products. Additionally, gold can be shaped into thin sheets or fine wires, broadening its use in various fields.

Example: Gold’s use in wedding rings due to its non-reactive nature ensures it remains beautiful over time. In electronics, gold is used in connectors, switches, and relay contacts because it can carry electrical signals without corroding.

Scarcity & Extraction Costs

Gold is scarce and hard to get, making it expensive. Mining gold requires a lot of money and effort. It requires significant investments in technology and manpower, and mining can also harm the environment. Because there’s only a limited amount of gold worldwide, its value stays high. The complex and costly process of finding and mining gold highlights how rare it is, as it takes advanced technology and extensive searches to find new gold deposits.

Example: The Grasberg mine in Indonesia, one of the largest gold mines, requires massive investments in infrastructure and labour. The high cost of extraction is a significant factor in gold’s price.

Cultural & Symbolic Value

Gold is deeply valued in cultures worldwide. It’s a common feature in religious ceremonies and cultural traditions, where its beauty and rarity symbolise purity, wealth, and status. This symbolic importance makes gold even more desirable. Being part of many traditions and customs globally, gold’s symbolic role enhances its appeal and keeps demand high.

Example: In India, gold is vital to wedding ceremonies, symbolising prosperity and good fortune. Similarly, during Chinese New Year, gold is considered auspicious and is often given as a gift.

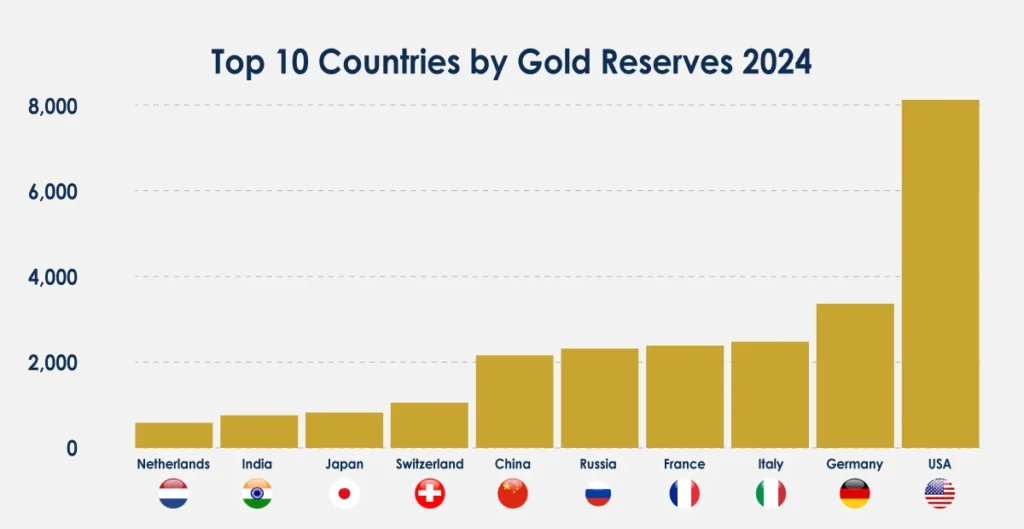

Investment & Reserve Asset

Gold is crucial for national reserves and is regarded as a safe investment choice. Central banks and private investors buy gold to spread out their risks (portfolio diversification) and stay safe during economic troubles (hedging). Its ease of trade and global acceptance make it a popular asset. Around the world, central banks hold a lot of gold to keep their economies steady and build trust.

Example: The United States holds the largest gold reserves, amounting to over 8,000 tons. Countries like Germany and China also hold significant gold reserves as part of their financial strategies.

Technological & Industrial Uses

Gold isn’t just for jewellery and investment. It plays a big role in technology and industry, especially electronics and medical devices. Its great ability to conduct electricity and resist rust makes it very important in high-tech uses. Gold’s reliability in these areas keeps it in high demand. From precise medical tools to advanced electronic gadgets, gold’s importance in modern technology highlights its ongoing value in industry.

Example: Smartphones use gold in their circuitry due to its excellent conductivity and resistance to corrosion. In medicine, gold nanoparticles are used in certain cancer treatments and diagnostic tests.

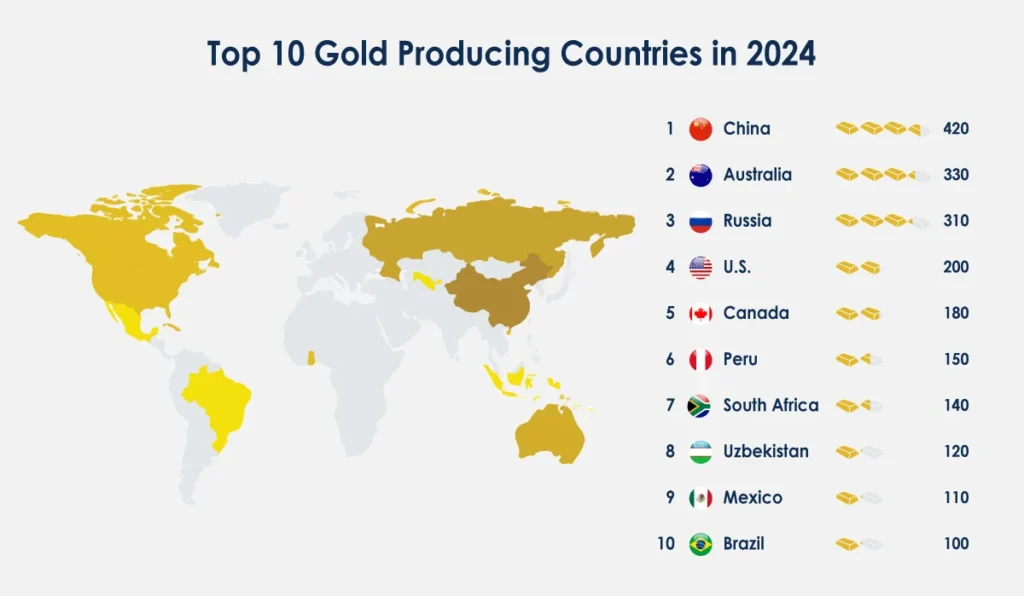

Top 10 Gold-Producing Countries in 2024 and Its Fun Fact!

Gold production is concentrated in a few countries. In 2024, the top gold-producing countries include China, Australia, Russia, the United States, Canada, Peru, South Africa, Uzbekistan, Mexico, and Brazil. These countries have vast reserves and advanced mining technologies.

Rank | Country | Gold Production (tons) | Fun Fact |

1 | China | 420 | China has been the largest gold producer for over a decade. |

2 | Australia | 330 | Australia is home to the largest gold nugget ever found, the “Welcome Stranger”. |

3 | Russia | 310 | Russia’s gold reserves are the second largest in the world. |

4 | United States | 200 | The first major US gold rush occurred in Georgia in 1828. |

5 | Canada | 180 | Canada’s Klondike Gold Rush attracted over 100,000 prospectors in the late 1890s. |

6 | Peru | 150 | Peru is the largest gold producer in South America. |

7 | South Africa | 140 | South Africa was once the world’s top gold producer. |

8 | Uzbekistan | 120 | Uzbekistan’s Muruntau mine is one of the largest gold mines in the world. |

9 | Mexico | 110 | Mexico’s gold production has increased significantly in the last decade. |

10 | Brazil | 100 | Brazil’s gold rush in the 1980s led to the rapid development of many mining towns. |

Why is Gold Popular for Trading?

Gold trading offers numerous advantages for traders or investors. Here are some key benefits of gold trading:

Safe Haven Asset: Gold is known for its stability during economic uncertainty. While other investments might lose value, gold often maintains or increases its worth, making it a reliable option.

Portfolio Diversification: Adding gold to a portfolio can reduce overall risk. It usually moves opposite to stocks and bonds, helping to balance your investments and overall portfolio risk.

High Liquidity: The gold market allows for quick buying and selling, and this liquidity ensures that traders can quickly enter and exit positions.

Potential for Profit: The price of gold fluctuates, offering opportunities to profit. Traders can capitalise on these changes by timing their trades to buy low and sell high.

How to Start Gold Trading?

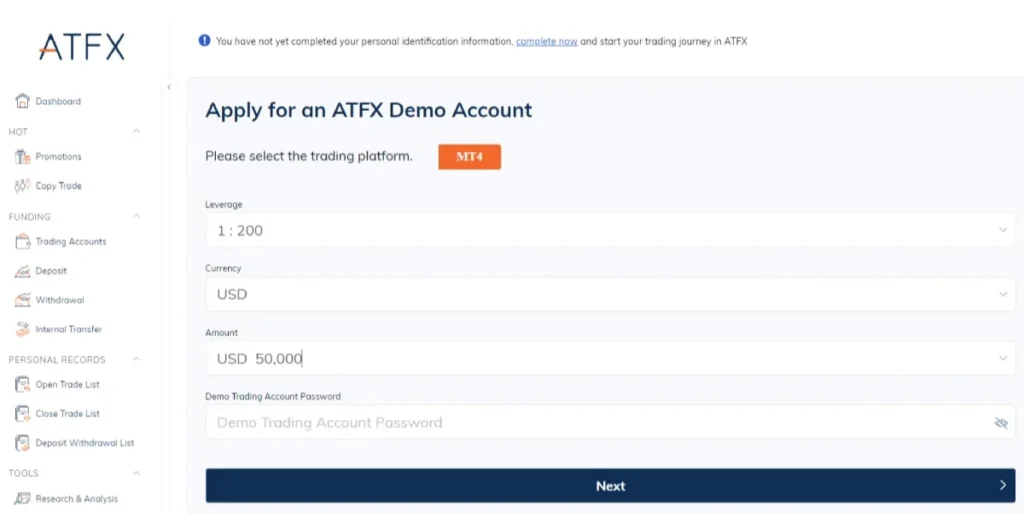

Getting started with gold trading is easier than you think, especially with the services offered by ATFX. Here’s a simple step-by-step guide to help you start trading gold:

Step 1: Visit our website at ATFX Gold Trading.

Step 2: Open a live account. If you are new to gold trading, start with our demo account first, which allows you to practice with a virtual fund of 50,000 USD.

Step 3: Start trading.

Step 4: Monitor and manage your trades.

What Affects the Price of Gold?

Gold prices are influenced by several factors, including global economic conditions, currency values, geopolitical events, supply and demand dynamics, interest rates, and investor behaviour. Understanding these influences can help investors make informed decisions.

Global Economic Conditions

Gold is a popular safe haven during economic uncertainty or recession, often leading to higher prices. In stable times, however, gold prices might drop as investors seek higher returns elsewhere.

Investor Behaviour

Market sentiment and investor behaviour, including speculative trading and portfolio changes, shape gold prices. Large-scale buying or selling by institutional investors can also impact the market.

Example: During the 2008 financial crisis, a surge in gold purchases as a safe haven asset led to a significant increase in gold prices.

Currency Values

The US dollar significantly affects gold prices. A weaker dollar makes gold more affordable for foreign buyers, increasing demand and raising prices. Conversely, a strong dollar can lower demand and reduce prices.

Geopolitical Events

Wars and political unrest can make gold more appealing as a secure asset, pushing prices up.

Supply & Demand Dynamics

Limited new gold discoveries and high extraction costs constrain supply. Factors like jewellery consumption, technological applications, and investment demand significantly influence prices.

Example: The increasing use of gold in technology and electronics has bolstered demand, increasing prices.

Interest Rates

Gold prices typically move opposite to interest rates. Higher rates make gold less attractive as it doesn’t yield interest, reducing its appeal and price. Lower rates make holding gold more attractive, thus increasing its price.

Practice Gold Trading through a Demo Account

If you’re not yet prepared to trade gold, consider using our demo account, which provides US$50,000 in virtual funds. This allows you to apply your trading knowledge without any financial risk.

For example, imagine executing a trade that would typically lead to a $500 loss. In the demo account, this loss is virtual, serving as a valuable learning experience without any real financial impact. The design of the ATFX demo trading platform mirrors that of a live account, helping users familiarise themselves with its tools and features before they move on to live trading.