When it comes to Cardano, people naturally compare it to Ethereum since their networks offer similar services as smart contract platforms. Developers can use the Ethereum and Cardano blockchains for similar functions, including running custom programming logic (smart contracts) and building programs (decentralised applications). Due to the rapid growth witnessed since its launch in 2017, Cardano is often called the “Ethereum killer”. The tagline directly references its faster transaction speeds and lower fees.

What Is Cardano and How Does It Work?

Cardano is a decentralised third-generation public blockchain platform that uses a proof-of-stake-based consensus mechanism to facilitate peer-to-peer transactions through its native cryptocurrency ADA. While it shares features and applications with other blockchain platforms, such as Ethereum, Cardano differentiates itself by utilising peer-reviewed scientific research as the cornerstone of its platform updates.

Like Ethereum, Cardano supports smart contract functionality (automatic execution of computer programs). It works similarly to an Ethereum fork but hopes to elevate its functions to a higher level. Specifically, Cardano aims to solve issues related to scalability, interoperability, and sustainability-related to cryptocurrency platforms.

What Is Ethereum and How Does It Work?

Ethereum (ETH) is an open-source, public blockchain platform with smart contract functions whose goal is to be a completely trustless smart contract platform that hosts other applications and services on the blockchain and processes payments.

The blockchain provides a decentralised Ethereum Virtual Machine (EVM) to process peer-to-peer contracts through its dedicated Ether (ETH) cryptocurrency. It supports peer-to-peer transactions using its cryptocurrency and ether and supports the creation of fungible tokens, non-fungible tokens (NFTs), semi-fungible tokens, decentralised applications, and many more. Click here to learn how to invest in NFTs.

Cardano vs Ethereum: 4 Similarities

Blockchain platforms with smart contracts

Cardano is based on the second-generation infrastructure of Ethereum and have more advanced functions than any leading protocol currently available in the crypto markets.

Basic operating mechanism

The basic operating principle of both blockchains is to provide as many modules and scripting languages as possible for users to build any type of smart contract or transaction that can be precisely defined.

Mining process

Both ADA and ETH can be mined using a proof-of-stake method, allowing individuals to stake their assets to validate transactions.

Fundamental roles

Both projects share the same fundamental roles of creating decentralised programs, autonomous organisations, and smart contracts. The resulting applications target finance, the Internet of Things, smart grids, sports gambling, etc. DAOs have the potential to enable many operating models that would otherwise be inoperable or prohibitively expensive to run.

Similarities of Cardano and Ethereum | |

Feature | Smart Contract Platform |

Operating mechanism | Adopt a consensus mechanism based on proof of stake |

Mining process | Mining using Proof of Stake |

Cardano VS Ethereum: 3 Differences

Design Philosophy

Cardano provides a platform similar to Ethereum. Still, it emphasises a research-driven design approach, allowing transactions in its native cryptocurrency ADA, and enabling developers to build secure decentralised applications. Unlike other blockchain platforms, it emphasises a research-driven design approach to achieve academic rigour, which it believes will drive the adoption of its technology.

Ethereum is an operating system built to host many custom assets and programs, creating a global open-source platform. Programs built on Ethereum include custom assets and new economic applications that enable decentralised products and services across a wide range of use cases.

Both blockchains feature smart contracts that allow developers to create decentralised applications. The big difference here is that Cardano smart contracts are designed to be more functional and accessible than Ethereum smart contracts. Cardano innovated and pioneered the PoS consensus algorithm. Its PoS system is more energy-efficient, scalable, and faster than the PoW mechanism currently used by Ethereum, saving energy costs and ensuring faster processing of transactions.Different Layered Architectures

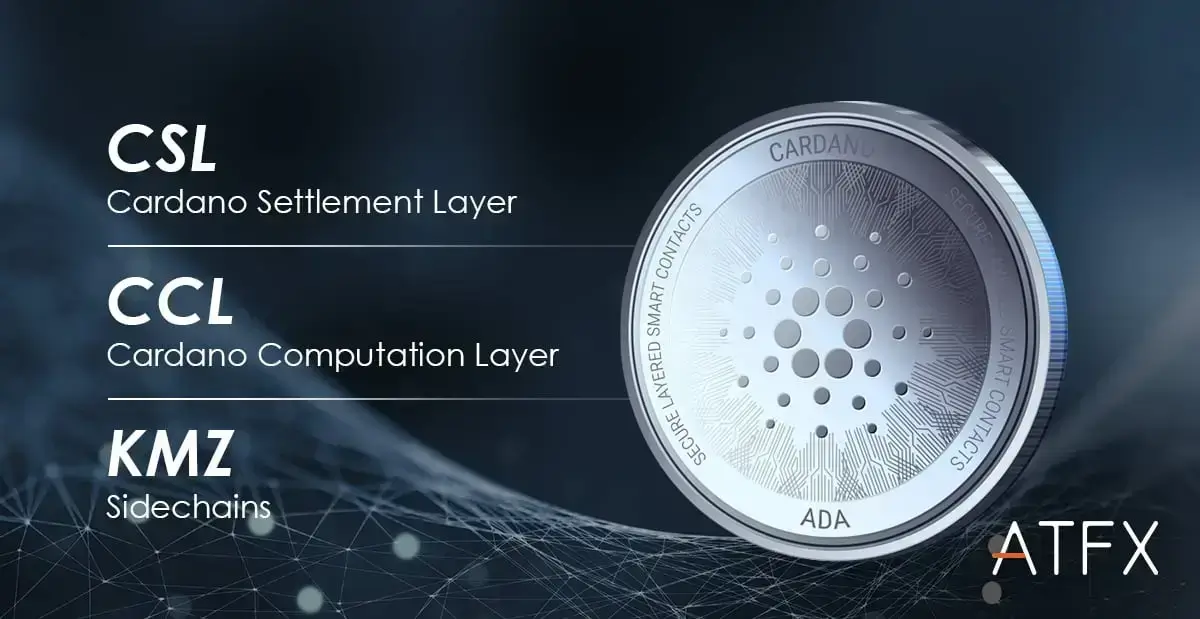

Cardano operates using a two-tier system: the Cardano Settlement Layer (CSL), which handles transactions, balances, smart contracts, etc.; and the Cardano Computation Layer (CCL), which will handle future applications. These two layers can work as two completely different chains, which gives it an advantage over Ethereum.

Another advantage of a two-tier system is that each layer can be upgraded independently without slowing down transactions on the other layer, allowing more people to use the network while processing more transactions. For example, Bitcoin’s current TPS is about 7 to 15, while Ethereum’s TPS is 15 to 45. However, as an advanced platform, Cardano can handle up to 250 TPS (transactions per second).

Another advantage of a two-tier system is that each layer can be upgraded independently without slowing down transactions on the other layer, allowing more people to use the network while processing more transactions. For example, Bitcoin’s current TPS is about 7 to 15, while Ethereum’s TPS is 15 to 45. However, as an advanced platform, Cardano can handle up to 250 TPS (transactions per second).

Since Ethereum handles smart contracts on the same layer, network congestion and high fees have become significant issues. Since the cost of transactions is tied to Ethereum’s value, which is now the second most valuable cryptocurrency, the network experiences high transaction volumes, easily leading to network congestion. However, these problems improved after Ethereum upgraded to 2.0.Supply Token Limitation

Cardano has a maximum total supply of 45 billion coins, similar to Bitcoin’s supply cap; this limitation creates a sense of scarcity that will help drive its value higher. On the other hand, Ethereum has an unlimited supply of coins, although the annual growth rate is capped at 4.5%. The cap ensures that the Ethereum network can keep rising and become more prominent and viable while the currency retains most of its value because its supply will not outstrip demand.

Main Differences between Cardano vs Ethereum | ||

Cardano | Ethereum | |

Layered Architecture | Double layer system | Single layer system |

Token Supply | 45 billion pieces | Unlimited |

Consensus mechanism | PoS (full name Proof of Stake) algorithm named Ouroboros | Based on PoW algorithm (full name Proof of Work) |

4 Advantages and 3 Disadvantages of Cardano

Advantages

More stable and scalable

Unlike other blockchain platforms and cryptocurrencies, Cardano’s updates and forks do not directly introduce new versions or iterations, related products, and new functions to the public. Instead, they go through a series of tests, and each development milestone or stage is peer-reviewed and more scalable.

More energy-efficient proof-of-stake system

Cardano adopts a more energy-efficient proof-of-stake system to achieve consensus. The security system based on the proof-of-stake algorithm known as Ouroboros ensures the mathematical accuracy of Cardano’s functions. This algorithm significantly reduces energy costs when finding new blocks, leading to faster operations without compromising quality.

Extensive trading opportunities

In the Cardano network, it is possible to make fast transactions and use digital assets – any user can create and execute smart contracts to protect their remittances and other financial-related operations.

Excellent transaction speeds

Even allowing instant transactions while charging no large commissions.

Disadvantages

Not the first-mover

In many people’s opinion, one of Cardano’s biggest drawbacks is that it does not have the same first-mover advantage as Bitcoin. And the use of ADA as a medium of exchange and store of value is not as widely accepted as Bitcoin and Ethereum.

Slow development process

A slow-and-steady development approach ensures that all rollouts are bug- and error-free and have a practical or viable, beneficial use case or application. Therefore, it is easy for the project to be overtaken by competitors.

Infrastructure is still weak

Cardano is a technically unproven platform and not thoroughly tested, unlike Ethereum and Bitcoin.

4 Advantages and Disadvantages of Ethereum

Advantages

Clear positioning

Ethereum was positioned as the crypto industry’s global computer in its early days. Its latest developments have cemented its position as the world’s decentralised financial bottom book. At present, all developments and applications revolve around this positioning.

Open system

Ethereum has more mature technology and a mature community of developers, contributors, and supporters. At the same time, everyone outside the ecosystem can participate in the project, making it possible to continuously develop and improve the Ethereum ecosystem.

Wide application

Ethereum has many blockchain applications, such as digital applications for gold and stocks, financial derivatives applications, DNS and digital authentication, etc.

Stronger liquidity

As the digital currency with the second-largest market value in the world, its liquidity is undoubtedly more robust, which is convenient for investors to trade freely.

Disadvantages

Poor scalability

Leading developers and researchers in the Ethereum community have always believed that scalability is the single most critical key that blockchain applications need to address for blockchain technology to achieve mass adoption. The biggest problem with Ethereum’s underlying design is that Ethereum has only one chain and no side chain, which is a very resource-consuming design.

The cost of smart contracts is too high

Ethereum still has a POW mining mode, and transactions are charged high fees to motivate miners to process transactions and protect the network.

Cardano vs Ethereum: Future Developments and Opportunities

Compared with Bitcoin, Ethereum has a broader applicability space and could even reshape the global financial system via continuous innovation, becoming a platform for all decentralised applications in the future. Industries such as aerospace technology and banking have been brought into the digital space. Ethereum has wide applications in currencies; hence, it has a high degree of security assurance.

While Cardano complements Ethereum, it has ambitious plans for the future. It intends to move from the settlement layer to the control layer, which will serve as a “trusted computing framework” for complex systems such as gambling and gaming systems. Other applications described on the company’s website include identity management, a credit system, and Daedalus, a general-purpose cryptocurrency wallet with automated crypto-transaction facilities and crypto-to-fiat conversion capabilities. However, it remains to be seen how well these functions will be implemented.

Is Cardano Better Than Ethereum? Will Cardano Replace Ethereum?

Cardano was initially designed to solve three critical problems with the current cryptocurrency trading system: high fees, lack of liquidity, and user-friendliness. Cardano is creating an open-source and decentralised currency exchange platform with features that make it more attractive to big players like banks and financial firms to address these issues.

While moving towards a next-generation blockchain with a scalable and sustainable platform, Cardano has some technological advantages over its competitors, but that doesn’t mean it will overtake Ethereum anytime soon. As of writing, over 60 dApps were built on Cardano’s blockchain, while nearly 3,000 had been built on Ethereum.

With its dominance in the dApp and DeFi space, when a project decides to build a blockchain application, there is about a 70% probability that Ethereum will be its first choice. There is no sign that other platforms will replace Ethereum, including Cardano. However, Cardano will continue improving and developing its platform under a framework similar to Ethereum’s. Still, just like Ethereum’s development took multiple years, Cardano will take several years to catch up since there are no exceptions to the rule.

Should You Invest in Cardano?

As of March 24, 2022, ETH’s market value is $366 billion, while Cardano’s market value is $38.1 billion. Cardano ranks seventh among major cryptocurrencies and is one of the best-performing altcoins. Of course, the market value cannot be used as the only representative of a blockchain’s value, but it is closely related to its degree of development.

Like other budding cryptocurrencies, the acceptance of ADA by investors is mixed, which determines its volatility. Each cryptocurrency faces stiff competition in a crowded ecosystem, and sustainability is the most outstanding value embodiment of subsequent development.

Conclusion

When comparing Cardano and Ethereum, many factors need to be screened, and the comparison we have made above can be used as a reference. For investors who prefer a more mature platform with relatively higher security, Ethereum investment may be a better choice because it has a relatively straightforward long-term value prospect. However, suppose your focus is on innovation, future development, and growth potential. In that case, Cardano investment may be relatively attractive, which requires its team to deliver consistent results to underpin its potential value.

How to Start Investing in Cardano or Ethereum?

You can begin your crypto trading path within minutes with a few easy steps. Open an account and start investing in Cardano, Ethereum, or other cryptocurrencies on your computer or phone. ATFX offers all the major financial products on a very practical trading platform. If you still want to learn the markets a bit more before investing real money, you can open a demo account and practice different strategies while still learning from a guide or the free training materials ATFX provides. Sign up right away!