Table of contents:

1. What is Deflation

2. Causes of Deflation

3. Impacts of Deflation

4. 2 Pros and 2 Cons of Deflation

5. Historical Incidents of Deflation

6. Deflation vs Inflation

7. Does Deflation Have Greater Negative Effects Than Inflation?

8. How To Make Profit During Period of Deflation

9. Learn How To Trade During Deflation through a Demo Account

What is Deflation

Deflation refers to a lower overall cost of goods and services. When the inflation rate falls below 0%, depreciation increases the actual value of money over time. Depreciation may seem advantageous at first glance because it increases the currency’s purchasing power, but its effects may be profound. Because deflation enormously impacts everything from personal savings to worldwide economic stability, understanding it is crucial for economists, policymakers, and the general public.

Deflation occurs when there’s a sustained drop in the price levels of goods and services, typically measured by the Consumer Price Index (CPI). This economic phenomenon differs from temporary price declines because it is persistent and affects the economy broadly, not just specific sectors. The causes of deflation are usually rooted in a reduction in the supply of money or credit or due to decreased demand for goods and services, which can stem from various factors, including increased savings rates, reduced consumer confidence, or significant improvements in technology that lower production costs.

Causes of Deflation

Various factors, mainly those related to shifts in supply and demand, may cause deflation. A decline in consumer spending is frequently brought on by increased financial uncertainty or savings rates, as well as an oversupply of goods. Furthermore, technological advancements can lower product prices and production costs, causing deflationary pressure. Depending on the financial environment, these elements can mix sophisticatedly.

Moreover, deflation can also be triggered by global economic trends, such as increased global competition or changes in trade policies that lower the price of imported goods. Additionally, governmental fiscal austerity measures, which involve reducing public spending and increasing taxes, can depress economic activity and lead to a decrease in consumer demand, further pushing prices downward. Another significant contributor to deflation can be a strong currency, which makes imported goods cheaper and domestic products less competitive abroad, thus exacerbating the decline in prices. Each of these factors can contribute to a sustained period of deflation, affecting everything from consumer behaviour to broader economic policies, often requiring coordinated international responses to address effectively.

Impacts of Deflation

The effects of deflation are numerous. It primarily means lower prices for consumers. However, if depreciation persists, it may result in lower business profits, leading to lower income and employment. Consumer spending is reduced as a result, triggering a vicious cycle that can cause an economic downturn. Depreciation may increase the cost of repaying existing debt, which could increase default rates on a financial level.

Additionally, deflation can lead to a deferral of consumption and investment. As prices continue to fall, both consumers and businesses might postpone purchases in anticipation of even lower prices in the future. This delay in spending exacerbates the downturn as production slows, leading to further reductions in workforce and wages, which in turn diminish consumer spending power even more. Moreover, the uncertainty generated by falling prices can lead to decreased confidence and increased market volatility. Financial institutions may become more risk-averse, tightening credit conditions and further restricting the flow of money into the economy, which can stifle economic growth and innovation. This cycle of negative economic activity can be difficult to reverse without significant intervention from policymakers.

2 Pros and 2 Cons of Deflation

Pros

Increased Purchasing Power as Prices Decline

Deflation, despite its potential drawbacks, can also bring about positive changes. When the price drops overall during depreciation, consumers may find that they can spend more with the same amount of money. This increased purchasing power opens up opportunities to purchase items and services that were earlier beyond their financial reach, potentially improving their quality of life.

Lower Costs Can Lead to Increased Exports in a Globalized Economy

Deflation lowers prices for goods produced internally, allowing manufacturers to lower their production costs. This could increase a nation’s export competitiveness on the global stage, leading to higher export sales abroad and enhancing the trade balance.

Cons

Businesses May Suffer from Lower Earnings, Leading to Job Cuts and Reduced Investment

One of the most concerning aspects of deflation is its potential to trigger a downward spiral in the economy. As prices drop, businesses experience a decrease in income, leading to job losses and reduced investment in new projects and technologies. This, in turn, can push businesses to lower costs to maintain profitability, further exacerbating the cycle. These negative pressures can lead to slower economic growth and a prolonged economic downturn.

Consumers and Businesses May Delay Purchases in Anticipation of Further Price Drops

Deflation has the contradictory effect of causing consumers to delay spending in anticipation that prices will drop even more despite having more purchasing power. This conduct, known as the negative spiral, further causes businesses to lower prices, perpetuating the cycle.

Businesses may delay investing in technology or capital goods upgrades in order to anticipate lower costs in the future. This sluggish purchase causes stagnation in technology and slows down economic development.

Historical Incidents of Deflation

The Great Depression of the 1930s

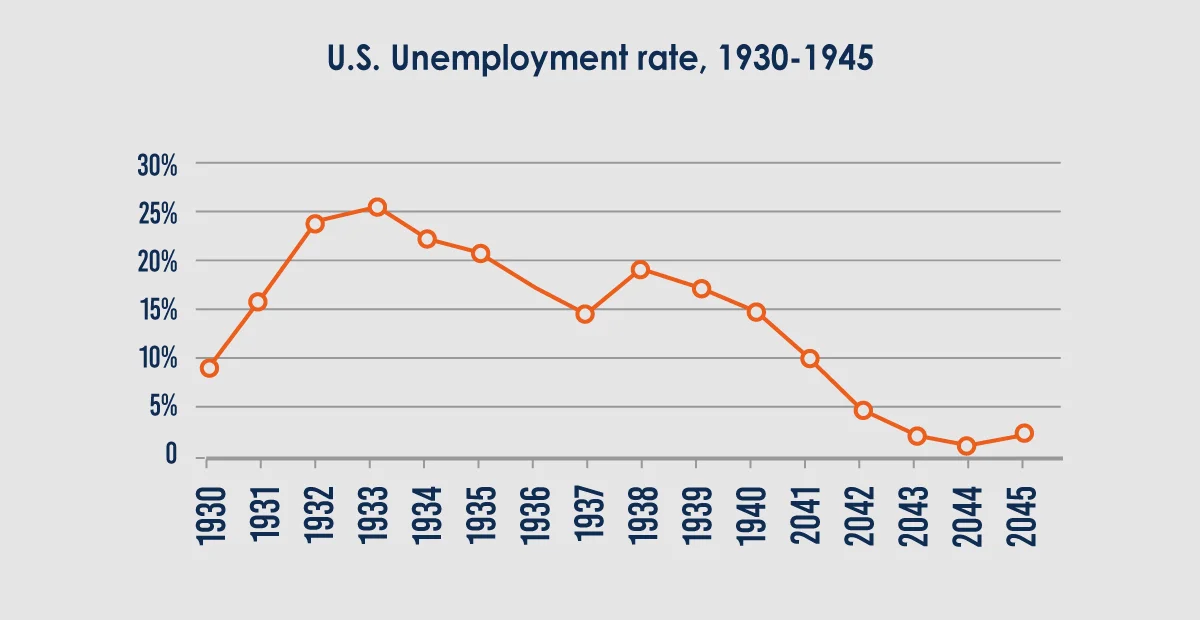

Understanding the historical incidents of deflation, such as the Great Depression of the 1930s, is crucial for gaining a comprehensive understanding of this economic phenomenon. The Great Depression, which began with the stock market crash of 1929 and lasted throughout the 1930s, was marked by deflation. Prices and wages plummeted due to massive unemployment and a severe drop in consumer spending. During this deflationary period increased the real value of debt, making it harder for individuals and companies to pay off what they owed. This led to a cycle of reduced spending and increased savings, further deepening the economic downturn. By learning from these historical incidents, we can better prepare for and mitigate the effects of future deflationary periods.

For example, between 1929 and 1933, the United States saw a 25% drop in prices, significantly increasing the burden of mortgages and loans and leading to widespread foreclosures and bankruptcies.

Japan’s “Lost Decade” in the 1990s

Japan’s experience in the 1990s provides another significant example of how deflation can severely impact an economy. After the asset price bubble burst at the beginning of the decade, Japan faced a prolonged period of deflation that lasted well into the 2000s. This deflation was characterised by falling prices, which, while initially seeming beneficial, led to decreased business revenues and a reluctance to invest in a falling market. As a result, the economy stagnated, and recovery efforts were complicated by the deflationary mindset that discouraged spending and investment.

During this period, real estate and stock market prices fell drastically, and despite low-interest rates, economic growth remained sluggish due to reduced consumer spending and corporate investment.

Additional Considerations

These two historic incidents demonstrate how deflation may cause an economic contraction cycle. Consumers and businesses anticipating further price declines may experience psychological effects, which may worsen economic slowdowns by causing more extended periods of spending and investment. These instances further illustrate policymakers’ difficulties in reducing deflation because current measures, such as lowering interest rates, do not suffice when rates are near zero. Businesses may wait to invest in technology or capital goods upgrades to anticipate lower costs in the future. This sluggish purchase causes stagnation in technology and slows down economic development.

Deflation vs Inflation

While deflation and inflation may seem like opposite sides of the same coin, they are both related to changes in the price of goods and services. Deflation, as we’ve discussed, refers to a decrease in the overall cost of goods and services, while inflation is the opposite, where the cost of living increases. Both high inflation and deflation can be harmful to an economy, so policymakers often strive to maintain a stable inflation rate.

Deflation and inflation impact the economy in different ways, particularly through their influence on consumer behaviour and business operations. During deflation, the decreased cost of goods might initially seem like a boon to consumers, allowing them to buy more for less. However, as prices continue to fall, people may start postponing purchases in anticipation of even lower prices, which reduces overall demand and slows economic activity. This can lead businesses to decrease production, cut jobs, and lower wages, creating a cycle of reduced economic growth. Conversely, while inflation reduces the purchasing power of money, causing prices to rise, it can also stimulate spending and investment as people try to buy goods and services before prices go up further, potentially driving economic growth. Both scenarios pose challenges, but deflation can be particularly difficult to manage because it involves a sustained downward trend that can be hard to reverse once it takes hold.

Learn what causes inflation

Does Deflation Have Greater Negative Effects Than Inflation?

Determining whether deflation is worse than inflation frequently depends on the particular economic context and how persistently price levels change. Some economists contend that depreciation is more challenging to control and can prolong the length of the economic downturn, as Japan has shown. Many people point out that high inflation can also cause economies to slack off, as have many developing nations.

How To Make Profit During Period of Deflation

Deflation can occur anytime, and it’s difficult to predict when it will occur. Therefore, planning a diversified portfolio that includes investments that flourish during deflation and investments that thrive during inflation can provide protection regardless of what happens in the economy.

Traders can invest in investment-grade (IG) bonds and dividend-paying stocks or keep their money in cash. Furthermore, commodities may provide a good defence.

Example: gold has traditionally been used to hedge against deflation and inflation.

Learn how to trade gold in 10 steps

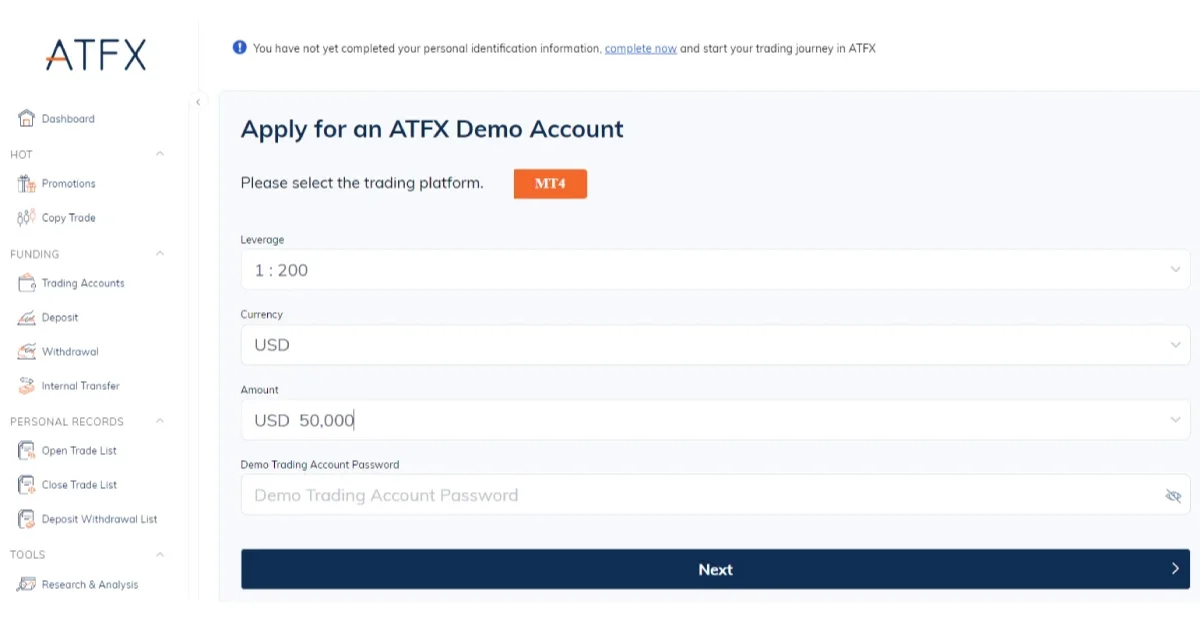

Learn How To Trade During Deflation through a Demo Account

If you’re not ready to trade live yet, we have a demo account with $50,000 in virtual funds, allowing you to practice your knowledge without financial risk.

For instance, a trader might execute a trade that, in reality, would result in a $500 loss. This setback is virtual in your demo trading account setting, offering a valuable lesson without monetary consequences. The ATFX demo trading platform’s design is identical to a live account, ensuring users become adept with its tools and features before transitioning to live trading.