Table of contents:

- Understanding Forex News Trading

- Types of News That Impact Forex Markets to Trade

- Types of News Trading Strategies for Forex

- How to Trade the News in Forex

- Pros and Cons of Trading the News in Forex

- Key Takeaways

- Trade The News Today With ATFX

Understanding Forex News Trading

Forex news trading relies on economic data, news, and major events rather than solely on conventional methods like technical analysis. The forex news trading strategy emphasises fundamental analysis, with traders forming forecasts about market shifts by considering economic indicators and global events.

News trading attracts traders with the opportunity for rapid price movements and substantial profits in a short time. However, it comes with higher risks due to increased volatility and unpredictable market reactions. Proficient news traders quickly analyse news events and understand their potential impact on currency pairs.

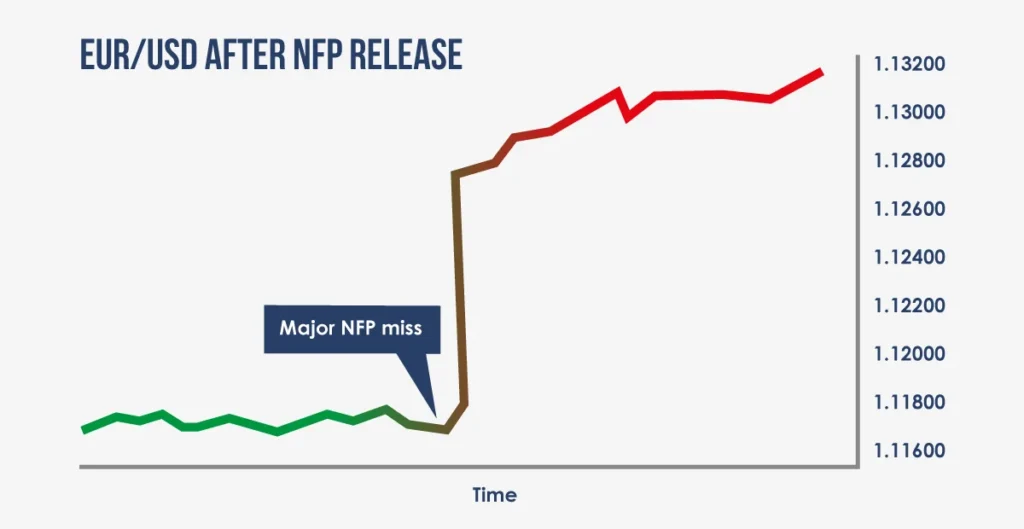

Example: The United States publishes the Non-Farm Payroll (NFP) report on the first Friday of every month. This frequently leads to substantial fluctuations in the USD and currency pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD, CAD/USD and more. Traders who predict the NFP outcomes can strategically take advantage of the price changes immediately after the report is made public.

Check out the most traded currency pairs.

Types of News That Impact Forex Markets to Trade

Various news and events can influence the forex market differently. By understanding these impacts, traders can better anticipate market movements.

Economic Data Releases

The information includes inflation, unemployment, gross domestic product (GDP), and retail sales. Should inflation exceed forecasts, it may prompt speculation about the central bank’s likelihood of increasing interest rates, thereby strengthening the affected currency.

Learn what causes inflation.

Central Bank Announcements

Significant fluctuations are common in the market due to decisions about interest rates, monetary policy statements, and speeches made by central bank officials. If the European Central Bank (ECB) suggests a potential increase in interest rates, the Euro could see an increase in value compared to other currencies.

Geopolitical Events

Elections, trade negotiations, and conflicts can create market uncertainty. After the 2016 Brexit referendum, the GBP/USD pair experienced significant volatility as traders responded to the potential economic consequences of the UK’s withdrawal from the EU.

Unexpected Events

Traders may experience significant market fluctuations when reevaluating risk and the potential economic consequences after sudden government changes, natural disasters, or terrorist attacks.

Types of News Trading Strategies for Forex

Traders can utilise various forex news trading strategies to exploit the market’s reactions to news events. Those who focus on forex news use a range of tactics to benefit from the market’s response to news events. Some of the most commonly utilised approaches include:

Straddle Trading Strategy

The essence of the straddle trading strategy is placing both a buy order and a sell order on a currency pair shortly before a significant news release. This allows traders to capitalise on market movement in any direction following the news outcome. If the news release exceeds expectations, the buy order will be executed, and if the news is unfavourable, the sell order will be triggered. This strategy benefits traders anticipating significant volatility but needs to determine the market’s future direction.

How It Works:

Pre-News Setup: Place a buy order above the current market price and a sell order below it. Both orders should have stop-loss levels set to minimise risk.

Post-News Reaction: The market will likely move sharply in one direction after the news is released. The triggered order captures the movement, while the opposite is automatically cancelled.

Example: The decision on interest rates by the US Federal Reserve is imminent, and there’s uncertainty in the market regarding a potential rate hike. News traders use this strategy to place a buy order for the EUR/USD pair at 1.1850 (above the current price) and a sell order at 1.1800 (below the current price). If the Fed catches the market off guard with a rate increase, the US dollar could strengthen, leading to a decline in the EUR/USD pair and consequently triggering the sell order. The trader profits from the downward movement while the buy order is cancelled.

Fade the News Strategy

This strategy means going against the first market response to a news release. The idea is that the initial sharp increase or decrease in price is usually an exaggerated reaction and will be succeeded by a reversal, causing the price to return to its levels before the news. Mastering this strategy entails having a solid grasp of market sentiment and the skill to recognise overreactions.

How It Works:

Response at the Start: Once the news is out, it’s wise to await a substantial market movement in a specific direction.

Critical Moment: Identify when the price seems to be steadying or changing direction, then execute a trade in the opposite direction.

Benefit from the Market Correction: When the market retracts, prices revert to their original levels, enabling news traders to profit from the pullback.

Example: If the US Non-Farm Payrolls (NFP) report exceeds forecasts by a considerable margin, there may be a sudden rise in the US dollar’s value. Nevertheless, a news trader employing the fade strategy could predict this surge in an exaggerated response. Before entering a short position, they will wait for signs of a reversal, like a temporary pause in price movement or the development of a reversal pattern in a shorter time frame. Capitalising on the retracement, the news trader could exploit price declines as the market undergoes corrections.

Breakout Strategy

The Breakout Strategy operates on the premise that essential news events can cause a breakout from a range or a consolidation pattern. Should a news event generate sufficient momentum, it has the potential to propel the price past crucial support or resistance levels, resulting in a pronounced directional shift. News traders use this strategy to capitalise on the momentum following a breakout.

How It Works:

Before the News: Find a currency pair trading within a narrow range or consolidation pattern before an upcoming news event.

Entry Order Placement: It’s recommended that entry orders be placed a little beyond the range so that the trade can be automatically executed during a breakout resulting from the news.

Optimising Momentum Opportunities: Following a breakout, news traders capitalise on the momentum by employing trailing stops to secure profits as the price continues moving toward the breakout.

Example: If the Bank of England (BoE) is getting ready to announce its decision regarding interest rates, the GBP/USD pair has maintained a narrow range of 1.3800 to 1.3850 for multiple days. Should a breakout trader choose to place a buy order at 1.3860 and a sell order at 1.3790, an unexpected rate hike by the BoE could lead to the GBP/USD surpassing the 1.3860 level, thereby triggering the buy order. Consequently, the trader could exploit the upward momentum by adjusting the stop-loss to lock in profits as the price increases.

News Reversal Strategy

The News Reversal Strategy resembles the fade strategy but emphasises entering a trade after a notable reversal pattern emerges following a news-driven spike. Typically, this strategy is employed when the initial market response is considered unsustainable or unclear news announcements result in a swift reversal.

How It Works:

Keep an eye out for the Spike: Pay close attention to the immediate market reaction once the news is announced.

Reversal Pattern Recognition: Watch for indications that the original momentum is diminishing, such as candlestick patterns signalling a change in direction (e.g., Doji, Engulfing), discrepancies in technical indicators, or prominent levels of support or resistance.

Seek Validation: When verifying a distinct reversal pattern, initiate a trade in the opposite direction of the initial trend.

Aim for Pre-News Levels: Prices frequently revert to levels close to where they were before the news, establishing a profit target for the trade.

Example: The Euro sharply dropped from 1.2000 to 1.1900 after the European Central Bank (ECB) issued a dovish statement. However, the market quickly realised that the dovish tone was anticipated, and the initial response might have been an overreaction. An hourly chart displayed a bullish engulfing pattern, suggesting a potential reversal. A trader utilising this strategy initiated a long position at 1.1910, anticipating a return towards 1.1980.

How to Trade the News in Forex

Learning how to trade the forex market based on news and choosing suitable news events requires research, analysis, and understanding of market expectations. Below is a detailed roadmap:

Step 1: Select the News Events

It is essential to stay updated on upcoming significant news events that could impact the market. Economic calendars are invaluable for identifying forthcoming releases. Look for events like central bank announcements, job reports, and inflation statistics.

Step 2: Analyze Market Expectations

Before the news release, assess what the market is expecting. For instance, the market expects a robust job report, but the actual data turns out to be less impressive, and the currency could experience a steep decline. Understanding these expectations helps in positioning trades.

Step 3: Choose a Broker

Finding the right broker is essential for successfully executing forex news trading strategies. When starting your news trading adventure, seek out brokers with a strong reputation and tight spreads like ATFX. ATFX differentiates itself by providing an extensive array of products and competitive CFD trading spreads.

Step 4: Set Up the Trade

Depending on your strategy, traders should set up their trade before the news is released. When utilising the breakout strategy, consider placing entry orders at critical levels where you anticipate the market will shift in response to unexpected news.

Step 5: Manage Risk

News trading can be unpredictable, so managing your risk exposure effectively is essential. Employ stop-loss orders to safeguard against significant losses and evaluate the magnitude of your trades to avoid overexposure.

Step 6: React Quickly

Significant price movements triggered by news events offer the opportunity to earn high returns, allowing for the potential to make substantial profits quickly.

Pros and Cons of Trading the News in Forex

Pros | Cons |

Potential for High Profits: Substantial profits can be earned when news events cause significant price fluctuations, providing an opportunity to make high profits quickly. | High Volatility: News trading can lead to highly unpredictable fluctuations, which, if not handled correctly, can cause significant losses. |

Clear Catalysts: News provides clear reasons for market moves, making it easier to understand and predict price action. | Slippage: Sudden price movements may prevent your orders from being executed at the intended price, resulting in slippage. |

Opportunities Across All Markets: All markets offer opportunities due to the numerous economic releases and events each week, making news trading a frequent possibility. | Psychological Pressure: Participating in news trading can induce psychological stress, demanding rapid decision-making and effective emotional management. |

Key Takeaways

Forex news trading strategies offer substantial rewards by leveraging market reactions to economic and geopolitical events. Traders can navigate volatility by understanding key news events, choosing the right forex news trading strategy, and managing risks. However, news trading carries significant risks, demanding thorough preparation, quick decisions, and robust emotional discipline.

Trade The News Today With ATFX

Whether you’re an experienced trader or a beginner, trying out your new forex news trading strategies on a demo account is crucial before transitioning to a live account. This will allow you to improve your skills and build confidence without risking your capital. Before entering the dynamic realm of forex news trading, ensure you hone your trading methods in a safe environment to optimise your chances of success with ATFX today!