Looking to learn more about Forex vs Stocks? Then you are in the right place! The financial world offers a myriad of opportunities for traders and investors. Two of the most prominent markets are the Forex and stock markets. In this article, you will learn the differences and similarities between the two, along with other aspects such as pros and cons, correlation etc.

Table of contents:

3. Forex vs Stocks: 9 Differences

4. Forex vs Stocks: 8 Similarities

5. Forex vs Stocks: Which One is More Profitable?

6. Relationship Between the Forex and Stock Markets

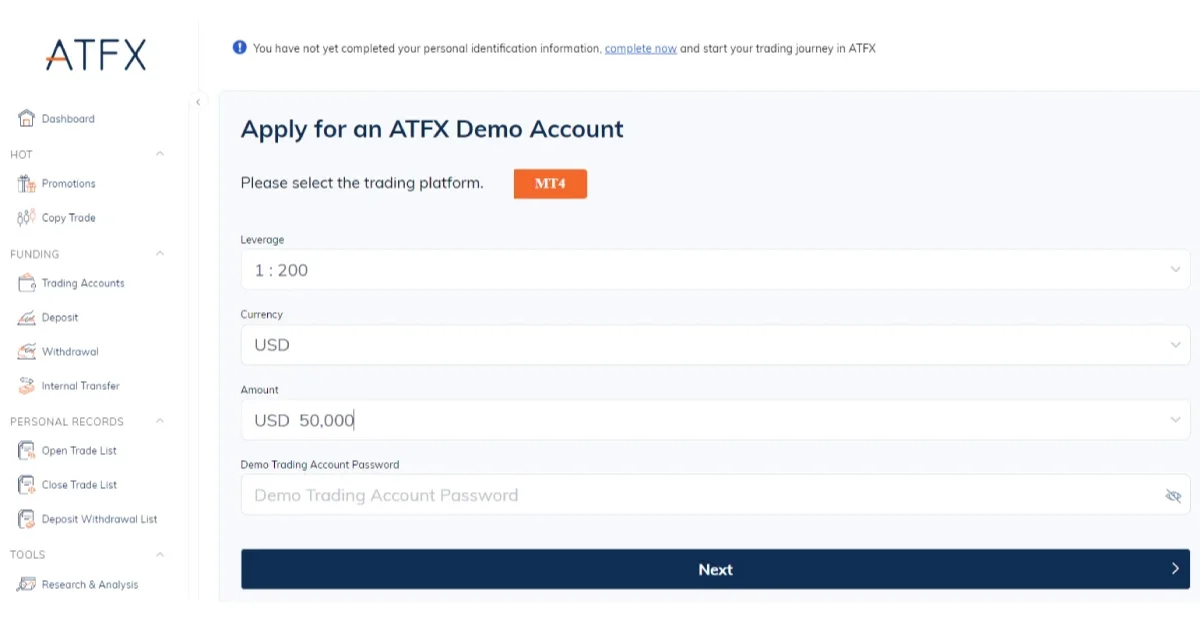

Practice Stock and Forex Trading through ATFX Demo Account

What is Forex Trading?

Forex, or foreign exchange, is the global arena for trading national currencies in pairs like the EUR/USD. It’s the world’s largest financial market, with a daily volume exceeding $6 trillion. Currencies are categorised as major, minor, or exotic pairs. Learn more about what is forex trading & how it works .

Example: when the EUR/USD rate shifts from 1.10 to 1.15, a transaction of €100,000 could mean a $5,000 difference due to the rate change. This market operates 24/5, driven by banks, institutions, and individual traders. Learn how to trade EUR/USD in 10 steps .

What is Stock Trading?

Stock trading involves buying and selling shares of publicly listed companies on stock exchanges. These shares represent fractional ownership in the company. As of 2021, the global stock market capitalisation reached approximately $95 trillion.

Example: if someone had purchased 10 shares of Apple in 2000 for around $3 each, their investment would be worth $99,394.40 in 2023, given the stock splits and price appreciation. Stock traders aim to capitalise on short-term market movements, while investors often hold long-term, banking on company growth.

Forex vs Stocks: 9 Differences

Forex and stock trading, while sharing some similarities, operate under distinct dynamics and parameters. Let’s look at what sets them apart.

Summary table

Differences | Forex Trading | Stock Trading |

Market Structure | Decentralized market with no central exchange. Trading occurs directly between participants over-the-counter (OTC). | Centralised exchanges like the NYSE or NASDAQ. Provides more transparency in terms of price and volume data. |

Ownership | You’re speculating on the future value of one currency against another. No actual ownership of the currency. | Buying a stock means purchasing a piece of ownership in a company. Shareholders may have voting rights and might receive dividends. |

Short Selling | Inherently a two-sided market. Going short is as straightforward as going long. | Short selling requires borrowing shares. It’s a more involved process with potential restrictions or additional costs. |

Dividends and Interest | Traders might earn or pay interest based on the “rollover” or “swap” rate, which is the difference in interest rates between the two currencies in a pair. | Stock investors might receive dividends when a company distributes profits. |

Market Hours | Operates 24 hours a day, five days a week. | Limited to specific stock exchange operating hours. |

Volume and Liquidity | Extremely high liquidity with a daily trading volume exceeding $6 trillion. | Liquidity varies by stock and exchange. |

Factors Influencing Prices | Influenced by global events, economic data, interest rates, and geopolitical tensions. | Influenced by company performance, industry trends, market sentiment, and broader economic factors. |

Leverage | Often offers higher leverage, sometimes up to 100:1 or even 500:1. | Typically offers lower leverage, often around 2:1 for day trading and 4:1 for overnight positions. |

Number of Choices | Focuses mainly on major, minor, and exotic currency pairs. | Offers thousands of individual stocks to choose from across various stock exchanges worldwide. |

Here are more detailed descriptions of each difference, with examples and figures:

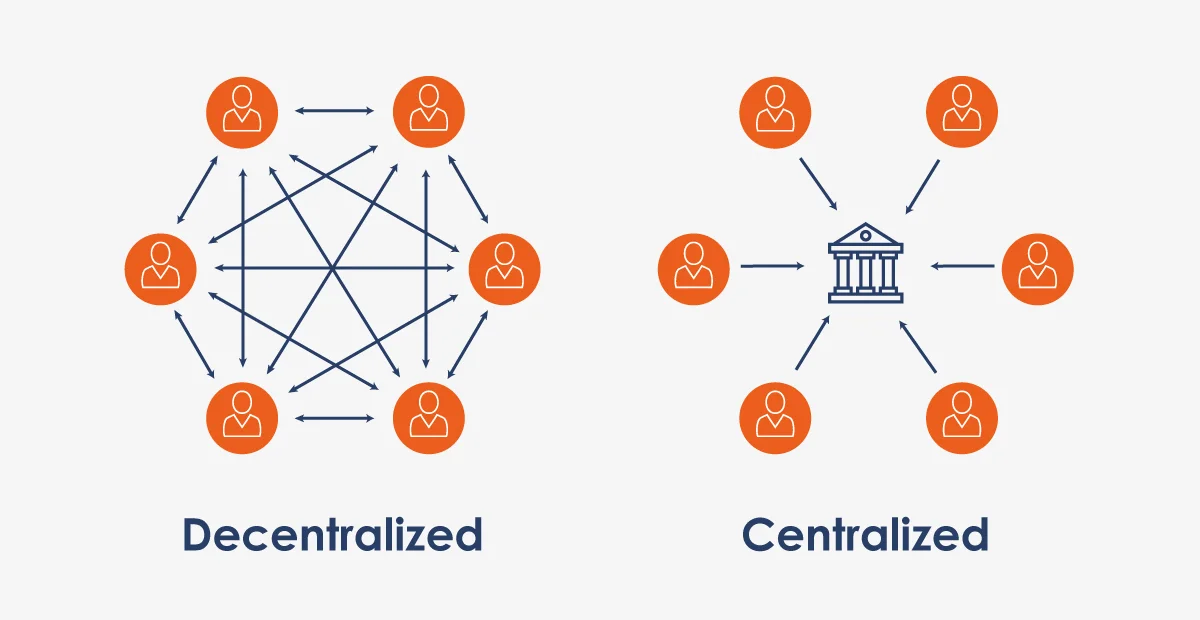

Market Structure

Forex: It’s a decentralised market, meaning there isn’t a central exchange. Instead, trading occurs directly between participants over-the-counter (OTC).

Stocks: Stocks are traded on centralised exchanges, such as the NYSE, NASDAQ, or Tokyo Stock Exchange. This centralisation provides more transparency in terms of price and volume data.

Example: When buying a stock, you purchase it from a seller on a specific exchange. In Forex, you could be trading with various participants, from banks to individual traders, without a centralised location.

Ownership:

Forex: When trading currencies, you don’t own the actual currency. You’re speculating on its future value against another currency.

Stocks: Buying a stock means purchasing a piece of ownership in a company. As a shareholder, you may have voting rights and might receive dividends.

Example: Owning Apple stock means you own a tiny fraction of Apple Inc. and might receive dividends. Trading the EUR/USD pair doesn’t give you ownership of euros or dollars; you’re speculating on their relative values.

Short Selling:

Forex: It’s inherently a two-sided market. When you believe a currency’s value will rise, you buy or “go long.” When you think it will decrease, you sell or “go short.” Going short is as straightforward as going long.

Stocks: While you can short-sell stocks, the process is more involved. It requires borrowing shares to sell them at the current price, hoping to buy them back later at a lower price.

Example: If you believe the Japanese yen will weaken against the U.S. dollar, you can easily sell the USD/JPY pair . But if you think a stock like Tesla will drop, you’d need to borrow shares to short sell, which might come with restrictions or additional costs.

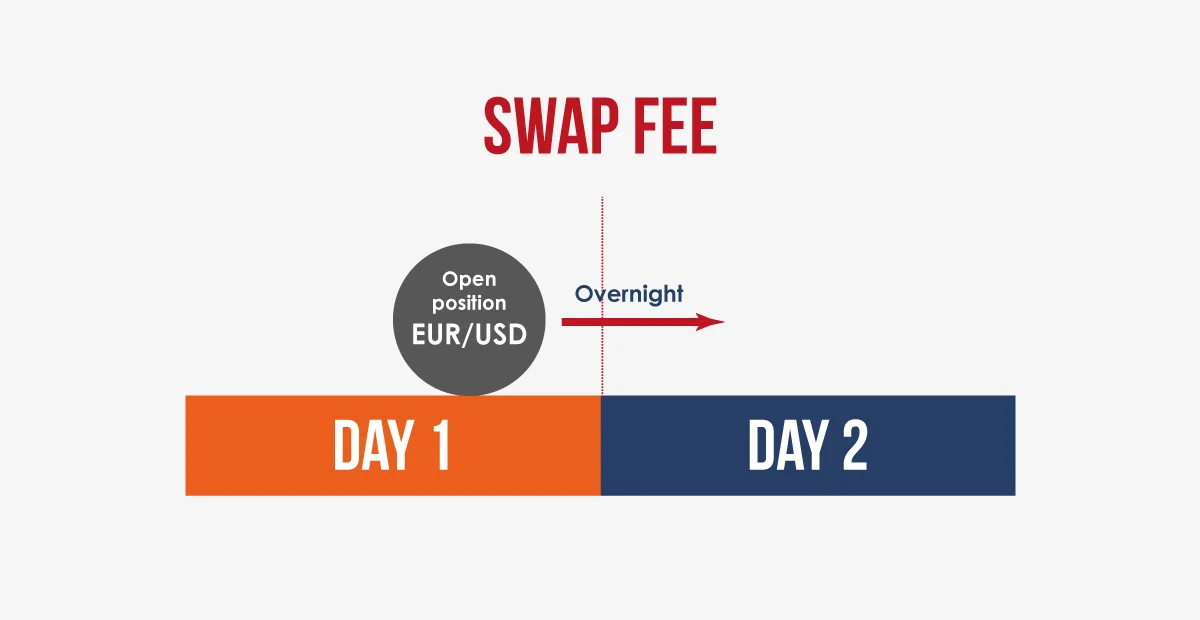

Dividends and Interest:

Forex: Traders might earn or pay interest based on the difference in interest rates between the two currencies in a pair, known as the “rollover” or “swap” rate.

Stocks: If a company shares profits with its shareholders, stock investors might receive dividends. Forex traders don’t receive dividends.

Example: Holding Microsoft shares might earn you dividends when the company distributes profits. Holding the EUR/USD pair overnight could result in either earning or paying interest, depending on the interest rate differential.

Market Hours:

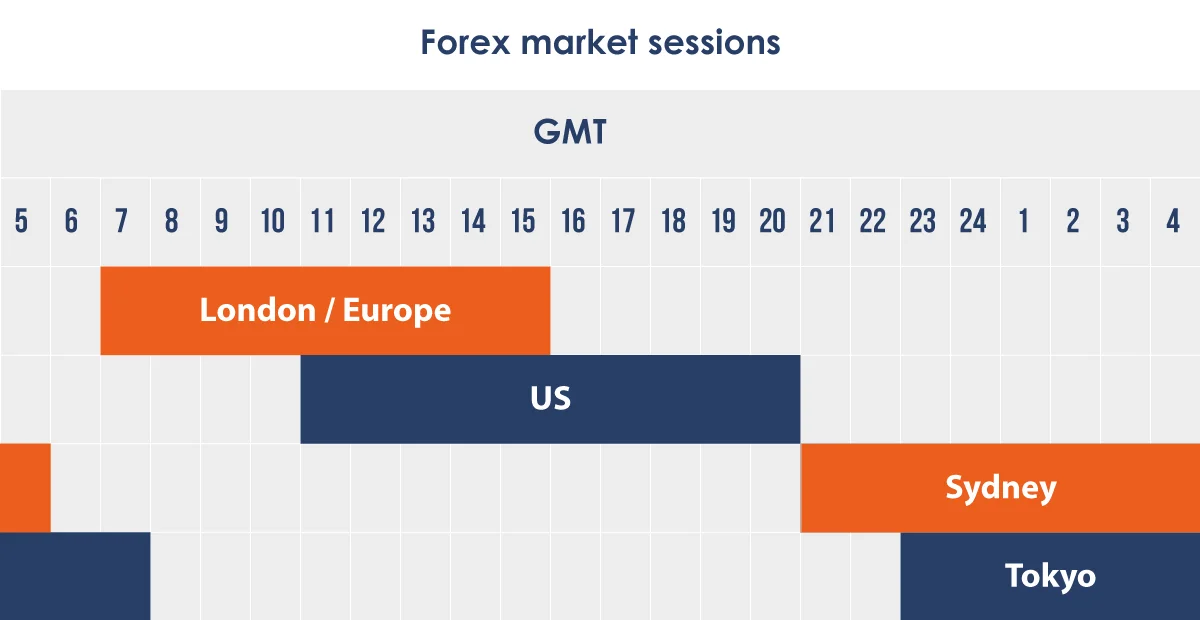

Forex: Operates 24 hours a day, five days a week, allowing for continuous trading across different time zones. Learn why forex markets are open 24 hours a day .

Stocks: Trading hours are limited to the specific stock exchange’s operating hours, typically from 9:30 AM to 4:00 PM Eastern Time for exchanges like the NYSE.

Example: A Forex trader in Australia can trade the EUR/USD pair during their regular daytime hours, even though it’s nighttime in Europe and the U.S.

Volume and Liquidity:

Forex: Extremely high liquidity due to its global nature, with a daily trading volume exceeding $6 trillion as of 2019.

Stocks: Liquidity varies by stock and exchange. Blue-chip stocks like Apple or Microsoft tend to have high liquidity, while smaller stocks may not.

Figures: The NYSE alone has a daily trading volume of around $200 billion.

Factors Influencing Prices:

Forex: Prices are influenced by global events, economic data, interest rates, and geopolitical tensions.

Stocks: Prices are influenced by company performance, industry trends, market sentiment, and broader economic factors. Check out what is trend trading .

Example: A major tech company’s earnings report might significantly impact its stock price, while a change in U.S. interest rates could influence the value of the U.S. dollar in the Forex market.

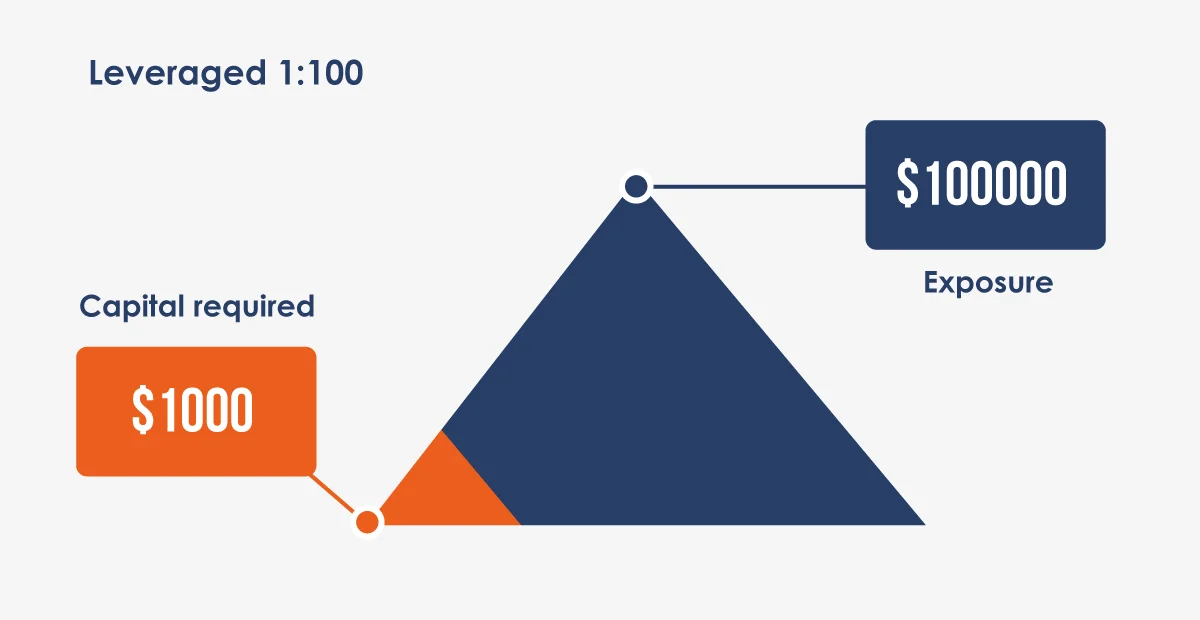

Leverage:

Forex: Often offers higher leverage, sometimes up to 100:1 or even 500:1 in some jurisdictions.

Stocks: Typically offers lower leverage, often around 2:1 for day trading and 4:1 for overnight positions. Learn why day traders fail and how to turn it around .

Example: With a $1,000 deposit in a Forex account with 100:1 leverage, a trader can control a position worth $100,000.

Number of Choices:

Forex: Focuses mainly on major, minor, and exotic currency pairs, totalling around 100 pairs commonly traded. Learn the 10 most traded foreign currencies in the Forex market.

Stocks: Offers thousands of individual stocks to choose from across various stock exchanges worldwide.

Figures: There are over 2,800 stocks listed on the NYSE alone.

Forex vs Stocks: 8 Similarities

Forex and stock trading are avenues for investors and traders to profit from market movements. Here are their shared characteristics:

Market Analysis:

Traders in both realms utilise technical analysis , studying price charts, and fundamental analysis, examining economic indicators or company financials, to make informed decisions. Learn how forex traders use candlestick charts to analyse trends .

Risk Management:

Whether it is setting stop-loss orders to limit potential losses or diversifying a portfolio, risk management is paramount in both markets.

Regulation:

Both markets are overseen by regulatory bodies that ensure transparency, fairness, and protection for traders and investors. For example, in the UK, both Forex and stock brokers operate under the oversight of the Financial Conduct Authority (FCA), which ensures that financial markets work well and consumers get a fair deal. Learn how to choose the right broker for trading .

Leverage:

Both markets offer leverage, allowing traders to control larger positions with a smaller capital outlay. For instance, a Forex broker might offer 50:1 leverage, meaning with $1,000, a trader can control a position worth $50,000. Learn more about the type of brokers and which one you should choose .

Profit and Loss:

In both markets, participants can profit from rising and falling prices by buying low and selling high or through techniques like short selling. Learn how to calculate the margin, profit and loss in forex .

Speculation:

A significant portion of activity in both markets is driven by speculators who aim to profit from price fluctuations rather than the intrinsic value of currencies or stocks. Learn how to find undervalued stocks in 4 easy steps .

Automated Trading:

Forex and stock markets have seen a rise in automated trading strategies, where trades are executed by algorithms based on predefined criteria. Check out automated vs manual trading .

Brokerage Accounts:

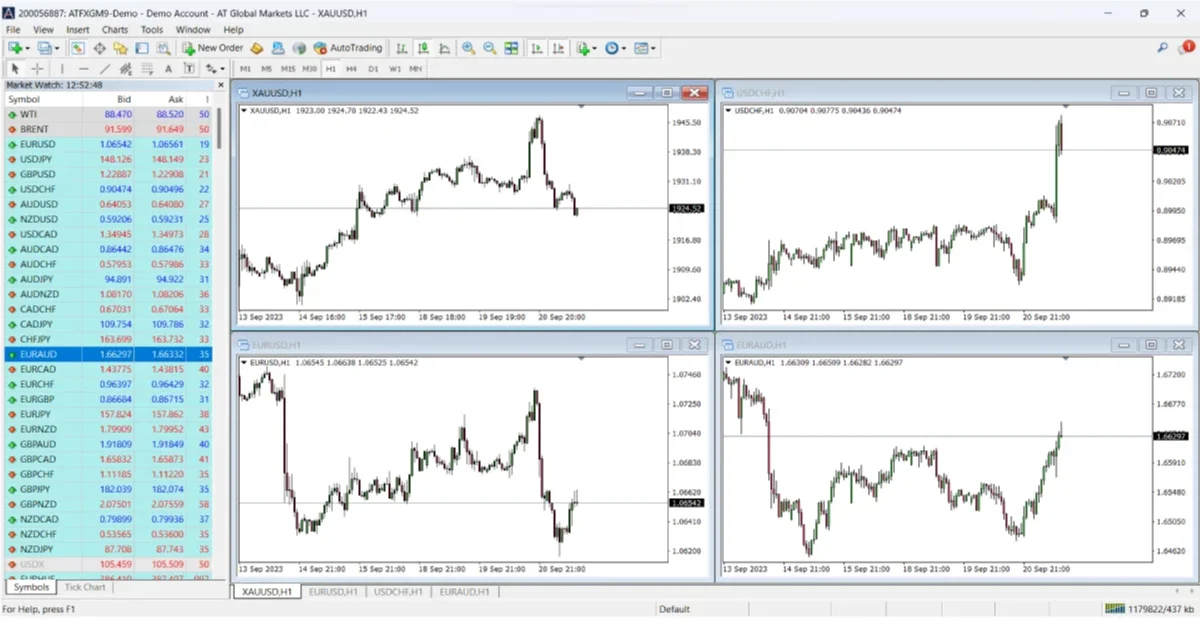

To participate in either market, traders typically need to open an account with a broker, which provides them with the Metatrader 4 (MT4) platform and tools to execute trades. Learn what is MT4 and how to use it , download MT4 to start trading now.

Forex vs Stocks: Which One is More Profitable?

Determining whether Forex or stock trading is more profitable can be subjective and largely depends on an individual’s trading style, risk tolerance, and expertise. Here, we delve into the profitability aspects of both:

Forex:

High Leverage:

Forex trading offers high leverage, potentially leading to substantial profits. However, it also increases the risk of significant losses. Learn why leverage is high in the forex .

Example: A trader using a 100:1 leverage can amplify their gains but also risks losing their investment quickly on adverse market moves.

24/5 Trading:

The Forex market operates 24 hours a day, five days a week, allowing for more trading opportunities. Open a forex trading account and start trading forex now!

Figures: The Forex market’s daily turnover exceeded $6.6 trillion in 2019, indicating high liquidity and potential profitability. Learn more about is forex trading profitable .

Stocks:

Investment Growth:

Stocks offer the potential for long-term investment growth through capital appreciation and dividends. Learn how to pick a stock .

Example: Investors who bought Amazon shares in the early 2000s have seen exponential growth in their investments.

Company Ownership:

Buying stocks means acquiring a stake in a company, with the potential for dividends and voting rights, which can be profitable in the long run. Check out stock market investment for beginners .

Figures: In 2020, Apple reported a net income of $57.41 billion, rewarding shareholders with substantial dividends. Open a stock trading account now !

Both Forex and stock trading offer unique opportunities for investors. Traders and investors need to educate themselves, practice, and develop a sound strategy to successfully navigate the complexities of either market.

Learn more about how to become a trader .

Relationship Between the Forex and Stock Markets

The Forex and stock markets are two distinct financial realms, but they often influence each other in various ways:

Risk Appetite and Safe-Haven Currencies:

When stock markets are bullish, indicating a high-risk appetite, investors might move away from safe-haven currencies like the U.S. dollar or Japanese yen. Conversely, during stock market downturns, these currencies often strengthen as investors seek safety.

Example: During times of geopolitical tension or economic uncertainty, investors might sell off stocks and buy safe-haven currencies, leading to a decline in stock indices and an appreciation of currencies like the Swiss franc.

Interest Rates and Equity Valuations:

Central bank interest rate decisions can influence the Forex and stock markets. Higher interest rates can strengthen a currency but also impact borrowing costs for companies, potentially affecting their stock valuations.

Example: When the U.S. Federal Reserve raises interest rates, it might lead to a surge in the U.S. dollar value. However, companies with significant debt might see their stock prices decline due to increased borrowing costs. Learn more about how Fed rate hikes affect the stock and Forex market .

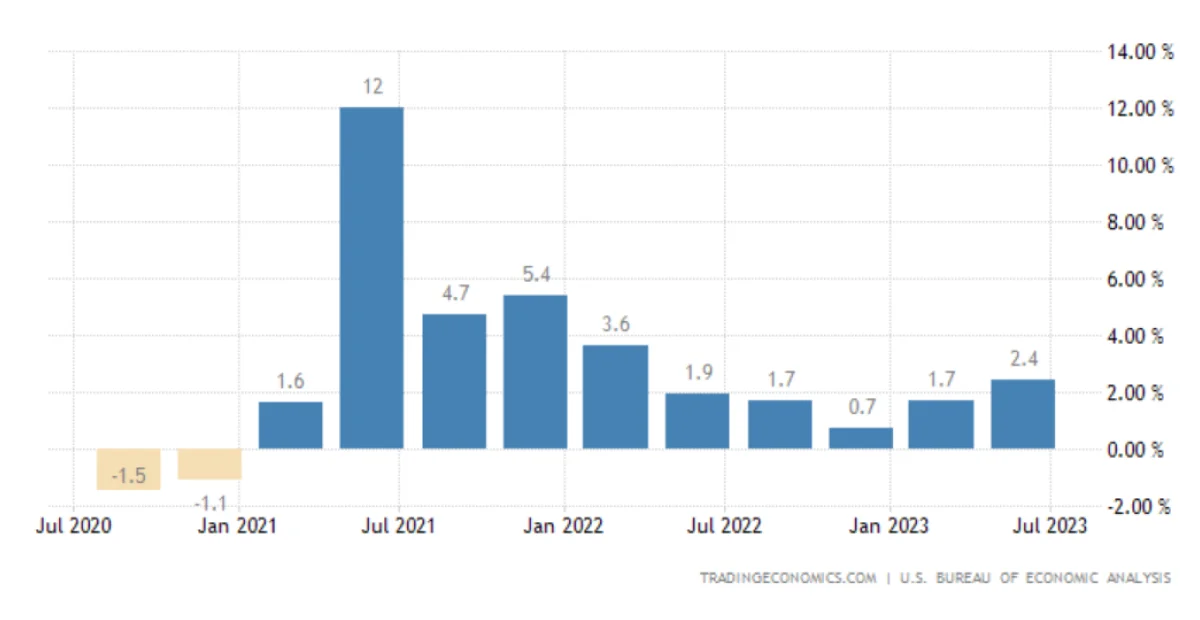

Economic Indicators:

Economic data, such as GDP growth, unemployment rates, and manufacturing output, can influence currency values and stock prices. Strong economic performance can boost a country’s currency and its stock market.

Figures: A report showing a 2.4% GDP growth above expectations might lead to a country’s stock market index rising by several percentage points and its currency strengthening against its peers. Learn more about indices trading .

Globalization and Multinational Corporations:

Many companies operate globally, earning revenues in multiple currencies. Fluctuations in currency values can impact these companies’ profitability and, by extension, their stock prices.

Example: A U.S.-based multinational earning significant revenues in Europe might see its profits (when converted back to dollars) affected by major swings in the EUR/USD exchange rate. Learn also how exchange rates become affected by the forex market .

Practice Stock and Forex Trading through ATFX Demo Account

ATFX, a leading online broker, apart from trading strategies and market news, they also offer a demo account that mirrors real trading environments, allowing traders to refine their skills without financial risk. This risk-free demo trading platform provides real-time market conditions, enabling users to grasp market dynamics and perfect their strategies.

For instance, a trader might execute a trade that, in reality, would result in a $500 loss. In your demo trading account setting, this setback is virtual, offering a valuable lesson without monetary consequences. The ATFX demo trading platform’s design is identical to a live account , ensuring users become adept with its tools and features. With extended availability, traders can practice at their leisure, ensuring they’re fully prepared before transitioning to live trading .