Key Takeaways:

|

What is a trader?

A trader is an individual who buys and sells financial assets in any financial market. Traders can work independently or for financial institutions, using strategic trades to profit from market movements.

Traders should specialise in the market they choose to trade, such as stocks, forex, or commodities. They use various strategies and tools to forecast market movements and time their trades for maximum profit.

Trader activities can range from day trading to swing trading to position trading, depending on their trading style and strategies.

How to become a trader?

- Learn the fundamentals of trading

- Earn a degree or a certificate

- Select the type of trader you want to be

- Choose the right market

- Select a broker

- Develop trading strategies

- Trading with a demo account

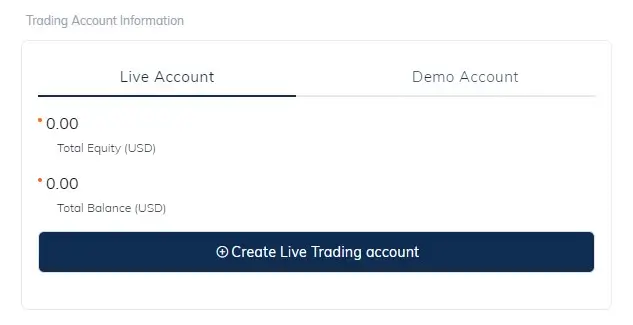

- Transition to live trading account

- Implement risk management and psychology control

- Maintain trading journal

- Engage in Continuous Learning and Networking

- Decide on your trading career path

Learn the Fundamentals of Trading

Understanding trading basics is the fundamental key entry level for all traders, whether they are beginners with no experience or professionals. The trading basics of may include the following:

- Understanding the supply and demand in financial markets

- Economic data, geopolitical events, market analysis

- Trading terminology

- Biding and asking prices

- Trading hours

- Financial market

The easiest way to learn the fundamentals of trading is to read a book or blog from a professional trader or broker and watch a trading basic tutorial video.

Earn a Degree or Certification

Getting a degree or certification in finance or economics related to trading education can provide more advanced knowledge about the industry. You do not necessarily need a certificate to be a trader, but a formal education provides a better learning experience.

- Comprehensive curriculums cover a wide range of topics, including financial markets, investment analysis, portfolio management, and risk management, providing you with a well-rounded understanding of the industry.

- Courses are taught by experienced professionals with real-world expertise in trading and finance, offering valuable insights and guidance.

- Programs incorporate hands-on learning experiences, such as trading simulations and case studies, allowing you to apply theoretical concepts in practical settings.

- Universities often have extensive networks of alumni and industry contacts, providing you with valuable networking opportunities and potential career connections.

Select the Type of Trader You Want to Be

Understand the types of trader goals, risk tolerances, strategies, and lifestyles that may influence trading style and decision-making. Three common types of traders are as follows

Day trader: Day Trading is best suited for individuals who can dedicate sufficient time to monitoring the markets during trading hours and are comfortable with the high-frequency nature of this approach.

Swing Trader: Swing trading is suitable for traders who want to capitalize on short-term to medium-term market trends while requiring less time to execute.

Position Trader: Position trading is a long-term investment strategy suitable for individuals comfortable with less frequent trading activity and willing to endure market volatility for potentially larger returns.

Choosing the right trading style according to your current conditions is important in finding the strategy that works best.

Choose the Right Market

Choosing the right financial market to trade is a crucial decision that can significantly affect your trading performance. With a wide range of options available, such as stocks, forex, commodities, and others, it’s important to assess each market based on your knowledge, preferences, and goals. Following are the common markets that traders trade.

Stocks: Trading stocks involves buying and selling shares of publicly traded companies. Stock trading may appeal to individuals interested in specific industries or companies and those seeking opportunities for long-term growth or short-term speculation.

Forex: Forex trading involves buying and selling currency pairs in the foreign exchange market. It may be suitable for individuals interested in global economics and currency markets and those seeking opportunities for short-term trading or hedging currency risk.

Commodities: Trading commodities involves buying and selling physical goods such as gold, oil, agricultural products, etc. It may appeal to individuals interested in tangible assets, inflation hedging, and diversification beyond traditional financial markets.

Factors to Consider Market to Trade

Select a market that aligns with your understanding and expertise. Having knowledge of the market’s fundamentals, drivers, and trading dynamics can give you a competitive edge.

It is important to choose a highly liquid market to ensure smooth execution of trades with minimal slippage. Such markets usually have tight bid-ask spreads and lower transaction costs.

It is important to assess market volatility as it can impact both trading opportunities and risk levels. Higher volatility can lead to greater profit potential but also entails higher risk.

Regulated markets offer greater transparency and security through oversight and investor protection measures.

Select a Broker

A reliable broker provides essential tools, resources, and support to help you execute trades effectively and navigate the complexities of trading. Following are some considerations when choosing a broker.

- Regulation: Ensure that the broker is regulated by reputable authorities in their jurisdiction.

- Security: Prioritize brokers with robust security measures to protect your personal information and funds.

- Trading Platforms: Evaluate the broker’s trading platforms to ensure they are user-friendly, reliable, and equipped with essential tools and features.

- Financial Asset Availability: Choose a broker that offers access to the markets and assets you’re interested in trading.

- Costs and Fees: Consider the broker’s fee structure, including commissions, spreads, and overnight financing rates.

- Educational Resources: Look for brokers that offer educational resources, tutorials, and market analysis.

- Customer Support: Reliable customer support is essential for resolving issues and addressing concerns promptly.

Develop Trading Strategies

Trading strategies help traders make informed decisions and navigate the complexities of the financial markets. Traders can develop effective strategies by combining fundamental and technical analysis.

Fundamental analysis involves evaluating the intrinsic value of an asset by analysing economic, financial, and qualitative factors.

- Economic Indicators

- Company Fundamentals

- Market Sentiment

Technical analysis involves analysing historical price data and chart patterns to forecast future price movements.

Trading with a Demo Account

A demo account allows traders to practice under simulated real-market conditions without the fear of losing capital for free. Traders practising with a demo account can benefit from the risk-free environment and real-market conditions, refine trading strategies, and familiarise themselves with the trading platform’s features and tools.

Transition to Live Trading Account

With enough practice and consistency in your demo trading results, it is time to transition to live trading with real money.

Start with a small amount of capital and manage portfolio risk to develop a consistent, disciplined trading strategy. Gradually improve by trading live in the real market.

Implement a Risk Management and Psychology Control

Risk management is a fundamental aspect of successful trading, as it helps protect your investments and minimize potential losses. By understanding and applying risk management techniques, you can safeguard your capital and increase your chances of long-term profitability.

Traders must implement risk management to reduce the emotional stress and psychological impact of trading.

Traders should always have a clear risk management technique plan as follows:

- Position Sizing

- Stop-Loss Orders

- Diversification

- Risk-Reward Ratio

- Risk Limits

Maintain Trading Journal

A professional trader keeps a detailed trading journal to evaluate each trading performance and gain valuable insights into one’s strengths, weaknesses, and areas for improvement.

- Track Your performance entry and exit points, position sizes, and the reasoning behind each trade.

- Identify patterns & trends

- Refine strategies

- Emotional regulation

Traders should regularly update trading journals, review each trade’s performance to learn from mistakes, achieve targeted goals, and always stay alert to adapt to the market.

Engage in Continuous Learning and Networking

Engaging in continuous learning and networking allows you to stay updated with market trends, expand your knowledge, and connect with other traders for valuable insights and advice.

Stay Updated with Market Trends

- Follow Industry News: Follow reputable news sources, financial publications, and industry websites to stay abreast of the latest developments in the financial markets. Pay attention to economic indicators, geopolitical events, and central bank announcements that may impact market sentiment and trends.

- Attend Webinars and Seminars: Participate in webinars, seminars, and workshops conducted by industry experts and seasoned traders. These events offer valuable insights, analysis, and market perspectives that can help you make more informed trading decisions.

- Read Trading Books and Magazine

Connect with Other Traders

- Join Trading Communities: Participate in online forums, social media groups, and trading communities where traders share ideas, discuss market trends, and offer support and advice. Engaging with a community of like-minded individuals provides opportunities for networking, collaboration, and learning from others’ experiences.

- Attend Trading Meetups and Events: Attend local trading meetups, conferences, and networking events to meet other traders in person and exchange ideas and experiences. Networking with fellow traders allows you to build relationships, share insights, and expand your professional network.

- Seek Mentorship and Guidance: Find a mentor or trading coach who can provide personalised guidance, feedback, and mentorship based on their experience and expertise. A mentor can offer valuable insights, help you overcome challenges, and accelerate your learning curve in trading.

Decide on Your Trading Career Path

As you progress in your trading journey, it’s important to consider your long-term goals and aspirations to determine your trading path. Whether you choose to continue trading independently or explore opportunities to trade professionally with a firm, your decision should align with your goals, preferences, and trading style. Here’s how to decide on your trading path:

Independent Trading

- Flexibility and Autonomy: Independent trading offers flexibility and autonomy. It allows you to trade on your terms and schedule and work from home. You have full control over your trading decisions, strategies, and portfolio management.

- Self-Responsibility: Independent trading requires self-discipline, self-motivation, and self-responsibility. You are solely responsible for your success and must continuously strive to improve your skills, knowledge, and performance.

- Potential for Higher Returns: Independent trading offers the potential for higher returns, as you retain all profits from your trades without sharing them with a firm. However, it also entails higher risks and uncertainties.

Professional Trading with a Firm

- Access to Resources and Support: Trading with a full-time job in a professional firm provides access to resources, technology, and support systems that can enhance your trading capabilities. You benefit from the firm’s infrastructure, research, and risk management tools.

- Structured Environment: Professional trading firms offer a structured and collaborative environment where you can learn from experienced traders, access proprietary trading strategies, and receive mentoring and guidance.

- Profit-Sharing Opportunities: Some trading firms offer a profit-sharing commission, where traders receive a share of the profits generated by their trading activities. This provides an additional incentive and potential for earning significant returns.

Making the Career Job Decision

Consider factors such as your risk tolerance, capital requirements, career aspirations, and lifestyle preferences when deciding on your trading path. Evaluate the pros and cons of each option and choose the path that aligns with your goals, values, and circumstances. Remember that your trading path may evolve over time, and it’s okay to reassess and adjust your approach as needed to achieve your objectives.

Train to Become a Trader Now! Successful Trader Await You

Sign up for a demo account now and start honing your skills risk-free. Don’t miss out on the opportunity to become a successful trader with live account.