Table of contents:

- What is Forex Trading

- What is Buy and Sell in Forex Trading

- How to Buy and Sell in Forex Trading

- When to Buy and Sell in Forex Trading

- Top 3 Most Traded Currency Pairs

- Buy and Sell in Forex Trading Summarized

- Buy and Sell Forex with ATFX

Overview of Forex Trading

Forex trading involves buying and selling currencies in the global financial markets to generate profits. Traders analyse and respond to the fluctuations in the values of currency pairs, utilising strategies like leverage to increase possible profits. The market operates continuously from Monday to Friday and incorporates a range of players such as banks, financial organisations, companies, and individual traders.

Understanding currency pairs, spreads, and pips and using technical, fundamental, and sentiment analysis strategies are essential. Because of the market’s volatility and potential for substantial losses, managing risk and effectively selecting a trustworthy broker is necessary.

Learn more about the history of the forex.

What is Buy and Sell in Forex Trading

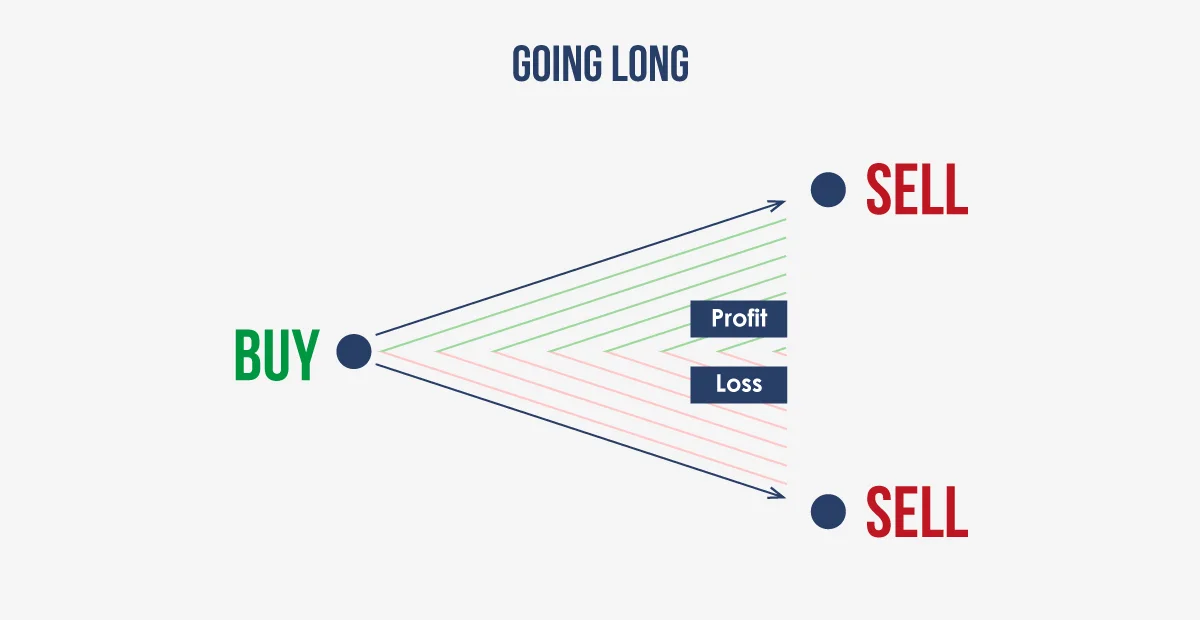

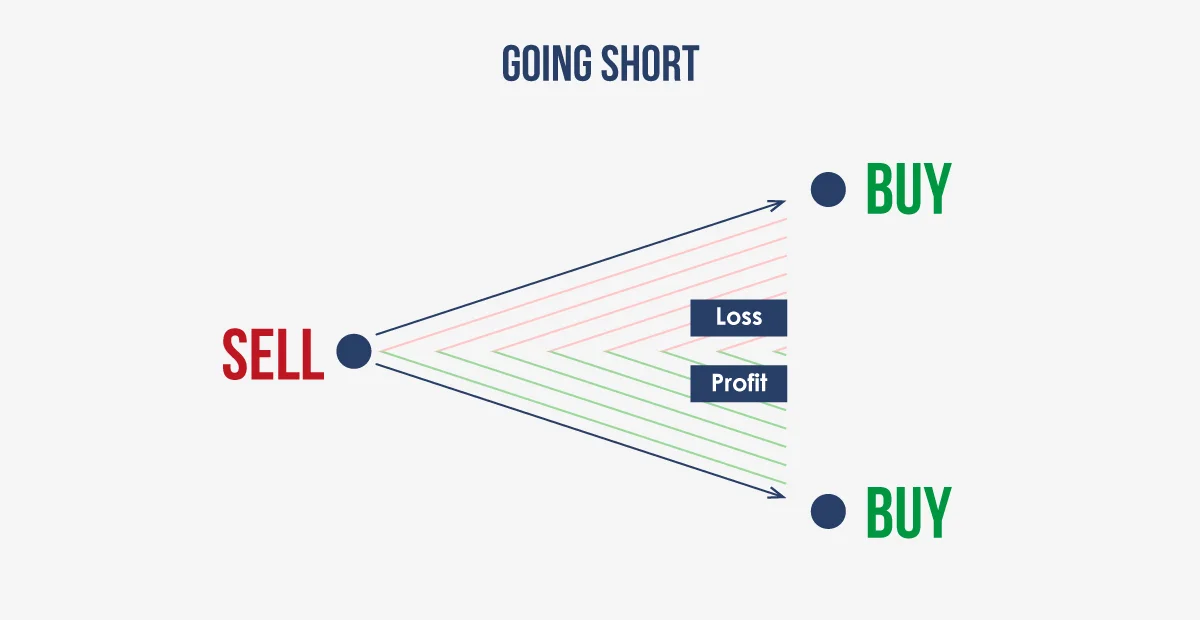

When trading forex, “buy” means to open a long position by buying a currency pair with the expectation that the base currency will increase in value compared to the quoted currency. On the other hand, “sell” means to open a short position by selling a currency pair, anticipating that the base currency will depreciate.

Buying (Going Long): When trading a currency pair, people buy the base currency while selling the quote currency. It is simply known as an option for the pair to be ‘long’ or to buy it. When traders engage in buying, they anticipate that the primary trading currency will increase in value compared to the secondary trading currency. In the case of trading the EUR/USD, the expectation is that the euro will gain strength against the dollar.

Selling (Going Short): When traders engage in “going short” on a specific currency pair, they are essentially selling the base currency and, at the same time, buying the quote currency. This is based on the anticipation that the base currency’s value will decrease relative to the quote currency. If the forecast is accurate, traders intend to purchase the pair at a more favourable rate, thus enabling them to profit. For example, when trading the EUR/USD, the trader bets that the euro will gradually devalue against the dollar.

How to Buy and Sell in Forex Trading

To be successful in the market, traders must understand how to buy and sell forex pairs. Traders must understand the different elements involved in buying and selling when trading forex before determining the optimal timing for entering the market to buy and sell currencies. As a result, a comprehensive guide on how to buy and sell forex is now available to traders.

Step 1: Understand the Market

Before getting involved in forex trading, it’s crucial to understand how the market is structured. In forex trading, traders are engaged in transactions with currency pairs such as the EUR/USD or USD/JPY, each denoted by a three-letter code for each specific currency.

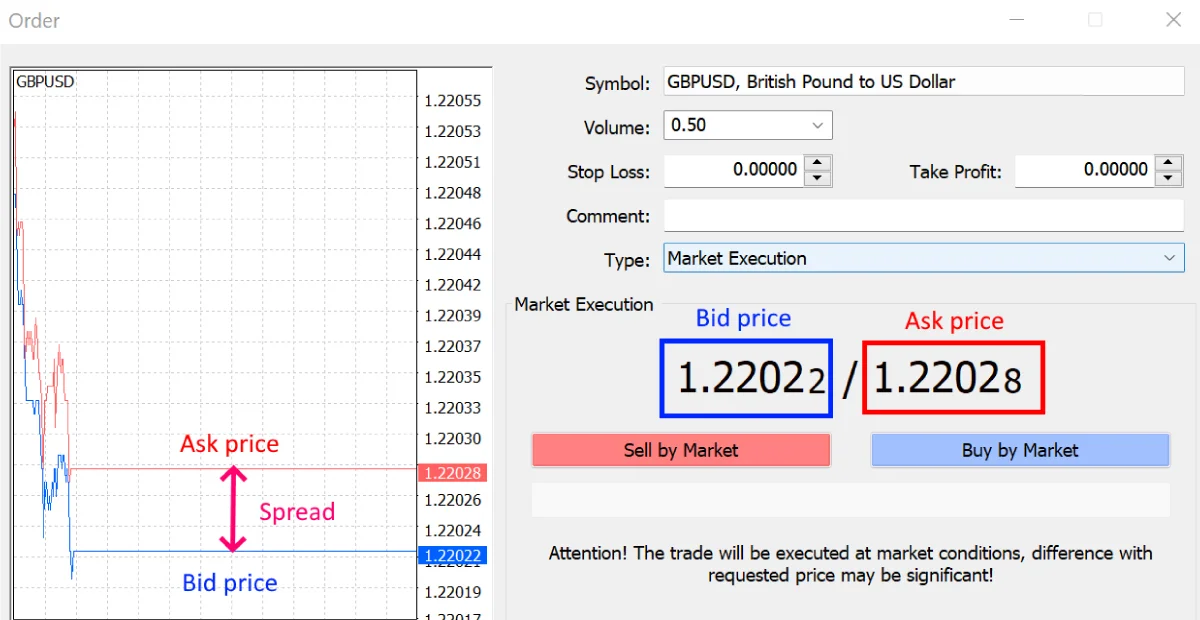

It’s crucial to grasp the terminology used in forex trading. The price at which a currency is available for purchase is referred to as the “bid price,” whereas buying a currency is known as the “ask price.” The difference between the bid and ask prices is known as the “spread,” representing the broker’s fee. A “pip” indicates the slightest price change a currency pair undergoes.

Step 2: Analyse the Market

To succeed in forex trading, it is essential to have a thorough understanding of the factors that influence the market and the ability to analyse these factors accurately, in addition to knowing the optimal timing for buying and selling.

Economic Indicators

In the forex market, traders closely monitor economic indicators that reveal a country’s financial health and stability. Macroeconomic conditions are evaluated based on gross domestic product (GDP), unemployment, and inflation rates.

Political Events

Political stability and governance can affect the strength of a country’s economy, which in turn can affect the strength of its currency. Significant factors include political events like elections, trade agreements, and geopolitical stability.

Technical Analysis

Analysing previous currency price movements is a crucial element of forex market research for predicting future behaviour through technical analysis. Technical indicators, charts, and patterns are all critical components of this process.

Learn more about how exchange rates become affected by the forex market.

Step 3: Create a Trading Account

When choosing a forex broker, you must consider certain factors to guarantee a productive, safe, and customised trading journey. ATFX, a well-known broker worldwide, excels in critical areas for traders, including providing competitive spreads, free trading tools, no commission charges, and fast trade execution times.

Step 4: Start Trading

After understanding how to buy and sell forex and setting up a demo or live trading account, traders can start trading forex by buying and selling currency pairs. Here are some points to remember for those prepared to begin forex trading.

Enter the Trade

Choose your preferred currency pair. Based on the market analysis, decide whether to buy or sell the pair.

Learn how forex traders use candlestick charts to analyse trends.

Decide on the Trade Size

Traders should decide the amount of the currency pair to purchase or sell based on their risk management strategies and the funds they are comfortable risking.

Traders should assess and determine the quantity of the currency pair to buy or sell, considering their risk management tactics and capacity to take on risk.

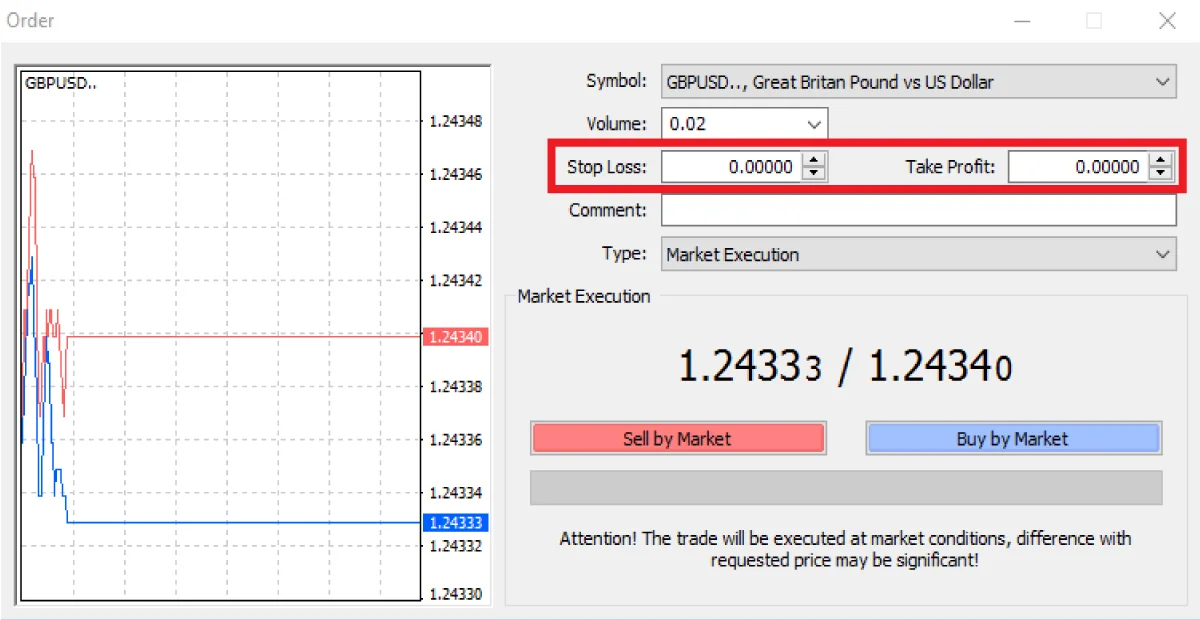

Set Stop-Loss and Take-Profit Points

Risk management requires these essential tools. If the market moves unfavourably, a stop-loss order will close your position at a predetermined price to protect against further losses. When the price reaches a level that aligns with your profit target, a take-profit order can close the position.

Monitor the Trade

Traders should monitor their active positions and current market conditions. Utilising alerts and signals can help traders stay updated on any significant changes.

Close the Position

Traders can manually close their trades if the stop-loss or take-profit orders are not executed. This decision may be influenced by a change in market sentiment, reaching their risk tolerance, or following a different strategy.

Step 5: Continuously Learn and Adapt

Staying flexible and constantly learning as the forex markets evolve is crucial. Keeping up with market news and the economic calendar, reviewing trading strategies frequently, and taking lessons from personal experiences are essential practices.

When to Buy and Sell in Forex Trading

After mastering how to buy and sell forex, it is essential to comprehend the timing of when to buy and sell in forex trading. Seasoned traders recommend trading when liquidity and volatility are at their highest points. The forex market functions through four primary trading sessions – Sydney, Tokyo, London, and New York. These sessions sometimes overlap, resulting in higher trading volume and increased liquidity. Traders must understand when to buy and sell in forex trading to maximise profits and minimise risks.

Overlap of the London and New York Sessions (8:00 AM to 12:00 PM EST)

Given the significant number of trades, this is the best period for forex trading. The coming together of two significant markets results in higher liquidity and volatility, frequently leading to tighter spreads and more excellent trading opportunities.

Tokyo-London Overlap (3:00 AM to 4:00 AM EST)

During this period, there is significant liquidity, particularly for currency pairs like the Euro, British Pound, and Japanese Yen. Still, the volatility is lower than during the London-New York overlap.

Forex traders employ different trading strategies to determine the best times to buy and sell forex pairs, primarily because of the market’s higher volatility and liquidity. Using effective strategies is crucial for successful trading in this market. Forex traders must consider various crucial decisions to optimise profits and minimise risks.

Trend Following

The market’s primary trend is established through trend following and investing based on a particular trend. This strategy is based on the idea that strengthening and weakening currencies can continue in the same direction over time.

Example: Traders employ indicators like the 50-day and 200-day moving averages. When the shorter-term average surpasses the longer-term average (golden cross), it creates a buy signal, while crossing below (death cross) creates a sell signal. Additionally, traders can use chart patterns to recognise bullish trends, like ascending triangles, and bearish trends in downward trends, such as descending triangles.

Day Trading

Day traders execute and finalise all trades within a single day to eliminate the influence of overnight price changes. They rely on technical analysis techniques, such as assessing market sentiment and short-term price shifts, to understand and spot short-term price variations.

Example: Day traders analyse short-term charts to identify potential trading opportunities. For example, upon observing an upward trend with a support level at a moving average on the 15-minute GBP/USD chart, they might initiate a long position at the beginning of the trading day and liquidate it on the same day when the price reaches a particular resistance level.

Scalping

Scalping involves repeatedly trading to profit from minor price changes. Scalpers typically only keep positions open for a few minutes or even seconds. Effective scalpers must be strict in managing losses and possess a profound grasp of technical analysis to spot potential trades.

Example: The EUR/USD pair constantly fluctuates between 1.1800 and 1.1810 during a trading session, which a scalper could capitalise on. For maximum profit, they will buy at 1.1801 and sell at 1.1809 multiple times during the day.

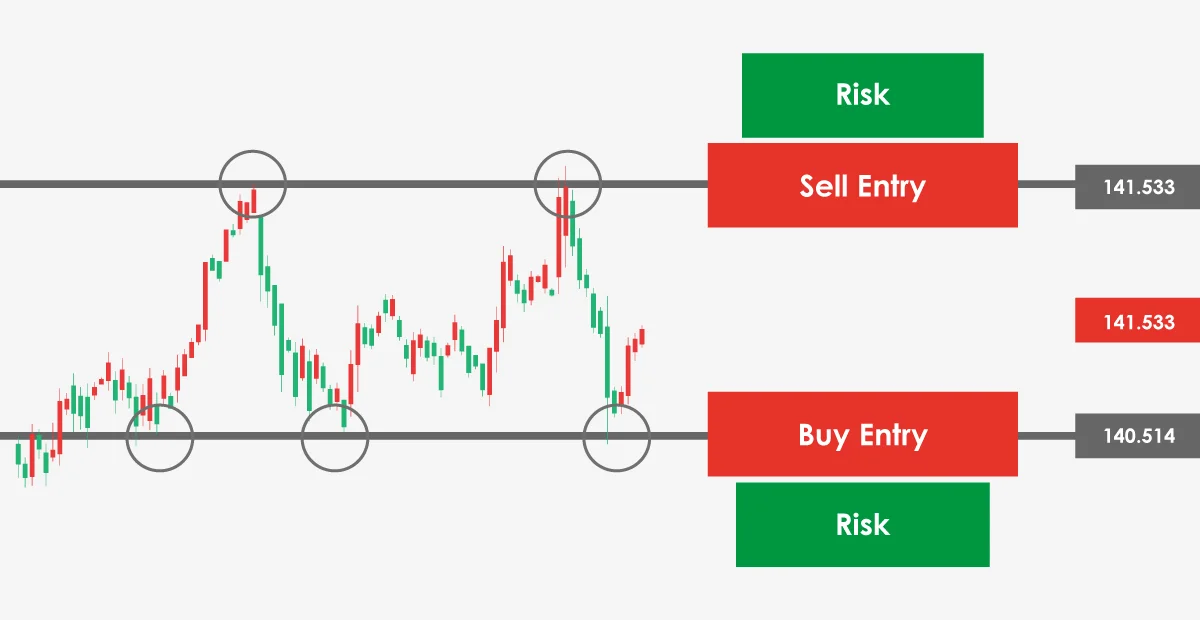

Range Trading

Forex range trading strategies use currency pairs that fluctuate within clearly defined support and resistance levels. Traders identify these ranges using technical analysis by buying close to support levels and selling near resistance levels. They also utilise indicators such as the RSI and Stochastic Oscillator to validate their trade entry and exit points.

Example: The EUR/USD has moved between 1.1200 (support) and 1.1350 (resistance) over the last few weeks. When the price bounced back from the support level with an RSI reading of 29, a trader could consider initiating a buy order at 1.1210. Placing the stop loss order at 1.1180 (slightly under the support) and the take profit at 1.1340 (just under the resistance) is an option.

Traders use market or limit orders to carry out these actions, and a deep understanding of market hours, volatility in overlapping trading sessions, and the influence of economic events is crucial for successful trading. Effective technical and fundamental analysis and robust risk management strategies are also essential to determine when to buy and sell in forex trading.

Top 3 Most Traded Currency Pairs

The most traded currency pairs globally are EUR/USD, GBP/USD, and USD/JPY due to their high liquidity, widespread popularity, and significant market trade volume.

GBP/USD

The GBP/USD currency pair called the “cable,” is the second most heavily traded in the forex market. The term “cable” originated from the underwater telegraph cable that transmitted exchange rates between London and New York in the 19th century. The volatility of this pair is greatly influenced by fundamental factors such as Brexit, economic indicators, and fluctuations in interest rates in the UK and the US.

EUR/USD

The EUR/USD, known as the “euro-dollar,” is the most widely traded currency pair in the forex market. It reflects the economic conditions of the European Union and the United States. Traders favour this currency pair due to its narrow spreads and abundant economic data, which allow for comprehensive fundamental analysis.

USD/JPY

The USD/JPY pair represents the exchange rate between the US dollar and the Japanese yen. Often called the “gopher,” it is the third-most traded currency pair. This pair serves as a crucial indicator of the economic well-being of Asian markets and is particularly sensitive to shifts in Asian economic conditions.

These three currency pairs possess distinct attributes that cater to varying levels of liquidity and present traders with diverse trading opportunities. An in-depth comprehension of the additional elements influencing these pairs is essential for success in forex trading.

Find out the ten most traded foreign currencies in the forex market and learn how to trade the EUR/USD in 10 Steps.

Buy and Sell in Forex Trading Summarized

Buying and selling in forex trading involves speculating on the movements of a pair of currencies.

When trading forex, a trader simultaneously purchases one currency and sells another or the opposite.

When traders expect the base currency to increase in value compared to the quote currency, they usually go long (buy). Conversely, they go short (sell) when they predict that the base currency will decrease in value against the quote currency.

The most favourable time for forex trading is when there is high liquidity and volatility, often during overlapping trading sessions.

Successful forex trading depends significantly on carefully planned strategies for identifying when to buy and sell forex. These strategies encompass trend tracking, day trading, scalping, and range trading.

The forex market commonly trades the US dollar, the most frequently used currency, and the EUR/USD currency pair, the most heavily traded pair.

Buy and Sell Forex with ATFX

After acquiring knowledge about buying and selling in forex trading and determining when to buy and sell in forex trading, evaluating comprehension of the current market conditions is essential. Experienced traders can engage in live forex trading using an ATFX live account. Beginners who lack a firm understanding of the financial market should begin with a demo account to practice. A demo account operates similarly to a live account, allowing users to become familiar with the platform, market, and trading strategies without risking real funds. Sign up for a complimentary demo account today to initiate the trading journey!