Table of contents:

- What are Oil Futures and Options?

- How to Trade Oil Futures & Options

- Benefits of Trading Oil

- Why Choosing ATFX to Trade Oil CFD

What are Oil Futures and Options?

Oil Futures are contracts to buy or sell a specific amount of oil at a set price on a future date. They are crucial instruments for controlling price risk and speculating on future swings in crude oil prices. For example, if you believe oil-producing countries’ tensions worldwide will cause scarcity by late 2024, you may purchase futures now and sell them for more when the situation unfolds.

Oil Options allow the buyer to buy (call) or sell (put) oil at a fixed price before the contract expires, but not the obligation to do so. This flexibility allows traders to manage risk and profit from favourable price movements. For example, you may buy a call option to buy oil at a lower price if you believe OPEC’s planned agreement to decrease output in the middle of 2024 would lead to higher oil prices.

How to Trade Oil Futures & Options

1. Learn the Key Differences between Oil Options and Futures

Before you begin trading crude oil futures and options, you must first understand the distinctions between the two. Below, we describe how oil futures and options are used and traded, highlighting the significant differences in commitment levels, related risks, possible returns, expenses, and flexibility each trading instrument provides.

1.1 Commitment to Trade

Futures: High commitment. For instance, if a trader buys oil futures for delivery in December 2024, they must buy the specified amount of oil at the agreed-upon price, regardless of market fluctuations.

Options: Low commitment. If a trader purchases an oil call option at $70 per barrel, they can exercise the option or let it expire, depending on whether market prices exceed the strike price.

1.2 Risk Exposure

Futures: High-risk exposure. For example, if a trader buys oil futures anticipating a price increase, they face significant losses if oil prices unexpectedly drop.

Options: Lower risk exposure. If a trader buys an oil call option and prices fall below the strike price, their loss is limited to the premium paid for the option.

1.3 Profit Potential

Futures: Both high-profit potential and a high potential for losses. For instance, if a trader uses futures contracts to leverage their position on oil, they can potentially amplify profits but also face substantial losses if prices move against their position.

Options: Moderate profit potential. If a trader buys oil call options and prices rise above the strike price, they can profit from the price increase, but the potential gains are typically lower than futures due to the premium paid.

1.4 Costs and Premiums

Futures: Low initial costs. For example, if a trader buys oil futures, they don’t pay an upfront premium but may need to maintain a margin account and additional funds if margin requirements increase.

Options: Higher initial costs. If a trader purchases oil call options, they pay an upfront premium for the options contract.

1.5 Flexibility and Strategic Depth

Futures: Limited flexibility. For instance, if a trader buys oil futures contracts to capitalise on an expected price increase, their strategy is straightforward but cannot hedge against downside risk.

Options: Higher flexibility. If traders combine both call and put options on oil, they can implement more complex strategies to hedge against market volatility and profit from price movements in either direction.

2. Understanding What Makes Prices Change

One aspect of learning to buy oil futures and options online is understanding the factors influencing changes in crude oil futures and options prices.

2.1 Factors that Influence Prices in Oil Futures Trading

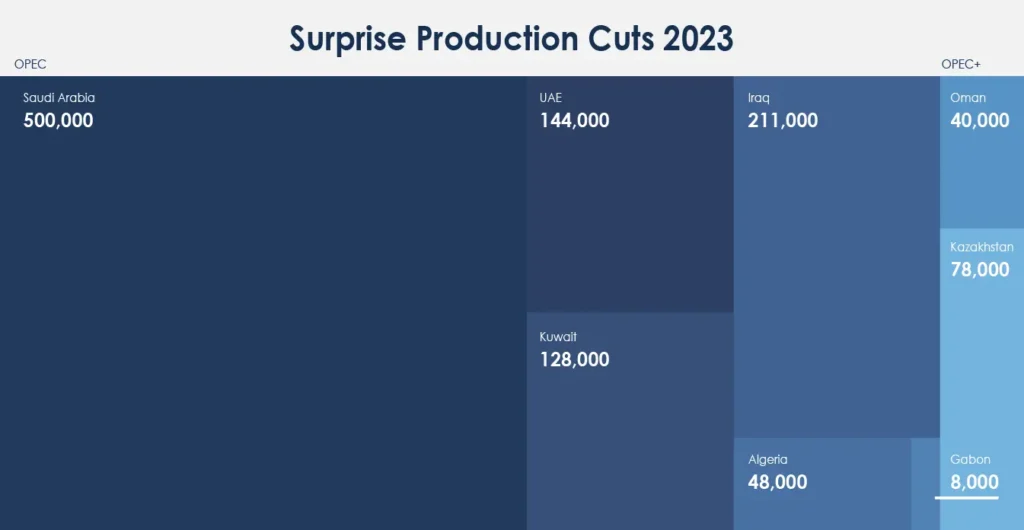

Global Production Levels: In March 2023, OPEC+ decided to cut oil production by 1.16 million barrels per day. This decision led to a noticeable increase in global oil prices as the reduction in supply created upward pressure on the market.

Geopolitical Events: The Russian invasion of Ukraine in February 2022 significantly impacted oil prices. The conflict disrupted supply chains and resulted in sanctions against Russia, one of the world’s largest oil producers, causing prices to surge.

Economic Indicators: In 2021, as the global economy began to recover from the COVID-19 pandemic, there was a marked increase in oil demand. The resurgence of industrial activity and transportation needs increased oil prices significantly from the lows experienced during the pandemic.

2.2 Factors that Influence Prices in Oil Options Trading

Volatility: In early 2022, oil market volatility surged due to the sudden changes in U.S. energy policies under the Biden administration, including the revocation of the Keystone XL pipeline permit. This unpredictability affected the prices of oil options as the market reacted to the policy shifts.

Supply and Demand Dynamics: In October 2021, unexpected U.S. shale oil production declines due to labour shortages and supply chain issues led to tighter supplies. This situation increased the premiums on oil options as traders anticipated higher future prices due to the constrained supply.

Time Decay: In late 2020, as oil options approached their expiration dates amidst the fluctuating market conditions caused by the COVID-19 pandemic, their time value decreased significantly. The market’s instability made it challenging for traders to predict future prices, thereby impacting the pricing of these options.

3. Choose a Way to Trade Oil Futures or Options

Before you start trading oil futures and options, there are other ways to trade oil that you might want to consider.

3.1 Trading Through CFDs (Contracts for Difference)

Trading oil futures or options through CFDs (USOIL.MMMYY & UKOIL.MMMYY) allows traders to speculate on oil price movements without owning the underlying asset. Traders can profit from rising and falling markets by buying (going long) or selling (going short) oil CFDs. For example, if a trader believes oil prices will fall due to a global economic slowdown, they might sell oil CFDs to profit from the anticipated price drop.

Oil Futures CFDs: When trading oil futures using CFDs, begin by choosing the particular oil futures contract you wish to trade, such as WTI Crude Oil or Brent Crude Oil. Based on your market analysis, open a position—go long if you anticipate a price increase or short if you foresee a price drop. Leverage can enhance your market exposure, but it’s crucial to manage your risk with stop-loss orders. Stay vigilant by tracking market trends and economic indicators to guide your trading decisions effectively.

Oil Options CFDs: When trading oil options with CFDs, start by selecting the type of option that aligns with your market outlook—call options for expected price increases or put options for anticipated declines. Open a position with the appropriate contract size and expiry date. Leverage enables you to control larger positions using less capital. To safeguard your investment, stay updated on market conditions and employ risk management strategies.

Open either a demo or a live account with ATFX today to start trading oil futures or options in CFDs!

3.2 Trading Trough ETFs (Exchange-Traded Funds)

Investing in Oil ETFs provides exposure to oil prices by investing in oil futures contracts, oil-related companies, or both. ETFs offer a diversified and relatively low-risk way to invest in the oil market. For instance, a trader might buy shares of an oil ETF that tracks the price of crude oil, benefiting from the overall trend in oil prices without dealing with the complexities of futures contracts.

3.3 Using Online Brokers

Another way to trade crude oil is through online brokers like ATFX. ATFX offers a convenient and accessible way to trade various oil-related instruments, including CFDs and ETFs. Online brokers provide advanced trading tools, comprehensive market analysis, and real-time data to help traders make informed decisions. Using an online broker, traders can efficiently manage their oil trading activities and access a wide range of resources to enhance their trading strategies.

4. Select Short or Long-Term Trading Strategies

When trading crude oil futures or options, understanding the duration of your trade is crucial. Here’s a breakdown:

4.1 Oil Futures:

Short-Term Trading: Short-term traders focus on immediate events like geopolitical tensions or sudden meetings impacting oil supply. They often choose monthly contracts to capitalise on these events. For instance, in September 2023, a trader selected an October 2023 oil futures contract to benefit from escalating tensions in the Middle East.

Long-Term Trading: Long-term traders look at broader economic cycles, such as global demand shifts or changes in energy policies. They prefer quarterly or yearly contracts to align with these trends. For example, in September 2023, another trader opted for a June 2024 futures contract, anticipating a gradual recovery post-pandemic and sustained growth in oil demand.

4.2 Oil Options:

Short-Term Trading: Traders capitalise on short-term market movements by utilising daily, weekly, or monthly expiries, often influenced by events such as inventory reports or political developments. For example, in June 2023, a trader opted for a weekly option following Saudi Arabia’s unexpected announcement of a voluntary oil production cut of 1.0 million barrels per day for July and August 2023. This surprising decision caused significant volatility in oil prices, presenting an opportunity for short-term gains.

Long-Term Trading: Investors targeting extended market trends, such as production cuts or economic recoveries, often select options with longer expiry dates. This approach allows the market more time to adjust, potentially enhancing the likelihood of profitable trades. For instance, in August 2023, a trader chose a quarterly option set to expire six months later, corresponding with the prolonged OPEC+ production cuts scheduled through the end of 2024. This strategy leveraged the expected trends of reduced production and increased demand, potentially leading to favourable outcomes.

5. Create a Trading Account with ATFX

Creating a trading account with ATFX depends on your risk appetite. You can choose to create a live or demo account. Start your trading journey with ATFX today by setting up your live and demo accounts:

5.1 Opening a Live Trading Account:

- Fill out an online application form.

- Provide identification for security.

- Fund your account.

Read here to learn more about opening a live trading account.

5.2 Opening a Demo Trading Account:

- Provide basic details.

- Receive login details instantly.

- Switch to a live account whenever you’re ready.

Follow the simple steps here to open a free trading demo account to try to buy oil futures online. It’s the perfect way to learn and trade confidently!

Benefits of Trading Oil

Trading oil in the financial markets offers several advantages:

- Profit Opportunities: Oil futures and options offer numerous opportunities to capitalise on price volatility.

- Market Insight: Active trading grants deeper insights into global economic trends.

- Liquidity: Oil markets are highly liquid, facilitating easier entry and exit for traders at any given time.

- Diversification: Adding oil to a portfolio can help diversify investments, potentially reducing risk.

- Leverage: Traders can use leverage to increase their buying power in the market, potentially amplifying investment returns.

Why Choosing ATFX to Trade Oil CFD

At ATFX, we stand out in the trading world for several compelling reasons:

- Globally Trusted: With a reputation built on trust and reliability, ATFX is the go-to choice for traders worldwide. Our commitment to transparency and integrity ensures your trading experience is secure and dependable.

- Robust Trading Volume: Join a platform where trading thrives with significant volume. ATFX’s bustling trading environment provides ample opportunities for traders to execute their strategies efficiently.

- Professional Trading Signals: Gain an edge in the markets with expert insights. Our team of professional analysts delivers timely and accurate trading signals, empowering you to make informed decisions and seize profitable opportunities.

- Copy Trading Platform: Experience the power of social trading with our innovative copy trading platform. Whether you’re new to trading or a seasoned investor, you can easily follow successful traders’ strategies and replicate their success.

- Educational Webinars and Seminars: Elevate your trading skills from beginner to professional with our comprehensive educational resources. From informative webinars to hands-on seminars, we provide valuable insights and practical knowledge to help you navigate the markets effectively.

Embark on your trading journey with ATFX today – whether you’re a seasoned investor or just starting out, take the first step towards financial success by creating your live or demo account and start buying or trading oil futures online now.