Looking to learn how to trade EUR/USD? This comprehensive guide is tailored for beginners and advanced traders alike, providing a step-by-step approach to mastering the forex trading market. In this article, you will learn how to trade EUR/USD in 10 steps!

Table of content

2. Understand Why You Should Trade EUR/USD

3. Factors Influencing EUR/USD

4. Understand the Best Time to Trade EUR/USD

5. Choosing a Reliable Forex Broker

6. Create your EUR/USD demo trading account

7. Develop your trading strategies for the EUR/USD

8. Transition to live trading and place your first trade

9. Always monitor your trades & update your trading strategy

10. Understand and avoid common EUR/USD trading mistakes

Ready to practice EUR/USD trading without putting in real money?

What is the EUR/USD?

The EUR/USD currency pair, is one of the top 10 ten most traded foreign currencies in the Forex market , commonly known as the “Eurodollar,” represents the exchange rate between the Euro (EUR) and the US Dollar (USD). In simpler terms, it tells us how many US dollars are required to purchase one Euro. This pair acts as a barometer of the relative strength and economic health of the Eurozone and the United States.

Example: if the EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy one Euro. The first currency (EUR) is known as the ‘base currency,’ while the second currency (USD) is called the ‘quote currency.’

Learn more about what is Forex trading & how does it work?

Understand Why You Should Trade EUR/USD

The EUR/USD currency pair, represents the Euro and the U.S. Dollar, and holds a unique position in the Forex market. Here’s why many traders choose to focus on this pair:

High Liquidity:

As the most traded currency pair globally, the EUR/USD offers unparalleled liquidity, ensuring traders can enter and exit positions with minimal slippage.

Predictable Patterns:

Due to its high trading volume, the EUR/USD often exhibits patterns and trends that technical traders can identify and leverage. Check out also : is technical analysis important for trading Forex?

Lower Spreads:

Due to its high liquidity, brokers often offer tighter spreads for the EUR/USD than any other currency pairs, reducing trading costs.

Diverse Trading Opportunities:

Whether a scalper, day trader, swing trader, or position trader, the EUR/USD offers opportunities catering to the various trading styles.

Global Importance:

The Euro and the U.S. Dollar are two of the world’s major currencies, representing two of the largest economies. Their relative strengths and weaknesses can reflect broader global economic trends.

Economic Data:

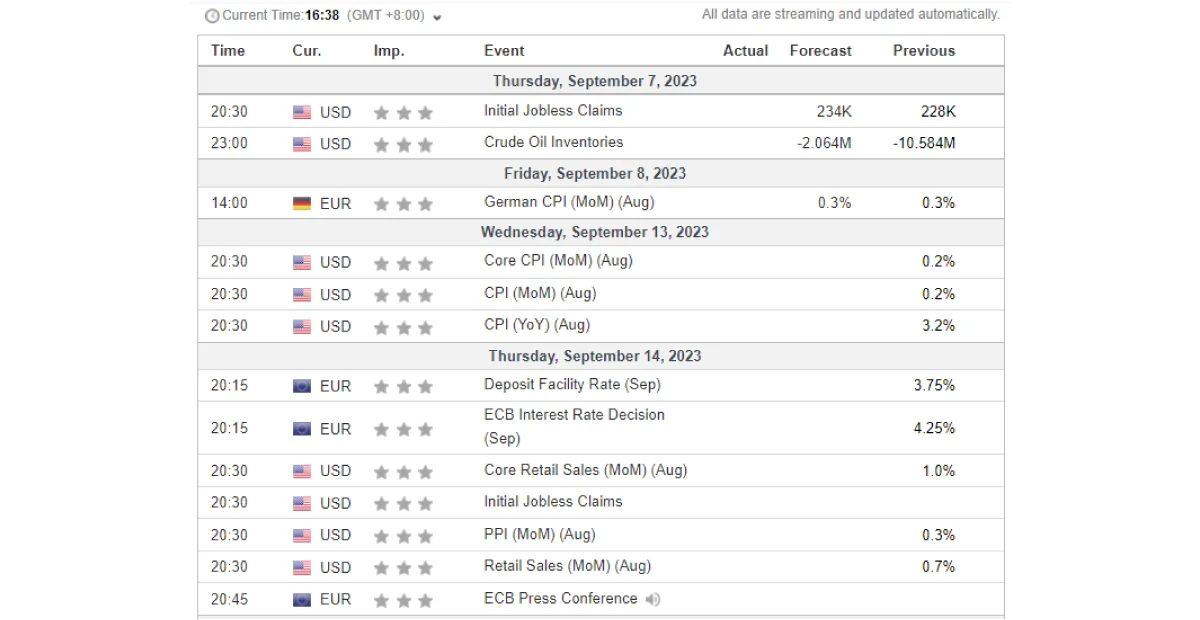

Both the Eurozone and the U.S. regularly release significant economic data, providing fundamental traders with numerous opportunities to base their trades on real-world economic events.

The image above shows economic data released from the Eurozone (along with its member countries, such as Germany) and the United States.

Factors Influencing EUR/USD

The EUR/USD exchange rate doesn’t move in a vacuum; it’s influenced by a myriad of factors stemming from both the Eurozone and the United States. Understanding these factors is crucial for any trader looking to navigate the depths of the Forex market.

Economic Indicators:

These are statistics about economic activities. Key indicators include Gross Domestic Product (GDP), Consumer Price Index (CPI), unemployment rates, inflation rates, and consumer confidence indexes.

Example: If the US announces a higher-than-expected GDP growth while the Eurozone’s GDP remains stagnant, the US dollar might strengthen against the Euro, causing the EUR/USD rate to fall.

Learn also : what is Consumer Price Index (CPI) and how does it Forex market ?

Interest Rates:

Set by central banks, interest rates can heavily sway the currency’s value. Higher interest rates offer lenders better returns, attracting foreign capital and causing the currency to appreciate.

Example: In December 2015, when the Federal Reserve raised interest rates for the first time since 2006, the US dollar saw a surge in its value against many other currencies, including the Euro.

Political Stability and Economic Performance:

A country’s political conditions and performance can either instil confidence or deter investors. Stable governments often lead to a stronger national currency.

Example: During the uncertainty of the Brexit vote in 2016, the Euro experienced volatility due to concerns about the broader implications for the European Union’s stability.

Geopolitical Events:

Wars, elections, natural disasters, and financial crises can create uncertainty and may influence a currency’s value.

Example: The ongoing trade tensions between the US and China in the late 2010s often caused fluctuations in major currency pairs, including the EUR/USD, as traders reacted to news headlines and official statements.

Speculation:

If traders believe a currency will strengthen in the future, they will buy more of it now. Their actions, en masse, can cause the currency to strengthen as anticipated, creating self-fulfilling prophecies.

Example: Rumors of the European Central Bank introducing stimulus measures led traders to sell Euros in anticipation of its devaluation.

Learn more about the key factors that move the Forex market .

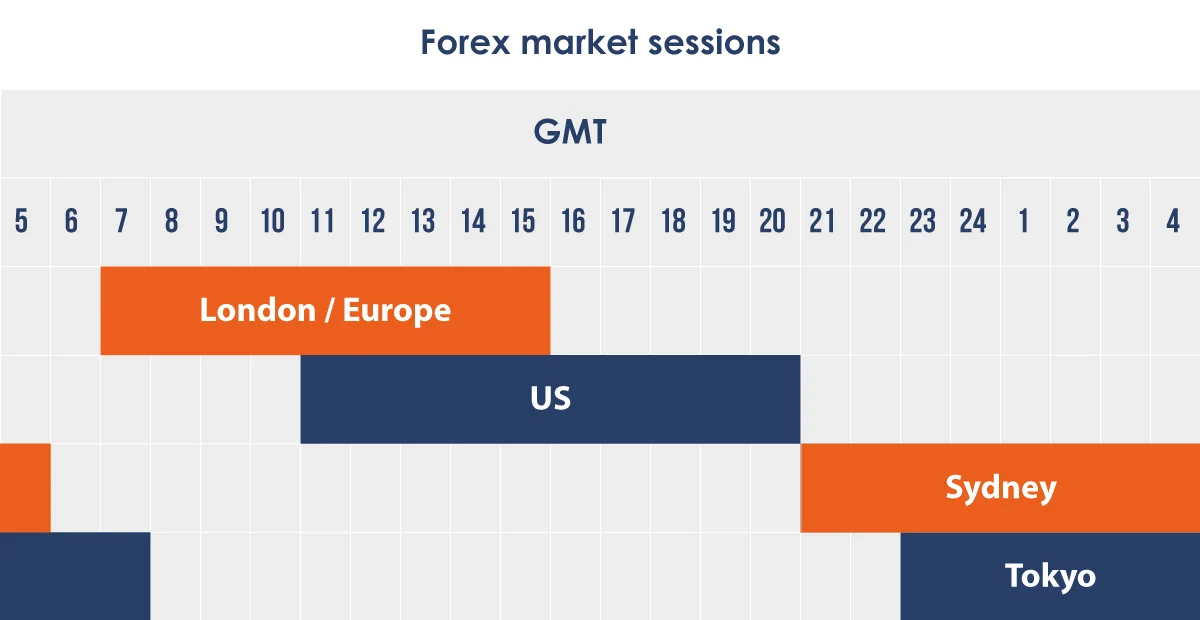

Understand the Best Time to Trade EUR/USD

The EUR/USD is the most traded currency pair in the world, but its activity levels can vary throughout the day. Knowing the best times to trade EUR/USD it can significantly impact your trading success.

European and U.S. Overlap:

This is the prime time for EUR/USD trading. When both the European and U.S. markets are open, from 12:00 to 15:00 (Greenwich Mean Time, GMT), the pair experiences the highest trading volume and liquidity. This overlap often leads to tighter spreads and significant price movements.

European Market Hours:

The European session, starting at 06:00 and ending at 14:00 (Greenwich Mean Time, GMT), can also be active, especially during the early hours when major economic data from the Eurozone is released.

U.S. Market Hours:

Starting from 12:00 and ending at 20:00 (Greenwich Mean Time, GMT), the U.S. session can see increased volatility, especially when significant U.S. economic data or Federal Reserve announcements are due.

Avoid Off Hours:

Late U.S. sessions leading into the Asian market hours tend to be quieter for the EUR/USD, with lower liquidity and fewer market participants.

By understanding these time frames and market dynamics, traders can optimize their trading strategies, ensuring they’re active during the most opportune moments for the EUR/USD pair.

Learn more about why are Forex markets open 24 hours a day ?

Choosing a Reliable Forex Broker

Navigating the vast ocean of Forex trading requires a dependable ship, and that ship is your Forex broker. The right broker not only provides access to the markets but also offers tools and resources to enhance your trading experience.

You may also be interested in learning the types of brokers – which one should you choose ?

Educational Resources:

For those new to the trading scene, the learning curve can be steep. Brokers that prioritize education, like ATFX, can significantly ease this journey by offering resources such as webinars, tutorials, and in-depth market analyses. These resources not only provide foundational knowledge but also keep traders updated on market trends and effective trading strategies.

Regulation:

A regulated broker adheres to strict standards set by financial authorities, ensuring transparency and protection for traders. This also means they take good care of your money. Take ATFX for example; they follow the rules set by regulatory authorities in the UK called the Financial Conduct Authority (FCA), which is known worldwide for ensuring brokers like ATFX do things the right way.

Customer Support:

Whether you’re a seasoned trader or just starting out, there will be moments when you’ll need assistance, be it for technical glitches, account inquiries, or clarifications about trading processes. A responsive and knowledgeable customer support team, like the one at ATFX, can make the difference between a smooth trading experience and a frustrating one.

Trading Platforms:

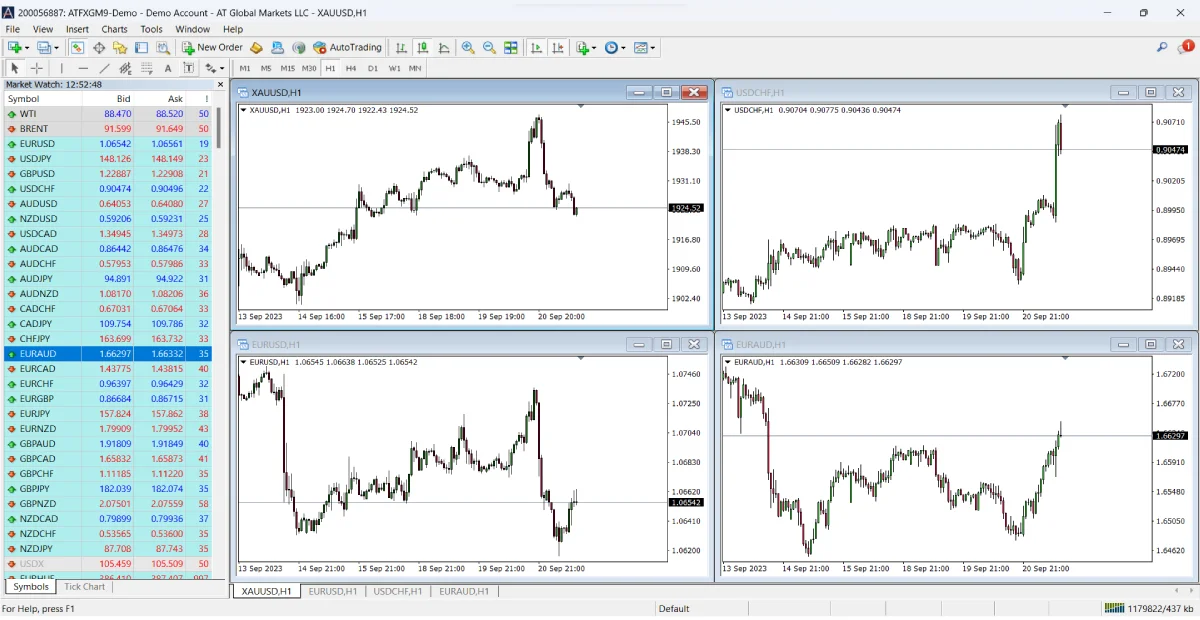

A user-friendly and feature-rich platform can significantly enhance a trader’s efficiency.

Example: ATFX provides platforms such as MetaTrader 4 (MT4) that offer advanced charting tools, automated trading robots, and a vast marketplace of indicators . Download MT4 on your device now ! Learn more about what is MT4 and how to use it .

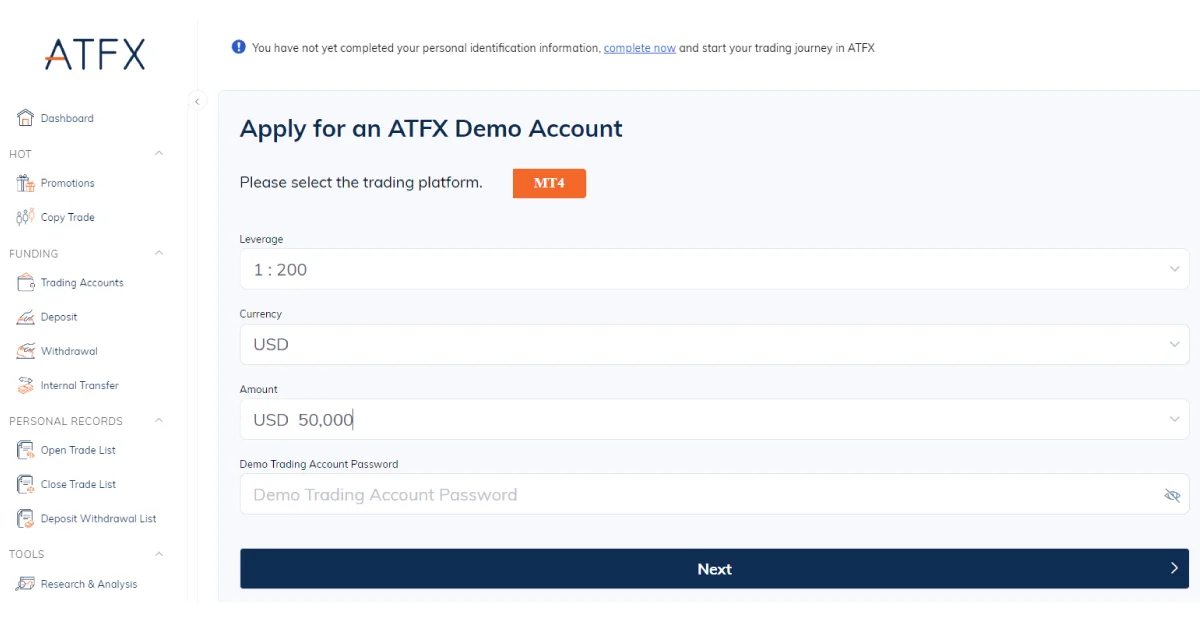

Create your EUR/USD demo trading account

Begin by setting up a EUR/USD demo trading account on the ATFX platform. This allows you to familiarize yourself with the EUR/USD trading without any financial risks, ensuring your capital remains safe.

Once registered, you’ll need to verify your account by providing the necessary identification documents requested by ATFX. It’s essential to note that you can choose when to fund your account with real money. If you’re new to forex, take this opportunity to learn the basics of trading the markets.

The demo account serves as a learning platform, introducing you to ATFX’s various tools and functionalities. Familiarize yourself with the platform’s operations, ensuring you’re comfortable and confident. Utilize this period to hone your skills and boost your confidence before transitioning to live trading with the EUR/USD.

You may also be interested in how to use demo accounts to improve trading

Develop your trading strategies for the EUR/USD

The EUR/USD, being the most traded currency pair, offers a plethora of opportunities for traders. Various strategies can be employed depending on your risk appetite, time commitment, and market outlook.

Scalping:

Scalping is a high-frequency trading strategy that capitalizes on minute price changes in the market. Traders, known as scalpers, focus on tiny price gaps caused by bid-ask spreads or immediate order flows. The primary objective is to grab small profits repeatedly throughout the day. Given the short duration of trades, precision and quick decision-making are essential. You may want to learn more about what is scalping and the best pairs to scalp .

The chart above shows EURUSD rebounding from a similar support region, signalling an entry to capture a short-term rise.

Example: A scalper noticed a sudden but small uptick in EUR/USD after a minor news release. He quickly entered and exited the trade within minutes, capturing a small profit.

Figures: Scalpers might make 20-100 trades daily, targeting 5-10 pips per trade.

Day Trading:

Day trading involves initiating and concluding trades within a single trading day. The primary goal is to capitalize on short-term price movements without leaving any positions open overnight, thereby avoiding potential losses from overnight market fluctuations. This strategy requires a good understanding of daily market trends and the ability to act on real-time data.

Example: A day trader decided to go long on EUR/USD after analysing morning economic data, expecting a bullish day. He closed his position by the end of his trading session, securing his gains.

Figures: Day traders typically aim for 20-100 pips per trade, depending on market volatility.

You may also be interested in : why do day traders fail and how to turn it around ?

Swing Trading:

Swing trading is a medium-term strategy where traders aim to capture gains by holding onto trades for several days or even weeks. The focus is on identifying and profiting from short- to medium-term price patterns. Swing traders rely on both technical analysis to spot potential price swings and fundamental analysis to understand underlying market trends.

The chart above shows EURUSD from a daily perspective, which failed to break the previous high, suggesting a possible retracement signal. Learn more about how Forex traders use candlestick charts to analyze trends .

Example: Noticing a forming upward trend on the EUR/USD weekly chart, a swing trader entered a long position, planning to hold it for several days to capitalize on the expected upward swing.

Figures: Swing traders might target gains of 100-500 pips over their trade duration.

Learn more about Swing Trading vs Day Trading: 8 Differences You Should Know

Position Trading:

Position trading is a long-term strategy rooted in comprehensive fundamental analysis and broader macroeconomic trends. Traders maintain their positions for extended periods, spanning weeks, months, or even years, aiming to benefit from sustained market movements. This approach requires a deep understanding of global economic factors and patience to wait for the fruition of predicted trends.

Example: Believing in the long-term economic recovery of the Eurozone, a position trader decided to go long on the EUR/USD with a horizon of several months, anticipating a steady appreciation of the Euro against the Dollar.

Figures: Position traders might aim for gains exceeding 1000 pips, factoring in broader economic shifts.

You may also be interested in this article “forex trading strategies”

Transition to live trading and place your first trade

Once you’re confident in your trading approach, you can transition to a live trading account with ATFX.

Begin by funding your account with your initial investment. As you venture into live trading , apply the tactics and measures you’ve honed to mitigate risks. Commencing your trading journey with a modest sum is advisable, ensuring you maintain minimal risk exposure as you familiarize yourself with the dynamic live market.

You may also be interested in this article “how to become a trader”

Always monitor your trades & update your trading strategy

Keep track of the EUR/USD pair using ATFX’s learning tools. Read our trading strategies and market news blogs often for fresh news and watch our YouTube channel for helpful tips.

It’s key to see how your trades are going. Always watch your trades and the market. Sometimes, you might need to change your plan based on the market or as you learn more. To do well in trading, always learn and be ready to change with the market.

Understand and avoid common EUR/USD trading mistakes

Below are the top 6 common mistakes

Overleveraging:

Using excessive leverage can amplify both potential gains and losses. Traders might be tempted by the possibility of larger profits, but a small adverse price movement can lead to significant losses. Learn about why leverage is high in the Forex market ?

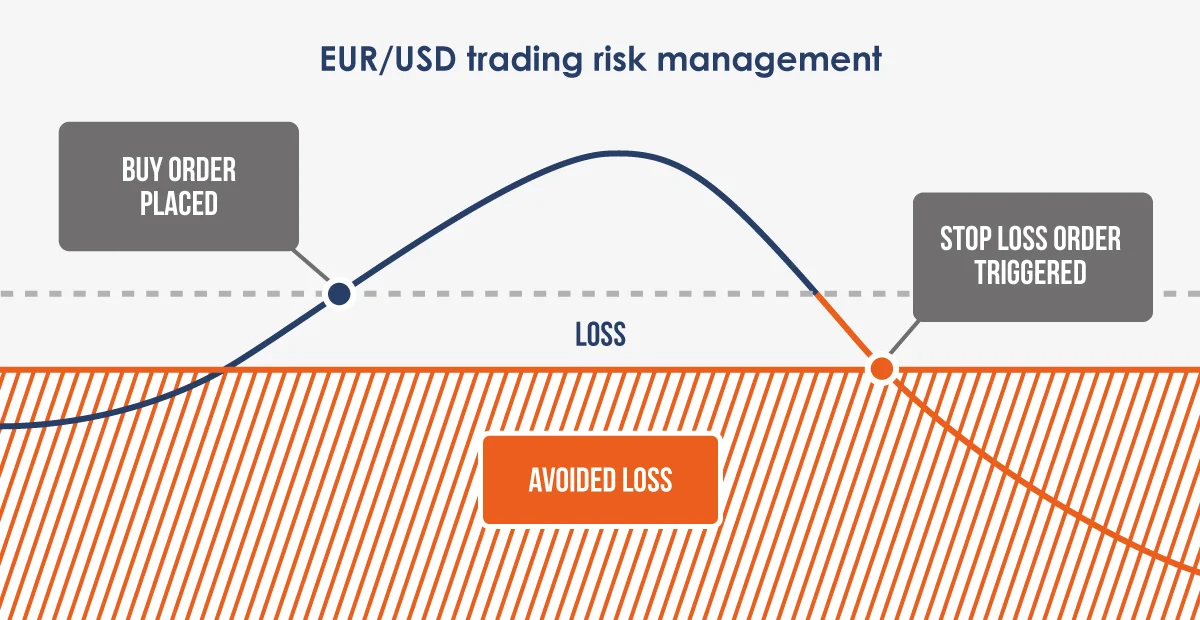

Poor Risk Management:

Not determining in advance how much of your capital is at risk for each trade can lead to disproportionate losses.

The image above shows how stop loss can avoid disproportionate losses.

Lack of a Trading Plan:

Entering the market without a clear strategy or plan often leads to impulsive decisions driven by emotions rather than logic.

Chasing the Market:

Trying to jump into a trend too late or exiting too early can result in missed opportunities or losses. It’s essential to have a clear entry and exit strategy.

Failure to Review and Learn:

Not analyzing past trades, both successful and unsuccessful ones, can prevent a trader from learning and improving.

Ignoring the Long-Term Trend:

While short-term fluctuations can provide trading opportunities, it’s crucial to be aware of the longer-term trend. Going against a strong trend without a good reason can be risky.

Ready to practice EUR/USD trading without putting in real money ?

Looking to get started with EUR/USD forex trading? Sign up for a free demo account and get a feel for the trading world. Once confident, you can transition to a live account for real-time trading. With ATFX, you’re not just limited to the EUR/USD as we offer many other tradeable instruments along with our user-friendly MT4 platform which is great for trying out different trading methods. Plus, we have helpful guides and learning tools to help you along the way. So, sign up for your free demo trading account now!