How to trade stocks? For individuals at any level of trading expertise, the stock market presents an exciting but challenging journey. Grasping the nuances of making stock transactions and overseeing investment portfolios demands a thorough understanding of market trends, effective risk control, and ongoing education. In this article, you will learn how to trade stocks, providing essential insights and strategies tailored for both beginners and advanced traders.

Table of Contents:

1. Understanding the Basics of Stock Trading

3. Choose a Brokerage Platform

4. Choose Your Preferred Trading Strategy

6. Risk Management in Stock Trading

7. Staying Informed and Continuous Learning in Stock Trading

8. 6 Common Stock Trading Mistakes to Avoid

Learn How to Trade Stocks with a Demo Account Now!

Understanding the Basics of Stock Trading

It’s crucial to start from the basics whether you are a beginner or an advanced trader:

What is Stock Trading?

Stock trading involves purchasing and selling stocks, representing ownership fractions in a corporation. Acquiring a stock means you’re obtaining a minor portion of that company, referred to as a share. Traders gain by selling these stocks at a price higher than their purchase cost. Check out stock market investment for beginners .

How Does the Stock Market Work?

The stock market functions via a series of exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ. Firms offer their shares on these platforms, where traders engage in buying and selling. Stock prices are set by the balance of supply and demand: if the demand to purchase a stock exceeds the interest in selling it, its price increases, and the opposite is true as well. Check out the top 15 largest stock exchanges in the world.

Key Terms in Stock Trading

Bull Market: A market condition where stock prices are rising or expected to rise.

Bear Market: A market condition characterised by falling stock prices. Learn how to invest in bear market.

Bid and Ask: The bid is the highest price a buyer is willing to pay for a stock, and the ask is the lowest price a seller is willing to accept.

Volume: This indicates the number of shares being traded. Higher volume often means more interest in a stock.

Market Order/Limit Order: A market order buys or sells a stock immediately at the best current price, while a limit order only executes at a price you specify.

Example:

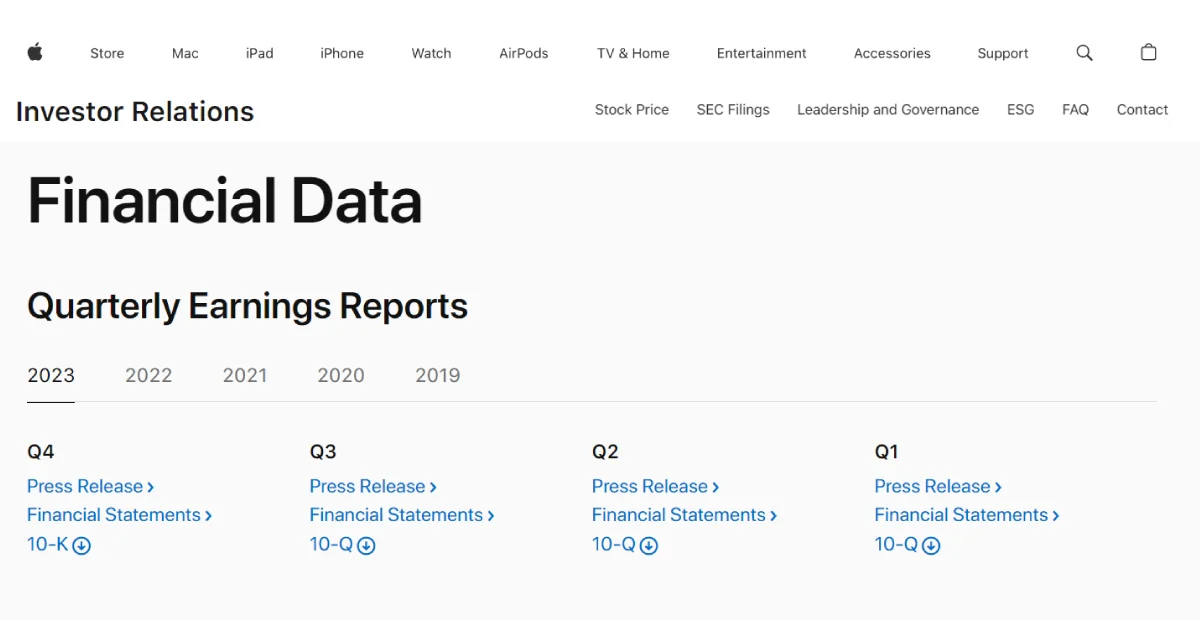

Consider the story of Apple Inc. (AAPL). If a trader bought 10 shares of Apple at $25 per share in July 2016, their trade would have amounted to $250. As of July 2021, with Apple’s stock price around $145 per share, the same shares would be valued at $1,450. This increase in stock price reflects the company’s growth and success over the years, benefiting the trader’s decision.

Set Your Investment Goals

Your investment goals should reflect your personal financial needs and aspirations.

4 Common Investment Goals:

Saving for Retirement: Aim for long-term growth. Starting with $10,000 and investing $500 monthly at a 7% return can yield over $1 million in 30 years.

Generating Income: Invest in dividend-paying stocks. A $100,000 portfolio with a 4% dividend yield can earn $4,000 yearly.

Capital Appreciation: Purchase stocks that are expected to rise in value. A $10,000 investment in a promising startup can lead to substantial gains.

Funding Specific Goals: Use stocks to save for goals like home purchases or education. For example, $200 monthly in stocks and bonds can significantly grow in 18 years for a child’s education fund.

Risk Tolerance

Your risk tolerance is how comfortable you are with the possibility of losing money in exchange for the potential of higher returns. This is often tied to your investment timeline:

Short-Term Goals: If your investment goal is short-term (like saving for a wedding in 2 years), you might prefer less risky investments since there’s little time to recover from market dips.

Long-Term Goals: For long-term goals (like retirement), you might be more comfortable with higher-risk investments since you have time to ride out market fluctuations.

Example:

Consider Sarah, a 30-year-old graphic designer. She wants to retire by 65 with a retirement fund of $1 million. Sarah currently has $20,000 in savings and plans to invest $500 monthly. Assuming an average annual return of 7%, Sarah’s investment will grow to approximately $1.03 million by age 65.

Choose a Brokerage Platform

Selecting the right brokerage platform is a crucial decision for any trader. The choice of broker can significantly impact your trading experience, the fees paid, and access to various markets and instruments. Check out the types of brokers and learn how to choose the right broker.

Research Brokers

When researching brokers, consider factors like

Trading Fees: Compare commission rates, spreads, and any hidden fees.

Regulatory Compliance: Ensure the broker is regulated by a reputable authority such as the FCA and CySEC to guarantee the safety of your funds.

Platform Usability: Ensure the trading platform is user-friendly and suits your trading style.

Tools and Resources: Look for platforms offering educational resources, analysis tools, and customer support.

Create A Trading Account

Setting up a trading account typically involves:

Visiting the Broker’s Website: Start by navigating to the official broker’s website. This ensures you’re accessing a legitimate platform and not a phishing site.

Providing Personal Information: This includes your ID, social security number, and financial details.

Funding Your Account: Deposit money into your account to start trading. Most brokers offer various funding options like bank transfers or debit cards.

Consider ATFX as your Broker

ATFX is a global online broker that offers a wide range of trading instruments, including Hong Kong stock trading and global stock trading. ATFX is known for its competitive spreads, user-friendly platform, and FCA regulatory compliance, making it a suitable and reliable choice for traders. The broker offers access to global stock markets, enabling traders to diversify their portfolios. Learn how to become a trader.

Choose Your Preferred Trading Strategy

A well-crafted trading strategy is essential for navigating the stock market effectively. It guides your decisions, helps manage risks, and can increase your chances of executing successful trades.

These are 4 common trading strategies:

Scalping

Scalping seeks small profits from minor price changes, often making numerous trades throughout the day. Ideal for traders who can make quick trading decisions and dedicate a lot of time to continuous trading.

Example: A scalper spends their day executing many trades. They buy 1,000 company shares at $15.10 and sell them shortly after at $15.15, making a $50 profit. They repeat similar small trades throughout the day, accumulating a significant total profit.

Day Trading

Day trading involves buying and selling stocks within the same trading day, capitalising on short-term market fluctuations. Ideal for individuals who can commit full-time hours to monitor and respond quickly to market changes. Learn why day traders fail and how to turn it around.

Example: A trader begins the day at market opening, then analyses news and stock movements. They buy 500 shares of Apple Inc. at $194 per share, anticipating a rise due to positive news. By midday, the stock reaches $196, and the trader sells, netting a $1000 profit in a few hours. Check out day trading strategies.

Swing Trading

Swing trading aims to capture gains from stocks over several days to weeks, using technical analysis to identify price ‘swings’.Suitable for traders who can’t constantly watch the market but can dedicate a few hours weekly. Check out swing trading vs day trading.

Example:

A trader spots an upward trend in Apple Inc. stock. They buy shares on Monday at $171 each. Over the next week, the stock climbs to $179, and the trader sells, earning a profit on their week-long investment.

Position Trading

Position trading involves holding stocks for a long period, from months to years, based on long-term trends. Best for patient investors with a solid understanding of market fundamentals.

Example: A trader invests in Apple Inc. at $130 per share in January 2023, believing in the company’s long-term growth. After 6 months, as the tech industry expanded, the stock price increased to $193 per share in June 2023. The trader’s patience yields a substantial return when they sell their shares at this increased value.

Summary Table

Strategy | Suitability | Time Commitment | Risk Level |

Scalping | Ideal for traders who can make quick decisions and dedicate time to continuous trading. | Intense, throughout the trading day | High, due to the need for rapid decision-making |

Day Trading | Ideal for full-time traders who can monitor and respond to market changes. | Full-time during market hours | High, due to rapid market fluctuations |

Swing Trading | Suitable for those who can dedicate a few hours weekly but not constantly monitor the market. | Several hours per week | Moderate, dependent on market trends |

Position Trading | Best for patient investors with a good understanding of market fundamentals. | Long-term (months to years) | Lower, based on long-term market trends |

Start Trading Stocks

Entering the world of stock trading requires preparation, strategy, and a clear understanding of the risks and potential rewards. Learn how to find undervalued stocks and how to pick the right stocks.

Trade stocks with a Demo Account (aka Paper Trading)

Practice trading with virtual money before investing your hard-earned money. This allows you to test strategies and learn without the added financial risk.

Trade Stocks with a Live Account

Consider transitioning to a live account once you feel confident in your trading abilities on a demo account. Here are 3 things to take note of:

Research: Understand the company, its industry, financial health, and growth potential.

Diversify: Spread your investments across various sectors to mitigate risk.

Start Small: Begin with a small investment to test the waters.

Monitor Your Investments

Regularly check the performance of your stocks and stay informed about relevant market news and trends.

Example:

Consider a trader who has diversified their portfolio across several sectors. They use ATFX’s financial news site to stay informed about market conditions that might affect their investments. With the ATFX trading app, they keep an eye on their portfolio throughout the day. The MT4 indicator and analysis tool helps them to analyse market trends and make data-driven decisions. For instance, noticing a downward trend in one sector, they use the MT4 tool to analyse the potential impact and decide to rebalance their portfolio to minimise risk. Download MT4 here or try out the MT4 demo account now.

Risk Management in Stock Trading

Effective risk management is crucial in stock trading to protect your investments from significant losses. Here are the 3 techniques for risk management:

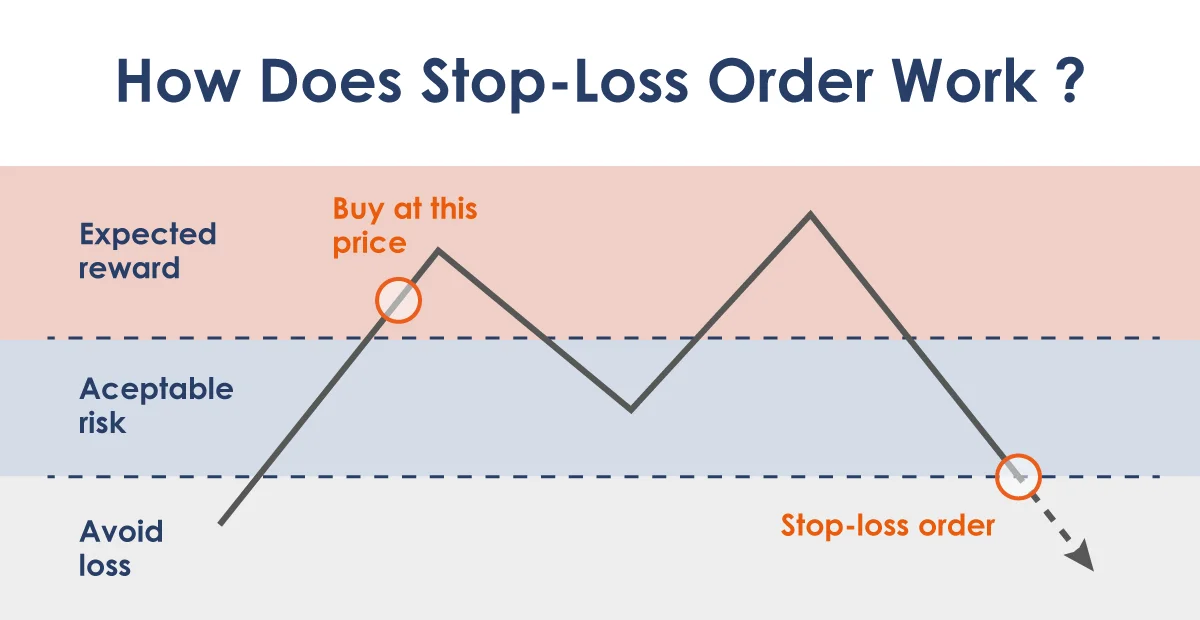

Setting Stop-Loss Orders

A stop-loss order is an order placed with a broker to sell a security when it reaches a specific price. It’s designed to limit an investor’s loss on a security position.

Example: If a trader buys a stock at $100, they might set a stop-loss order at $90. If the stock drops to $90, the stop-loss order is activated, and the stock is sold to prevent further losses.

Diversification

Diversification involves spreading investments across various assets or sectors to reduce the impact of any single investment’s poor performance.

Example: Instead of investing all their funds in technology stocks, a trader allocates their portfolio across tech, healthcare, energy, and consumer goods. If tech stocks decline, the other sectors can buffer the overall portfolio loss.

Regular Portfolio Review

Regularly reviewing and adjusting your portfolio ensures that it aligns with your changing risk tolerance and investment goals.

Example: A trader reviews their portfolio quarterly. Initially heavily invested in high-risk stocks, they decide to reallocate some funds into bonds and dividend-paying stocks as they approach retirement, aiming for more stable returns.

Staying Informed and Continuous Learning in Stock Trading

The market is dynamic, and ongoing education helps traders adapt to changing conditions and refine their strategies. Here are the 6 common resources for Continuous Learning

Websites:

Websites like Bloomberg, Reuters, CNBC and ATFX offer up-to-the-minute news on financial markets, individual stocks, and economic indicators.

Reports:

Reading industry reports from financial analysts and industry experts can provide a deeper understanding of market sectors and individual companies.

Software:

Tools like Metatrader 4 (MT4) offer in-depth market analysis, charting, and back-testing capabilities. Learn what MT4 is and how to use it .

Blogs:

Many brokerage firms and financial analysts run trading strategies blogs sharing insights and analyses.

6 Common Stock Trading Mistakes to Avoid

Stock trading can be complex and challenging, here are the 6 common mistakes to avoid:

Overtrading: Making too many trades in a short period is often driven by emotions rather than strategy.

Ignoring Risk Management: Not setting stop-loss orders or investing more than one can afford to lose. Example: A trader invests much of their savings in a single stock without a stop-loss order. When the stock’s value plummets, they face a substantial financial loss.

Following the Herd: Jumping on investment trends without doing personal research.

Lack of Diversification: Putting all your eggs in one basket by not diversifying your portfolio.

Emotional Trading: Letting emotions like fear or greed drive trading decisions.

Neglecting Research and Education: Failing to stay informed and continuously learn about the stock market.

Learn How to Trade Stocks with a Demo Account Now!

Learn to trade stocks by signing up for a free demo trading account at ATFX to get practical experience in the stock trading world. Once you feel confident, you can switch to a live trading account for actual trading. ATFX provides access to a wide array of trading markets, all accessible through our intuitive MT4 platform, ideal for trying out different trading strategies . Get started with your free stock trading demo account now!