Table of Content:

What is the difference between CPI and Core CPI?

How is CPI used as an indicator in Forex trading?

How CPI affects most currencies

How does the CPI affect forex pairs?

Why CPI matters in Forex trading

Learn more about CPI with a Forex demo account

What is CPI?

The CPI index is closely monitored by forex traders as it indicates potential opportunities for buying, selling, and hedging. It is a significant market-moving indicator that reveals the general inflation and pricing pressures in a country.

The CPI measures the average change in urban prices for a basket of goods and services that includes food and energy, although the core inflation readings exclude these items.

Since energy and food prices are volatile and heavily influenced by political headlines, economists prefer a more stable consumer basket to get a better understanding of the market.

What is the difference between CPI and Core CPI ?

The calculation of the Consumer Price Index differs from that of the Core CPI in that the latter measure omits the Food and Fuel categories. This is because the prices of these goods tend to be highly volatile. Excluding these two categories can help provide a clearer representation of the CPI’s dynamics.

| Aspect | CPI (Consumer Price Index) | Core CPI |

| Definition | Measures the changes in the price level of a basket of consumer goods and services | Excludes volatile items such as food and energy prices from the CPI calculation |

| Purpose | Reflects the overall inflation rate in an economy | Provides a more stable measure of inflation by eliminating short-term price fluctuations |

| Data Relevance | Highly relevant for economic and monetary policy decisions | More reliable for understanding long-term inflation trends and informing policy decisions |

| Volatility | Can be more volatile due to the inclusion of food and energy prices | Less volatile due to the exclusion of volatile items |

| Market Impact | Has a significant impact on the financial markets, including Forex | Often closely watched by market participants, but its impact may be less immediate compared to CPI |

Some financial experts and commentators, however, disagree with this approach, as it is difficult to envision a comprehensive basket of goods and services without including Food and Fuel items.

Nonetheless, the US Federal Reserve continues to favour Core inflation measures when making decisions, despite the noted objections.

CPI vs Inflation

Both CPI and inflation are related to the changes in the price level of goods and services in an economy over time. However, there are some distinctions between the 2:

| Consumer Price Index (CPI) | Inflation | |

| Definition | A measure that tracks price changes of a basket of goods and services over time. | The overall increase in the general prices of goods and services in an economy over time. |

| Purpose | Indicates the cost of living and helps to measure the purchasing power of consumers. | Reflects the decrease in the purchasing power of money over time. |

| Measurement | Calculated using the weighted average of price changes for various items in a basket. | Often expressed as a percentage rate. |

| Relationship | Used as a proxy to measure inflation, as it provides a snapshot of price changes for a representative basket of goods and services. | A broader concept that encompasses the overall increase in prices, with CPI being one way of measuring it. |

| Components | Includes various goods and services, such as food, housing, transportation, and healthcare. | Applies to all goods and services in an economy, not just those included in the CPI basket. |

| Impact on Economy | Affects economic policies, such as interest rates and social security payments, based on the cost of living. | Influences monetary policy, such as interest rates and money supply, to control price stability. |

| Index Types | Different CPI types exist, such as the CPI-U (for all urban consumers) and CPI-W (for urban wage earners and clerical workers). | Different measures of inflation exist, such as core inflation, which excludes volatile items like food and energy. |

| Time Period Comparison | Compares the prices of a basket of goods and services at specific time periods, typically month-to-month or year-to-year. | Compares the overall prices of goods and services in the economy across different time periods. |

| Base Year | Uses a base year to calculate the index, with the CPI set to 100 for that year. | No specific base year is used, but inflation rate calculations often reference a specific time period for comparison. |

How does CPI serve as a reference in Forex trading ?

The CPI is the most widely watched indicator for the inflation rate in the US. Hence, it affects the USD. The index is created through interviews and surveys of the urban workforce, with roughly 24,000 urban consumers sharing their spending habits with the Bureau of Labor Statistics (BLS) each quarter. The data provided helps the BLS determine price changes compared to the previous period.

While the process differs for each economy, most major economies share their CPI readings with the public. Any fluctuations in the CPI can impact the global performance of international companies and strengthen or weaken the particular currency.

How CPI affects most currencies

Monthly CPI updates are released by the Bureau of Labor Statistics before the 15th of the following month. The USD may strengthen if the reported CPI exceeds market predictions, indicating higher inflation. Conversely, if the CPI rate falls below expectations, the USD may weaken against other currencies.

In April 2019, the United States CPI was 2.0%, exceeding market expectations by 0.1%. As a result, the AUD/USD pair initiated a new downtrend, pushing the Australian Dollar down to a psychological support level of $0.6900 in the coming weeks. Although the CPI inflation can significantly impact price fluctuations, it should not be considered an isolated indicator of price changes. Instead, it should be incorporated into a more comprehensive fundamental strategy.

The CPI itself is not a standalone strategy. Numerous other factors contribute to each fundamental strategy, including severe weather events, political events, global incidents, and other financial markets. Central banks aim to maintain low inflation levels, with most governments establishing annual inflation targets. The Federal Reserve, the Bank of England, and the Reserve Bank of Australia typically set yearly inflation targets of between 2% and 3%.

The Consumer Price Index (CPI) is generally published monthly, although some countries opt to release the data quarterly. Germany even provides an annual overview alongside its monthly data.

How does the CPI affect forex pairs?

The release of a country’s Consumer Price Index (CPI) or Core CPI statistics can have a big impact on how that nation’s currency is valued in relation to other currencies. The value of the nation’s currency often increases if the CPI or Core CPI data beat market forecasts. In contrast, the value of the currency tends to decrease if the CPI or Core CPI is lower than expected.

The Core CPI data is frequently given greater attention by the currency markets since it depicts the inflation trend more precisely by eliminating volatile items like food and energy. In addition to the most current figures, the forex markets may sometimes be volatile due to modifications to the previous data.

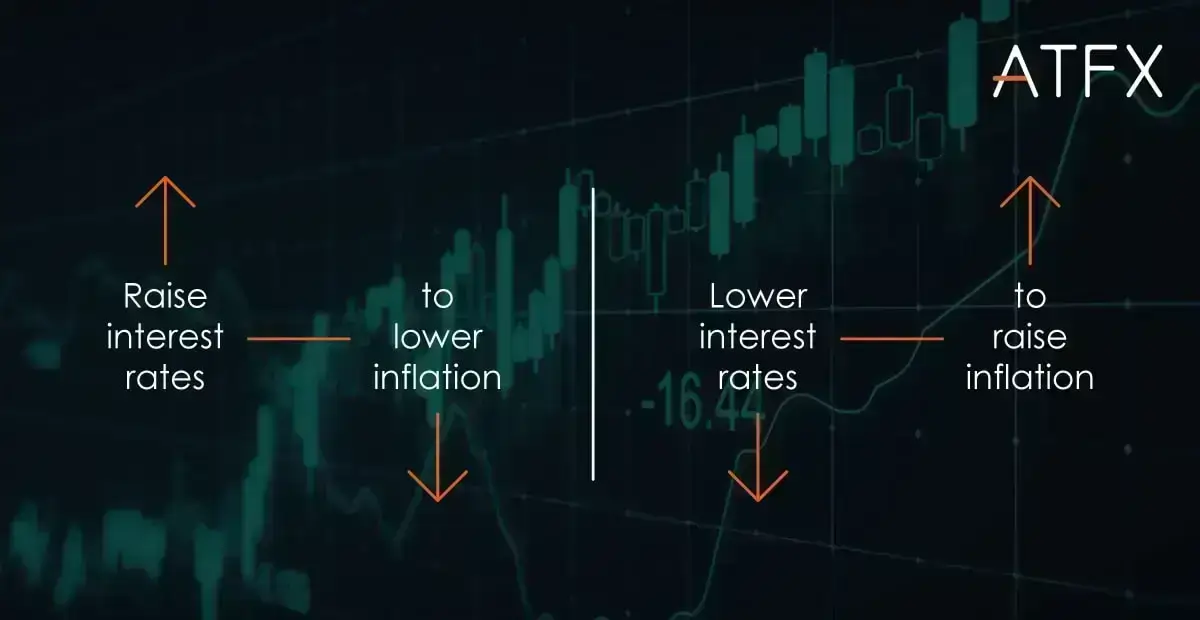

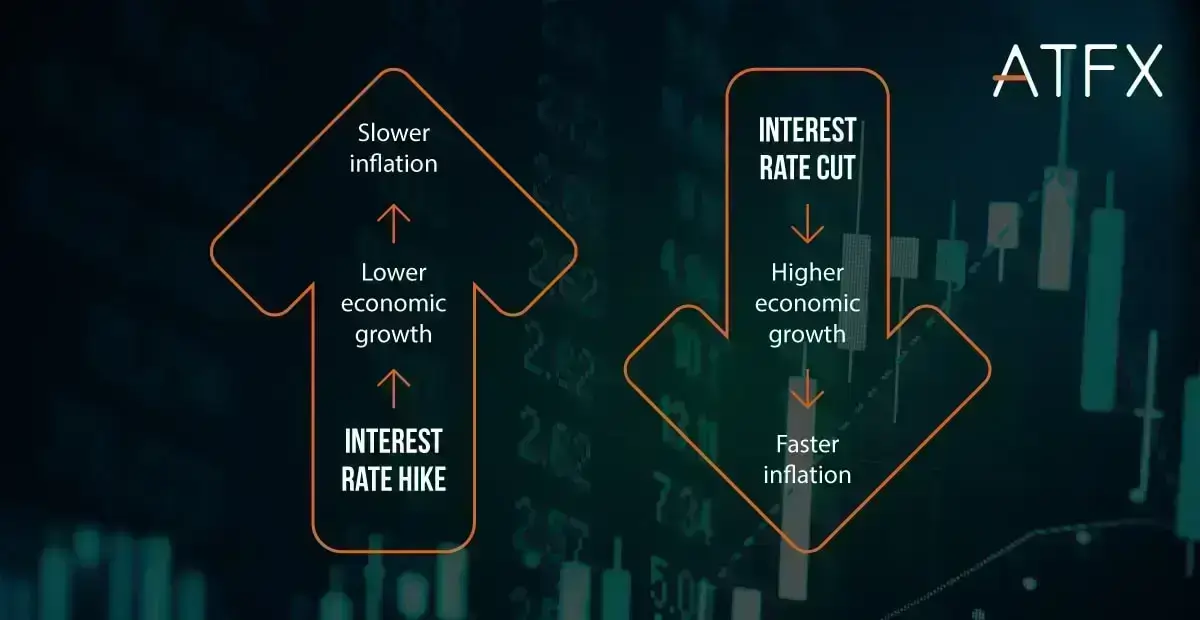

Higher inflation, indicated by an increase in CPI, reduces the value of an individual currency unit, as more units are required to purchase a particular item. Moreover, changes in the CPI can influence central bank monetary policies. A higher CPI may prompt a central bank to raise interest rates to control inflation, which generally leads to a stronger currency as its demand increases.

On the other hand, lower inflation can result in reduced interest rates and weaker currency demand, encouraging consumer spending, increasing money circulation, and stimulating a sluggish economy.

Given this knowledge, it is not unexpected that changes in the currency market might result from the release of CPI statistics. When these movements are very fluctuating, there is a significant potential for profit as well as proportionate dangers.

Why CPI matters in Forex trading

In the end, the CPI or Consumer Price Index gives Forex traders a quantifiable view into the state of US goods and service inflation. To provide traders with a sense of the country’s present inflationary pressures, this indicator is frequently used in conjunction with the PPI, or Producer Price Index.

When making decisions about whether or not to adjust levels of interest rates of benchmarks, like the Federal Funds Rate or the Prime Rate, policymakers who work with money—like the Federal Reserve Bank or voting members of the Federal Open Market Committee—typically examine the numbers of the CPI and associated trends.

Any changes to these interest rates, which are crucial for the US economy to operate, subsequently spread to the rest of the US economy via adjustments to commercial banks’ borrowing and lending rates. If these rates are decreased, the economy may be stimulated. However, if they are increased, they can stifle it.

Learn more about CPI with a Forex demo account

If you wish to learn more about CPI and Forex trading without investing your hard-earned money, we suggest you open a demo account. ATFX offers all the major financial products on a solid trading platform to practise different strategies while still learning from a guide or the free training materials ATFX provides. So, get your demo trading account for free now!