What is leverage trading in finance? Leverage is a financial strategy for increasing the potential return on investment by using borrowed funds. This strategy can be both an asset and a liability to traders, often leading to misunderstandings. Regardless of your level of understanding of the financial markets, grasping the concept of leverage in trading is crucial to your success. In this article, you will learn what leverage is in trading, its potential benefits and risks, and how to harness it effectively.

Table of contents:

1. What is Leverage in Trading?

2. How does Leverage Work in Trading?

3. Leveraged Trading vs. Non-leveraged Trading

4. Understanding Leverage Ratio in Trading

5. Should You Use Leverage in Trading?

6. How Much Leverage Should You Use?

7. 5 Benefits of Using Leverage in Trading

8. 5 Risks Associated with Leverage in Trading

9. 6 Risk Management Techniques for Leveraged Trading

10. Types of Financial Instruments that Use Leverage

11. From Leverage Theory to Action: Explore with Our Demo Account

What is Leverage in Trading?

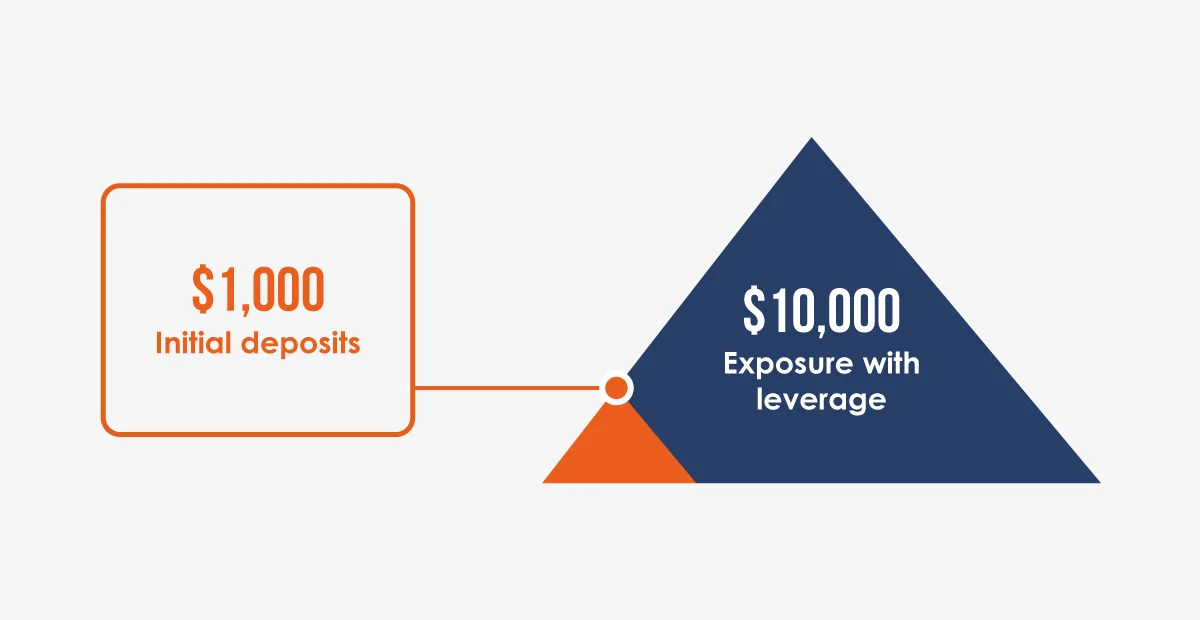

Leverage is an effective instrument in trading that allows traders to magnify their exposure to the financial market without having to increase their capital investment. Essentially, it’s a form of borrowed capital that allows traders to take on larger positions than they could have with their existing funds alone. Using leverage means that even with a small initial deposit, traders can control a much larger trading position in the market.

Example:

Imagine you want to buy a company’s stock, but you only have $1,000. If you were to invest without leverage, you could only purchase a maximum of $1,000 worth of the company’s stock. However, with a leverage ratio of 10:1, you could control up to $10,000 worth of that stock with your initial deposit of $1,000. This means that for every dollar you invest, your broker lends you $10.

How does Leverage Work in Trading?

Leverage in trading operates on a straightforward principle: it allows opening a trade position larger than the capital in your trading account. Think of it as a loan provided by the broker, multiplying trading power. However, it’s crucial to remember that while leverage magnifies potential profits, it also amplifies potential losses. Check out the types of brokers.

When leverage is used in trading, a contract with the broker is established. A portion of funds, known as the “margin,” is set aside as collateral. The broker then allows taking a trade in the market that’s a multiple of the margin based on their leverage ratio. Learn what margin is.

Example:

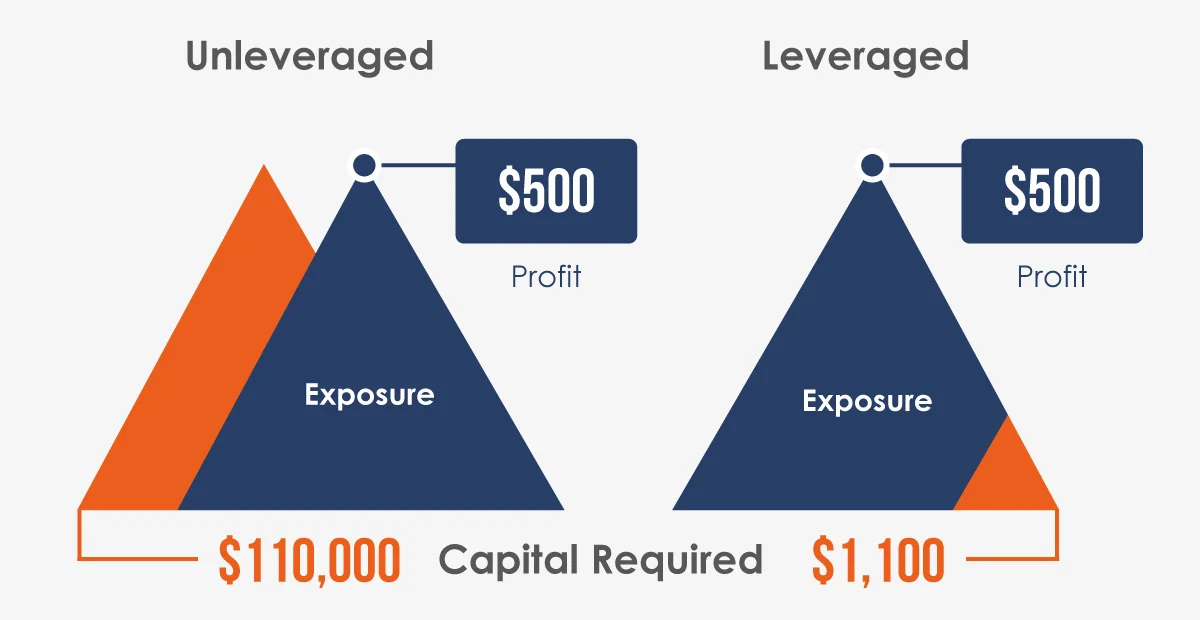

Imagine you’re a forex trader and think the EUR/USD exchange rate will rise. The current exchange rate is 1.1000, and you want to purchase one standard lot (100,000 units). Without leverage, you’d have to pay the full amount of $110,000 (100,000 x 1.1000) to open the position. However, if your broker offers a 100:1 leverage, you’d only have to deposit $1,100 as the margin (1/100 of $110,000) to control the entire $110,000 position. If the EUR/USD rate increases to 1.1050, your profit would be $500 (0.0050 x 100,000). Without leverage, a $0.0050 rise in the exchange rate based on your $110,000 investment would have yielded the same $500 profit. However, you would have invested a significant amount of your capital in the trade. Learn what is lot size in forex .

Leveraged Trading vs. Non-leveraged Trading

Understanding the differences between leveraged and non-leveraged trading is crucial to making informed trading decisions.

Aspect | Leveraged Trading | Non-leveraged Trading |

Definition | Using borrowed funds to amplify potential returns. | Using only personal capital without borrowing additional funds. |

Potential Returns | Significantly higher returns are possible compared to the initial margin. | Returns are directly proportional to the amount invested. |

Risks | Amplified potential for both profit and losses. One can lose more than their initial margin. | The maximum potential loss is the initial investment. |

Capital Requirements | Requires less capital upfront yet gives one the ability to control large positions. | Requires full funding of the position, thus more capital. |

Flexibility | Suitable for short-term strategies and taking advantage of market volatility. | Often more suitable for long-term investments focusing on steady asset appreciation. |

Real-life Profit Scenario | With 10:1 leverage on a $1,000 investment, a 10% asset increase could yield $1,000 profit (minus fees). | With a $1,000 investment, a 10% asset increase would yield a $100 profit. |

Understanding Leverage Trading Ratio

Understanding the concepts of margin and leverage ratio is also important to fully grasp the concept of what is leverage. The leverage ratio in trading representats how much larger a trader’s position can be compared to their actual deposit or margin. It’s a tool that magnifies both potential profits and potential losses, making it a double-edged sword. The leverage offered is typically expressed as a ratio, such as 10:1, 50:1, or 100:1, indicating how many times larger the trader’s position is than their margin.

Understand how margin works

Margin: This is the percentage of the full value of the trade that you must deposit to open a leveraged position. It acts as collateral or a security deposit, ensuring that you have enough funds to cover potential losses.

Leverage: Leverage is the factor by which you can increase your trade size compared to your margin. It’s expressed as a ratio, such as 10:1 or 50:1.

Margin | Leverage Ratio |

10% | 10:1 |

5% | 20:1 |

3% | 33:1 |

2% | 50:1 |

1% | 100:1 |

0.5% | 200:1 |

This table clearly illustrates the inverse relationship between margin requirements and leverage ratios. As the margin requirement decreases, the leverage ratio increases, allowing traders to control larger positions with smaller deposits.

Example: If you want to open a $100,000 trade position in the forex market with leverage of 100:1, you’d need a margin of 1% or $1,000. With a 50:1 leverage ratio, the required margin would be 2% or $2,000. Learn why leverage is high in the Forex market.

Breaking Down the Ratio:

If a broker offers a 10:1 leverage ratio, it means that for every $1 you deposit as a margin, you can control a position worth $10 in the market. Learn how to choose a broker. A leverage ratio of 100:1 allows you to control positions worth $100 for every $1 they have deposited as margin.

How It Impacts Trading:

Higher leverage ratios can amplify profits. For instance, with a 50:1 leverage, a 2% market move in your favour can result in a 100% return on your margin. Conversely, a 2% move against you would result in a 100% loss of your margin.

Regulatory Implications:

Different countries and regulatory bodies have set limits on the maximum leverage ratios that brokers can offer to retail traders, primarily to protect inexperienced traders from excessive risks.

Example: In the European Union, retail traders can only use 30:1 leverage on major currency pairs.

Should You Use Leverage in Trading?

After learning what leverage is, let’s explore when you might choose to use it in trading. The decision to use leverage is multifaceted and depends on various factors. Here’s a comprehensive look at the most crucial considerations:

Risk Tolerance:

If you have a low-risk tolerance, you might find the volatility of leveraged trading difficult to manage.

Experience Level:

If you are new to trading, you might not fully understand the risks associated with leverage and could make costly mistakes. Experienced traders are better equipped to navigate these risks.

Market Conditions:

In high-volatility markets, the risks associated with leveraged trading can be more pronounced. While leverage can be an effective instrument, it’s not suitable for everyone. You should carefully assess your risk tolerance, experience level, and specific market conditions before deciding to use leverage.

Learn how to become a trader.

How Much Leverage Should You Use?

Here’s a table that provides a guideline as to how much leverage a trader might consider using based on various factors:

Factor | Low-Risk Tolerance / Novice | Moderate Risk Tolerance / Intermediate | High-Risk Tolerance / Experienced |

Market Volatility | |||

Low (e.g., stable forex pairs) | 5:1 | 10:1 | 20:1 |

Moderate (e.g., major indices) | 3:1 | 5:1 | 10:1 |

High (e.g., cryptocurrencies) | 2:1 | 3:1 | 5:1 |

Capital Availability | |||

<$1,000 | 10:1 | 20:1 | 50:1 |

$1,000 – $5,000 | 5:1 | 10:1 | 20:1 |

>$5,000 | 3:1 | 5:1 | 10:1 |

Use of Risk Management Tools | |||

No tools used | 2:1 | 5:1 | 10:1 |

Using stop-loss/take-profit | 5:1 | 10:1 | 20:1 |

It is crucial to note that the above are just guidelines. Individual decisions should be based on a detailed understanding of one’s personal circumstances and current market conditions.

5 Benefits of Using Leverage in Trading

Here are some of the primary benefits of using leverage in trading:

Amplified Returns:

One of the most attractive benefits of using leverage is the potential for higher returns on investment. Even a small price movement in your favour can result in a significant percentage return on the margin staked.

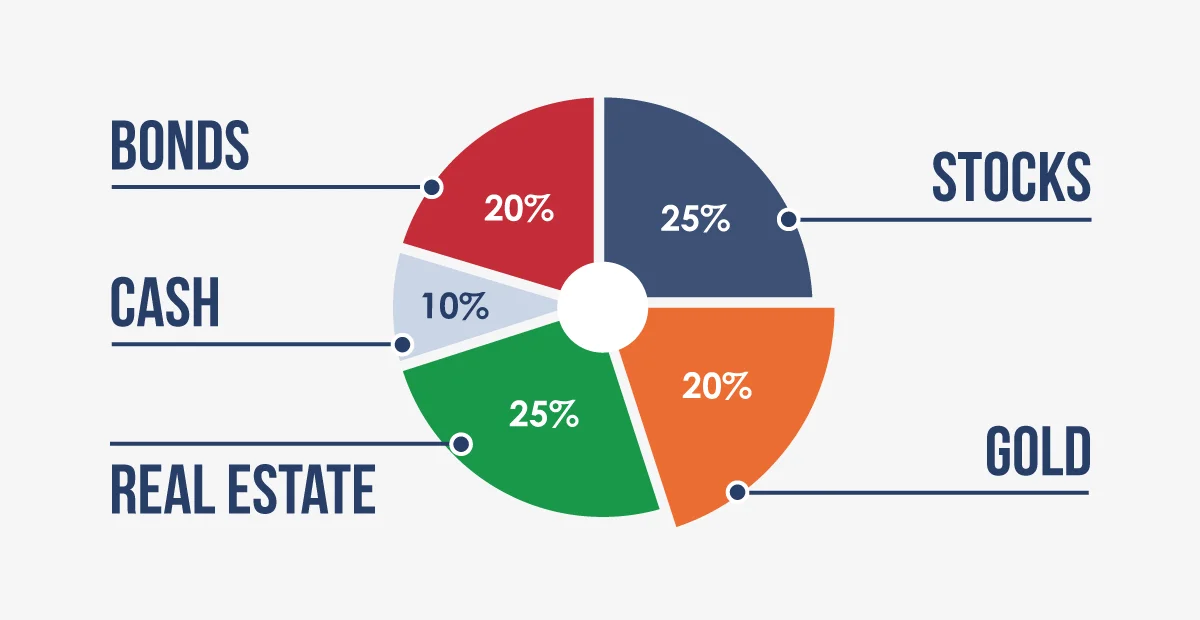

Capital Efficiency:

Leverage allows you to take large trading positions by depositing a relatively small amount of capital. This allows you can diversify your investments and take on multiple positions without tying up a significant amount of capital.

Access to Expensive Assets:

Some assets or markets might be out of reach for individual traders due to high prices. Leverage makes these markets accessible by reducing the amount of capital required to open a position.

Hedging Opportunities:

You can use leverage to hedge your portfolio by taking positions that might offset potential losses in other investments.

Flexibility and Diversification:

By controlling larger positions using less capital, you can diversify your portfolio, spreading risk across different assets or markets.

5 Risks Associated with Leverage in Trading

Here are the primary risks associated with using leverage in trading:

Magnified Losses:

Just as leverage can increase your potential profits, it can also amplify losses. A small adverse move in the markets can result in significant losses relative to your initial margin.

Example: Using 100:1 leverage on a $1,000 investment means you control a $100,000 position. If the market moves against you by just 1%, you could lose $1,000, wiping out your entire initial investment.

Margin Calls:

If a leveraged position moves against you and your account balance falls below the required margin level, the broker might issue a margin call. Such a call requires you to deposit additional funds or close out positions to meet the margin requirement.

Example: With a $5,000 account balance and 50:1 leverage, you take a position worth $250,000. If the market moves against you and your account balance drops to $4,000, the broker might issue a margin call, demanding additional funds to keep the position open.

Rapid Market Fluctuations:

Highly leveraged positions are more susceptible to rapid market fluctuations. Volatile markets can lead to quick and substantial losses.

Interest Costs:

Leveraged positions often come with associated interest costs for the borrowed funds. These costs can accumulate over time, especially for positions held overnight or longer.

Example: If you hold a leveraged forex trade overnight, you might incur a “rollover” or “swap” fee, which is the interest paid or earned for holding a currency pair trade overnight.

Overconfidence and Emotional Trading:

The allure of potential high returns from leverage can lead to overconfidence. You might take on excessive risk without proper analysis or let emotions fuel your trading decisions.

6 Risk Management Techniques for Leveraged Trading

Here are some key risk management strategies for leveraged trading:

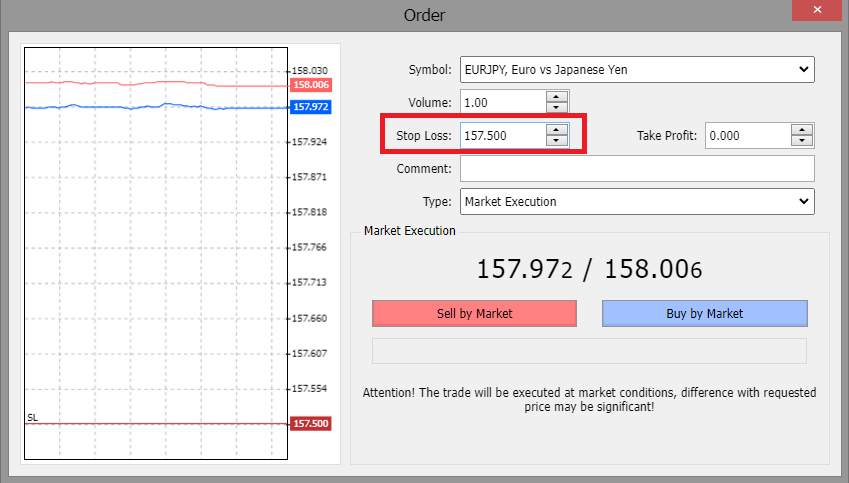

Setting Stop-Loss Orders:

A stop-loss order automatically closes a position once the asset price reaches a predetermined level, limiting potential losses.

Example: You enter a leveraged position, expecting a stock to rise. You set a stop-loss order 3% below your entry price. If the stock unexpectedly drops, the position will automatically close, capping your losses. Learn how to find undervalued stocks.

Using Take-Profit Orders:

Similar to a stop-loss order, a take-profit order automatically closes a position once the asset price reaches a predetermined profit level.

Position Sizing:

It involves determining the appropriate amount of an asset to buy or sell, ensuring that even if the trade goes against you as a trader, the loss won’t be catastrophic.

Diversification:

Spreading investments across various assets or markets to reduce the impact of a poor-performing asset on the overall portfolio.

Regularly Monitoring and Adjusting:

Continuously monitor open positions and market conditions and make necessary adjustments, such as moving stop-loss orders in line with price movements.

Education and Staying Updated:

Continual learning and staying updated with market news and trading strategies can help you make informed decisions and anticipate market movements.

Types of Financial Instruments that Use Leverage

Leverage allows traders to control larger positions in the market with a smaller amount of capital. Various financial instruments employ leverage, each with its unique characteristics and purposes:

Forex (Foreign Exchange):

The forex market involves trading currencies and is one of the most liquid markets globally. Due to its high liquidity and 24-hour trading cycle, it often offers high leverage. Learn how to trade forex.

Example: With a $2,000 account balance using 100:1 leverage, you can control a trade worth $200,000. If the currency pair moves up by 1%, you could make a $2,000 profit, effectively doubling your account balance. Learn about forex vs stocks.

CFDs (Contracts for Difference):

CFDs allow you to speculate on the underlying price movements of assets without actually owning the assets. They are contracts between you and a broker to trade the difference in an asset’s value from when the contract was opened to when it is closed. Learn how to trade CFDs.

Example: If you think a stock priced at $50 will rise, you could purchase a CFD for 100 shares. If the price rises to $55, you will profit from the $5 difference per share, making a total profit of $500, minus any fees or charges. Start trading stocks now.

Futures:

Futures are standardized contracts that obligate the buyer or seller to purchase or sell an asset at a predetermined price on a specific future date. Traded on exchanges, these contracts are utilized for both speculation and hedging purposes.

Example: As a farmer expecting to produce 1,000 bushels of wheat in three months, you could enter into a futures contract to sell the wheat at a particular price, locking in a good price now to avoid a potential price drop in the future.

Options:

Options give you the right, but not the obligation, to buy or sell an asset at a particular price within a specified timeframe. Options can be used for hedging, speculation, or to generate income.

Example: You buy a call option for a stock currently trading at $100, with a strike price of $105, expecting the stock’s price to rise. If the stock price rises to $110, you can exercise the option, buy the stock at $105, and then sell it at the current market price of $110 for a profit. Learn how to pick stocks.

From Leverage Theory to Action: Explore with Our Demo Account

Ready to put your knowledge to the test? Dive into the world of trading with ATFX’s state-of-the-art demo account . Experience real market conditions, practice leverage strategies, and build your confidence.

And when you’re ready to take the next step, seamlessly transition to our live account and unlock the full potential of trading with ATFX.