What is margin in forex? It’s a question that both novices and seasoned traders often ask. Margin is a fundamental concept in forex trading, acting as a bridge between small capital and larger market exposure. Whether you’re a beginner trying to learn the basics or an advanced trader seeking to refine your knowledge, understanding margin is crucial. In this article, you will learn what margin is in forex, its significance, and how it impacts your trading decisions.

Table of contents:

2. How Does Margin in Forex Work?

5. 6 Tips for Safe Margin Trading

6. Benefits and Risks of Trading on Margin

7. What Margin Rates Does ATFX Offer?

What is Margin in Forex?

Margin, in the context of Forex trading, is often misunderstood as a fee or a direct cost. In reality, margin is best described as a security deposit that traders provide to their brokers. It acts as collateral, allowing traders to access larger capital amounts for their trades, which amplifies their potential profits and losses.

When you decide to trade on margin, you’re essentially entering into a short-term loan agreement with your broker. The loan allows you to trade larger positions than you could solely with your own capital. The margin requirement, typically expressed as a percentage, represents the portion of the full trade value you must have in your trading account.

Example:

Imagine you’re interested in trading the GBP/USD currency pair. Let’s say the current price of GBP/USD is 1.3000. If you wish to trade one standard lot, which is 100,000 units, without margin, you’d need the full value of the trade, i.e., $130,000. However, with a broker offering a 1% margin requirement, you’d only need to deposit $1,300 into your account to open the same position. This means you’re controlling a $130,000 position with just $1,300 of your own money. Learn what lot size is in forex.

Leverage vs Margin: What’s the Difference?

While both leverage and margin are integral to Forex trading, they serve different purposes and are not synonymous.

Leverage refers to the ability to control a large trade position using a relatively small amount of capital. It is often expressed as a ratio, such as 100:1, which means that for every $1 of your capital, you can control a position worth $100. Learn more about what is leverage in trading .

Margin, on the other hand, is the actual amount of money required to open a leveraged position. It acts as a security deposit and is based on the leverage ratio offered by the broker.

Example:

To illustrate, using the previous example with the GBP/USD pair, If a broker offers 100:1 leverage, this means you can control a $130,000 position with just $1,300 (which is the 1% margin requirement). The leverage determines the size of the trade position you can control, while the margin determines how much you need to open that position.

How Does Margin in Forex Work?

Trading on margin is similar to using leverage in the financial markets. When you use margin, you’re essentially borrowing capital from your broker to control a larger position. This allows traders to amplify their exposure to the market without committing the full capital required for a trade.

What is Margin Requirement & Required Margin?

Margin Requirement is the percentage of the total trade value that a broker requires a trader to deposit into their account to open a leveraged position. It is regarded as a safety net for the broker as it ensures that traders have enough capital to cover their potential losses. Learn how to choose a broker.

Required Margin, on the other hand, is the actual dollar amount needed to open a position. It’s derived by multiplying the margin requirement (as a percentage) with the total position size.

Example:

If you wish to trade a position worth $100,000 and your broker has a margin requirement of 2%, the required margin would be 2% of $100,000, which is $2,000. This is the amount you need to deposit to open that position.

How to Calculate Margin in Forex

To calculate the margin in Forex, you simply multiply the margin requirement by the total position size. The formula is:

Margin = Total Position Size x Margin Requirement

Using the above example, if you’re trading $100,000 with a 2% margin requirement, the margin would be:

Margin = $100,000 x 0.02 = $2,000

Why are Margin Calculations Important?

Margin calculations play a pivotal role in forex trading for several reasons:

Risk Management:

Knowing the margin requirement helps traders understand how much capital they need to allocate for a trade, ensuring they don’t overextend themselves.

Trade Size Determination:

By understanding margin calculations, traders can determine the maximum position size they can control based on their available capital.

Avoiding Margin Calls:

Regularly calculating and monitoring used and free margin helps traders avoid margin calls, ensuring they always have enough capital in their accounts to cover potential losses.

Example:

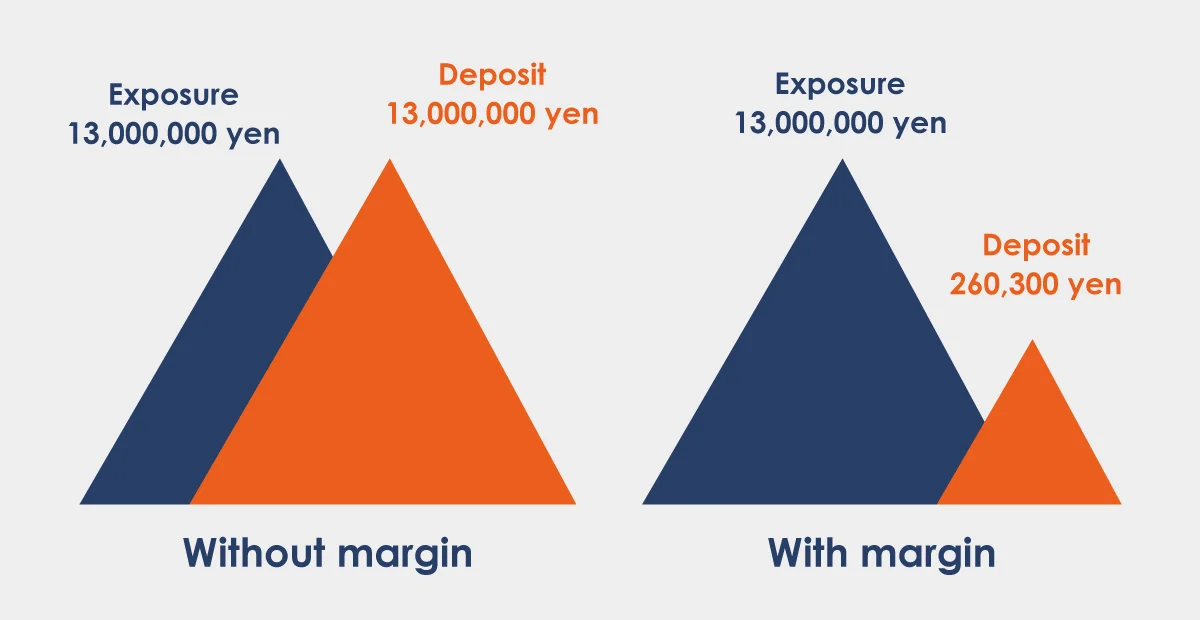

Consider a scenario where you believe the EUR/JPY currency pair, currently priced at 130.00, is set to rise. You decide to buy one standard lot, equivalent to 100,000 units. Without margin, you’d need the full value of the trade, which is 13,000,000 yen (or its equivalent in your base currency). However, with a 2% margin requirement, you’d only need to deposit 260,000 yen to open this position. This means you’re controlling a 13,000,000 yen position with just 260,000 yen of your own funds.

As the price of the EUR/JPY pair moves, the profits or losses are magnified based on the full value of the trade, not just the margin you’ve deposited. If EUR/JPY rises to 131.00, you’d make a profit based on the full 100,000 units, not just the 2% margin you’ve put up.

Types of Margin in Forex

As a Forex trader, understanding the different types of margin is a crucial part of effective risk management. Margin isn’t just a one-size-fits-all concept; there are specific types of margins that traders should be aware of, each serving a unique purpose in the trading process.

Free Margin:

Free margin refers to the amount of money in a trading account that remains available to open new positions. It acts as a buffer or cushion, representing the funds not currently tied up in active trades. The free margin is calculated by subtracting the margin used for open positions from the total equity (balance + or – any profit or loss from open positions).

Example:

Imagine you have a total of $10,000 in your trading account. Without any open positions, your entire balance is considered your free margin, allowing you flexibility in deciding how much of it to use for trading.

Initial Margin:

The initial margin, often termed the “entry margin,” signifies the minimum amount of capital required to open a new trading position. It’s essentially a security deposit, ensuring traders have sufficient funds to cover potential losses from the outset of their trade.

Example:

Suppose you’re keen on trading the USD/CAD currency pair, currently priced at 1.2500. If you’re aiming to trade one standard lot (100,000 units) and your broker mandates a 1% initial margin requirement, you’d need to set aside $1,250 as your initial margin to commence the trade.

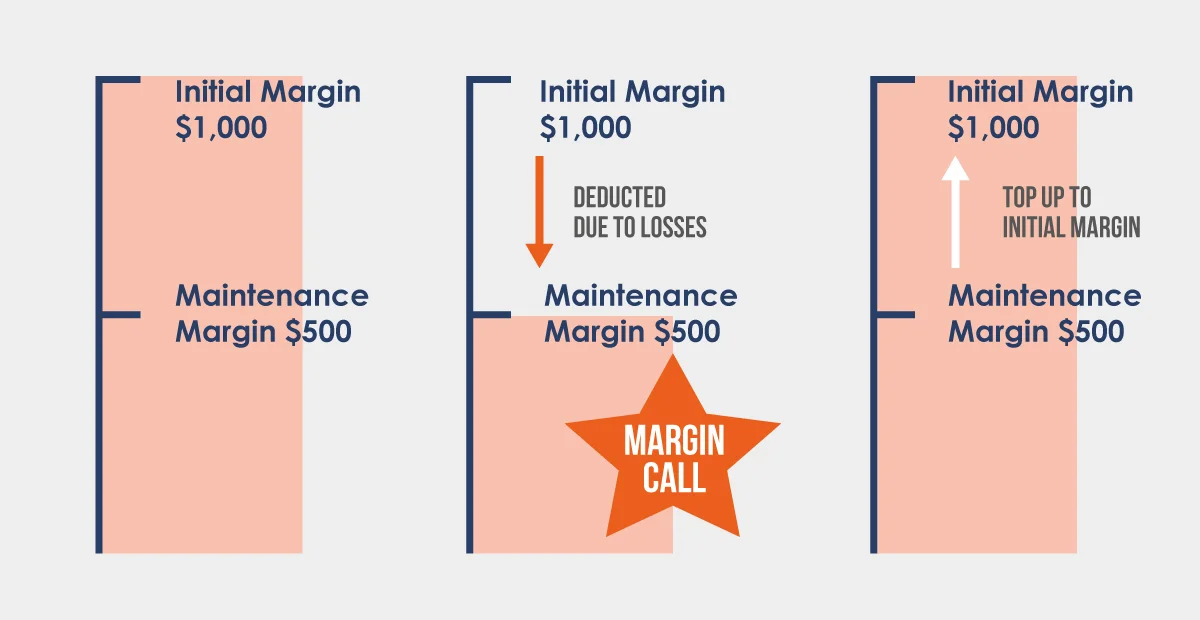

Maintenance Margin:

Maintenance margin is the minimum amount of money traders must retain in their trading account to keep a position open. If the account balance dips below this level due to unfavourable market movements, a margin call is triggered, urging traders to either deposit more funds or close out positions to meet the requirement.

Example:

Continuing with the USD/CAD scenario, if the broker’s maintenance margin is set at 0.5%, for your trade of one standard lot, you must always maintain at least $625 in your account. Should a market downturn cause your balance to drop below this threshold, a margin call would be initiated.

By understanding these different types of margins, traders can effectively manage their funds, optimize their trading strategies , and safeguard against potential losses in the Forex market.

Margin Call in Forex

A margin call is one of the most crucial concepts in Forex trading that every trader should be well-acquainted with.

What is a margin call ?

A margin call is a critical alert in the world of Forex trading . It acts as a protective mechanism for both the broker and the trader, ensuring that trading accounts do not go into a negative balance due to adverse market movements.

When trading on margin, traders essentially use borrowed funds from their broker to control larger positions. The broker will issue a margin call if the market moves against a trader’s position and the account balance approaches the maintenance margin. This is an alert or a demand from the broker for the trader to either deposit additional funds into their account or close some or all of their open positions to restore the account balance to the required maintenance margin level.

Example:

Imagine you, as a trader, have an account balance of $5,000. You decide to open a position in the EUR/USD pair with a 1% margin requirement, controlling a position worth $100,000. This means you use $1,000 of your balance as the initial margin.

However, unexpected news causes the EUR/USD pair to move against your position. As the losses mount, your account balance drops to $3,500. If your broker has a maintenance margin of 0.5% (or $500 for your position), and considering your initial margin of $1,000, you’re left with only $2,500 as a buffer. If the losses continue and your free margin approaches the maintenance margin level, the broker will issue a margin call. Learn how to trade EUR/USD.

Consequences of a Margin Call

The immediate consequence of a margin call is that the trader must act swiftly. They have a few options:

Deposit Additional Funds:

This is the most straightforward solution. By adding more money to the trading account, the trader can meet the margin requirements and keep their positions open.

Close Some or All Open Positions:

By closing positions, especially those that are not performing well, the trader can release the used margin and restore their account balance.

Broker Intervention:

If the trader doesn’t act in time, the broker might automatically close some or all of the trader’s positions to prevent further losses. This is known as a “stop out,” and the specific level at which this occurs varies by broker.

To avoid reaching a margin call:

Stay Informed:

Regularly monitor your account balance, margin level, and market news that might impact your positions.

Use Stop-Loss Orders:

This allows you to set a predetermined level at which your position will automatically close, limiting potential losses.

Trade Conservatively:

Especially if you’re a beginner, it’s wise not to use the maximum leverage available. Start with lower leverage until you’re more experienced.

6 Tips for Safe Margin Trading

Trading on margin is a double-edged sword, offering the potential for significant profits but also posing the risk of substantial losses. To navigate the complexities of margin trading safely, traders should adhere to certain best practices.

Understand Your Broker’s Margin Requirements:

Different brokers have varying margin requirements. You must familiarize yourself with these requirements and ensure you always have enough capital in your account to meet them.

Example:

Two brokers might offer different leverage ratios, such as 50:1 and 100:1. While the latter allows you to control a larger position with the same amount of capital, it also increases the risk. If you deposit $1,000, a 1% adverse move with 50:1 leverage could result in a $500 loss, but with 100:1 leverage, that same move could result in a $1,000 loss. Learn about the types of brokers .

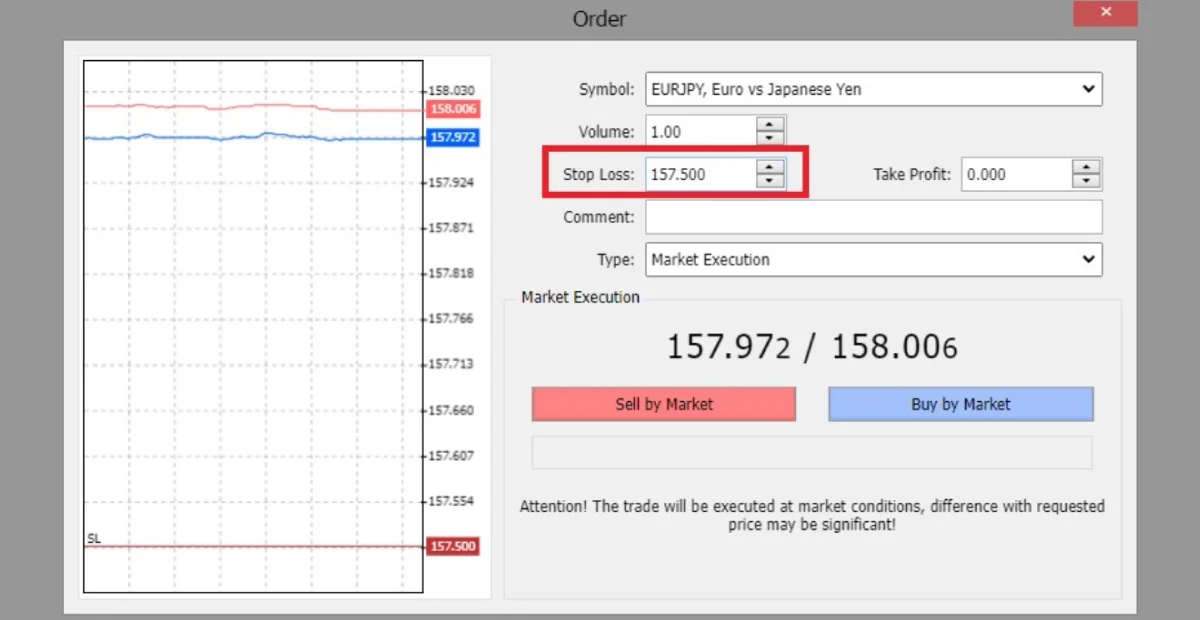

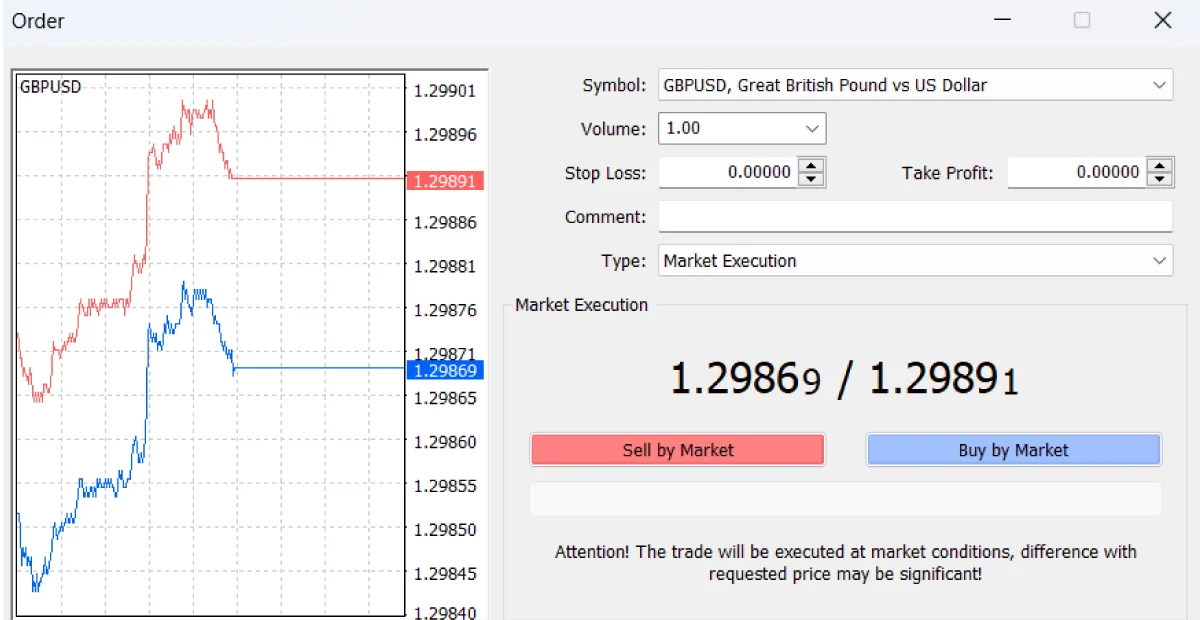

Use Stop-Loss Orders:

A stop-loss order automatically closes a position once it reaches a predetermined price level, limiting potential losses. It is a safety net that ensures you don’t lose more than you’re willing to risk.

Example:

If you open a position in the GBP/USD pair at 1.3000 and set a stop-loss at 1.2950, your trade will automatically close if the price drops to 1.2950, limiting your loss to 50 pips. Learn more about what is pip in forex .

Regularly Monitor Your Positions:

Stay updated with market news and regularly check your open positions. This proactive approach helps you react promptly to market changes and adjust your strategies accordingly.

Educate Yourself:

Continuous learning is key. Attend webinars, read books, and participate in trading forums to gain insights and learn from experienced traders.

Avoid Overleveraging:

Simply because you can control a large trade position with a small amount of capital doesn’t mean you should. Overleveraging can trigger significant losses. Determine a leverage level that is aligned with your risk tolerance.

Example:

Even if your broker offers 200:1 leverage, it might be prudent to use only 50:1 or even less, especially if you’re new to trading or uncertain about market conditions. Learn why leverage is high in the Forex market .

Maintain a Healthy Free Margin:

Always ensure you have enough free margin in your account. This acts as a buffer against adverse market movements and reduces the likelihood of a margin call.

Learn how to become a trader .

Benefits and Risks of Trading on Margin

Trading on margin amplifies both the potential rewards and risks of the Forex market. By understanding these dual aspects, traders can make informed decisions and strategize effectively.

Benefits of Trading on Margin:

Increased Buying Power:

Margin trading allows you to control large trade positions with less capital. Therefore, this means that even with limited funds, you can gain exposure to a significant position in the market.

Flexibility:

Margin provides traders with the flexibility to maximise their trading opportunities without having to deposit the full value of each trade.

Potential for Higher Returns:

Since you’re controlling a larger position, even small market movements can result in significant profits. This leverage can amplify your returns relative to your initial investment.

Example:

Suppose you have $2,000 in your trading account. With a 1% margin requirement, you can control a position worth $200,000. If the currency pair you’re trading moves in your favour by just 1%, instead of making a $20 profit (1% of $2,000), you stand to gain $2,000 (1% of $200,000) due to the power of leverage. Learn how to trade forex.

Risks of Trading on Margin:

Margin Calls:

If your account balance falls below the maintenance margin, you’ll face a margin call, which may force you to deposit additional funds or close positions at a loss.

Interest Charges:

Some brokers charge interest on the money you borrow to open a margin position. Over time, these charges can accumulate, especially if you hold positions open for extended periods.

Potential for Higher Losses:

Just as margin trading can amplify profits can be amplified, it can also magnify losses can be magnified. If the market moves against your trade position, you can lose a significant amount portion or even all of your initial investment.

Example:

Continuing from the previous example, if the currency pair moves against your position by 1%, instead of losing just $20, you could lose $2,000 due to the leveraged nature of the trade. This is a significant portion of your initial capital, highlighting the risks involved.

What Margin Rates Does ATFX Offer?

ATFX implements a tiered margin system, which means that the broker sets varying margin requirements based on different exposure levels.

Below is a representation of margin rates when engaging in popular forex pairs with ATFX:

Find out the 10 most traded currencies in the Forex market .

How to Trade on Margin

To start trading on margin, follow these steps:

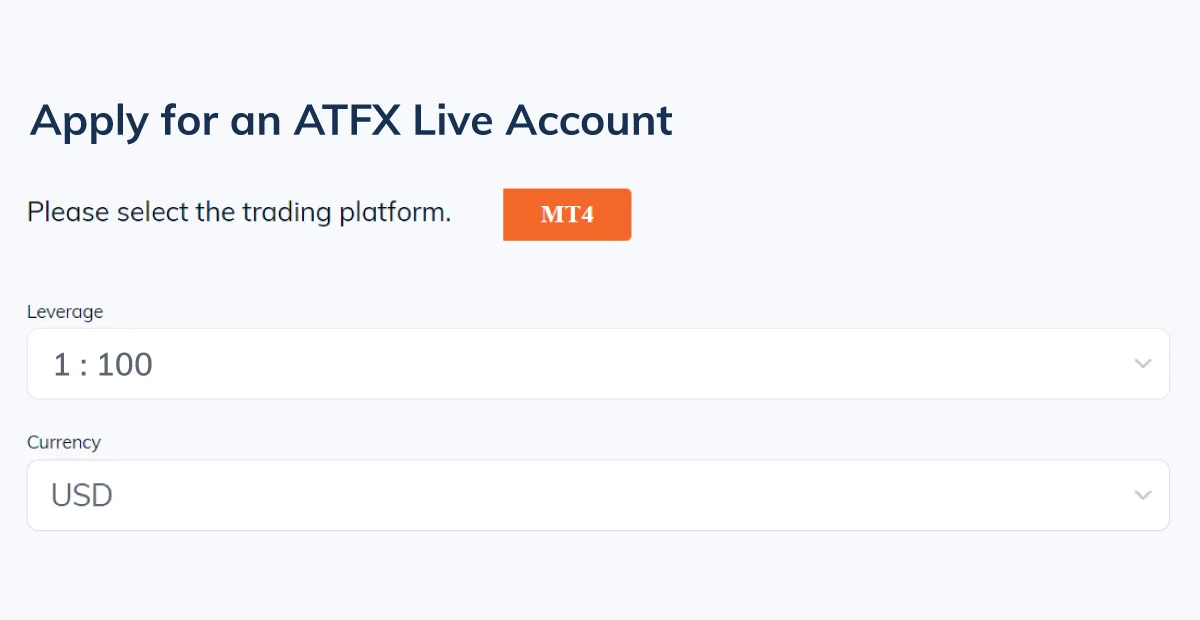

Create an ATFX account or log in to your existing account.

Create a live account and log in via MetaTrader 4 .

Search for the asset you want to trade via the Market Watch list and select it.

Choose your volume (position size)

Click on ‘buy’ or ‘sell’ in the order window and confirm the trade.

Open a live account or a demo account today.