Table of content

- What is Trend Trading?

- Basics of Trend Trading

- 5 Key Trend Trading Strategies

- 4 Pros and Cons of Trend Trading

- Case Study: Successful Trend Trading

- 3 Main Market Indicators for Trend Trading

- Conclusion

Start Your Trend Trading Journey with ATFX

I. What is Trend Trading?

Trend trading is a popular investment strategy used by investors in different markets like the stocks, forex, and commodities markets. Investors adopt this strategy intending to benefit from price momentum moving in a particular direction called a trend. This strategy is based on the popular adage, “the trend is your friend”. Traders look for patterns and signals that indicate a trend is starting or continuing, then attempt to profit from that movement.

II. Basics of Trend Trading

One must first understand the concept of a trend to utilise trend trading strategies effectively. Generally, there are 3 types of trends:

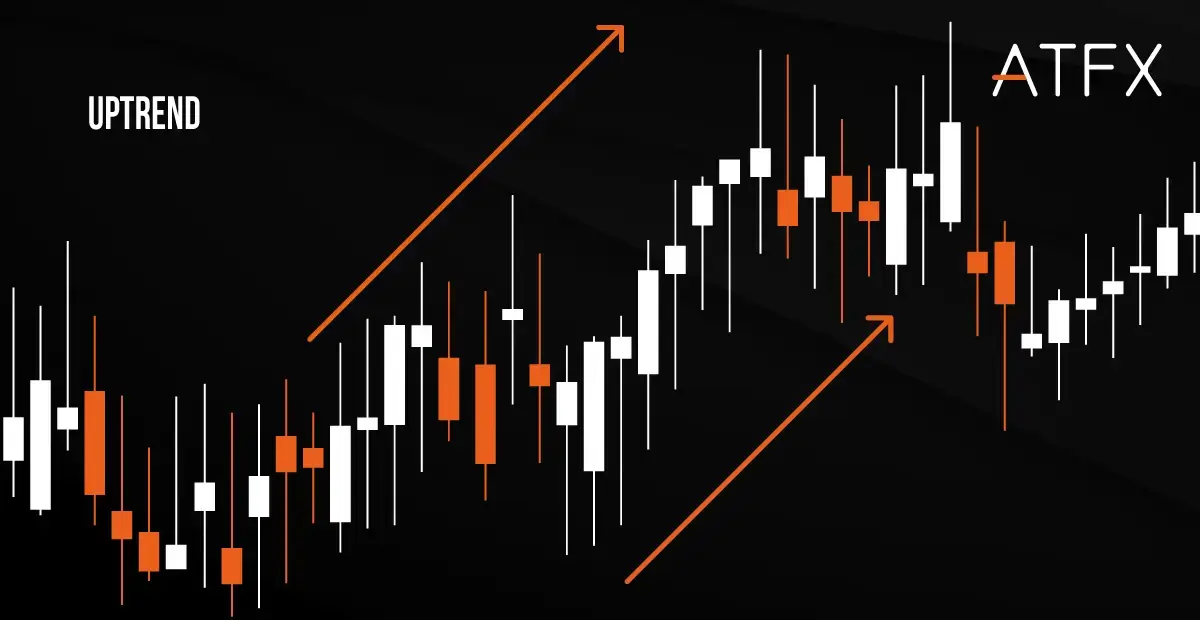

1. Uptrend:

Characterized by a series of higher highs and higher lows in price, indicating a bullish or upward trend.

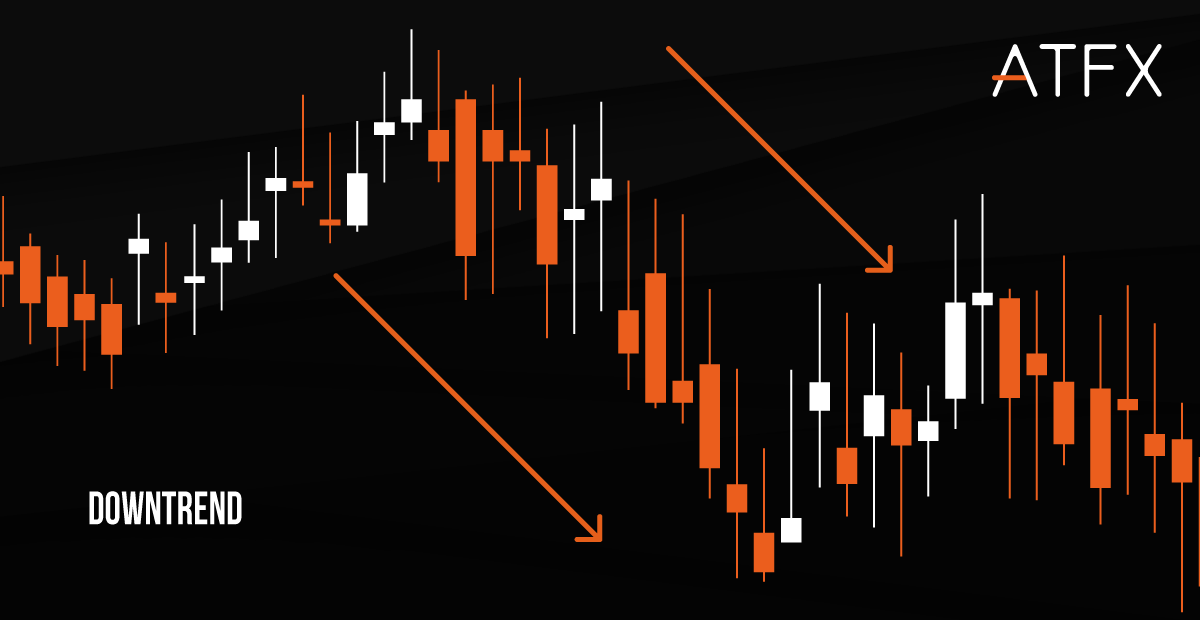

2. Downtrend:

Unlike an uptrend, downtrends exhibit a pattern of lower highs and lower lows, suggesting a bearish or downward trend.

3. Sideways/Horizontal Trend:

A sideways/horizontal trend occurs when the price is alternating between rising and falling and is stuck in a range as buyers and sellers are fighting for control. When the price is neither rising nor falling significantly over time, it’s described as moving sideways or ranging.

Trends can occur over various timeframes. Traders might specialize in short-term (intraday or a few days), intermediate-term (a few weeks), or long-term (several months to years) trends, depending on their trading style and risk tolerance.

III. 5 Key Trend Trading Strategies

Several strategies have been developed over time to capitalize on trend trading:

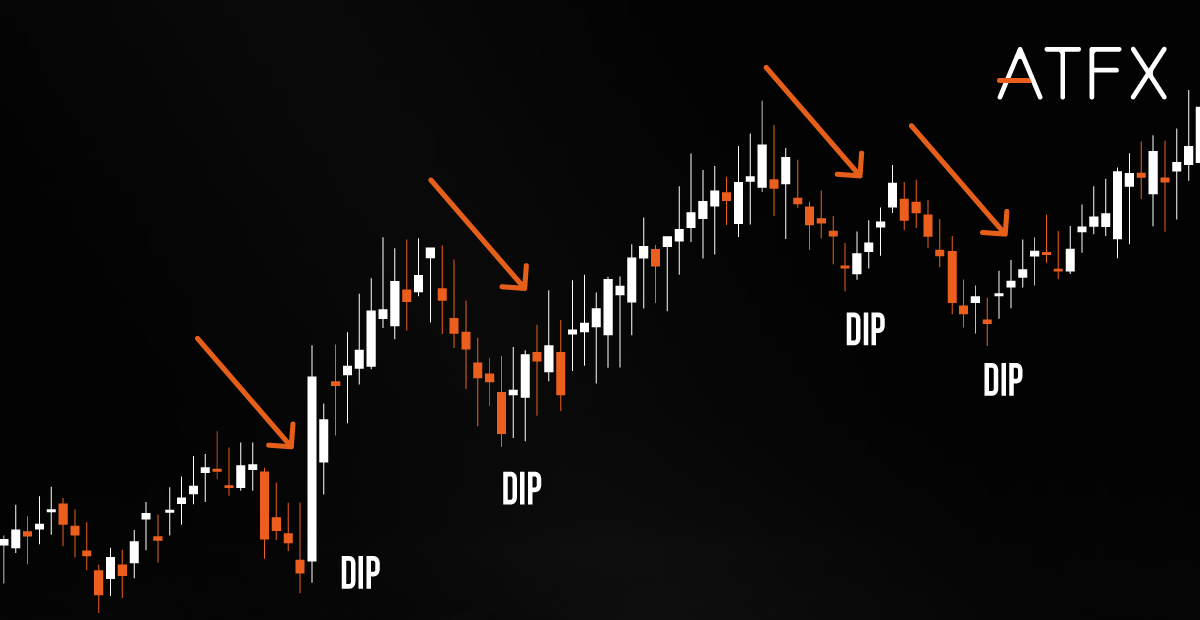

1. Buy the dips:

This strategy involves buying when prices pull back or when there is a ‘dip’ in an uptrend, as investors bet that the trend will continue upwards.

2. Sell the rallies:

This is the opposite of ‘buy the dips’, where traders sell when prices bounce back or ‘rally’ in a downtrend, anticipating that the trend will resume its downward trajectory.

3. Moving Average Crossovers:

A trader buys or sells when shorter and longer-term moving averages cross over each other, which is often seen as a signal that the trend is about to change direction.

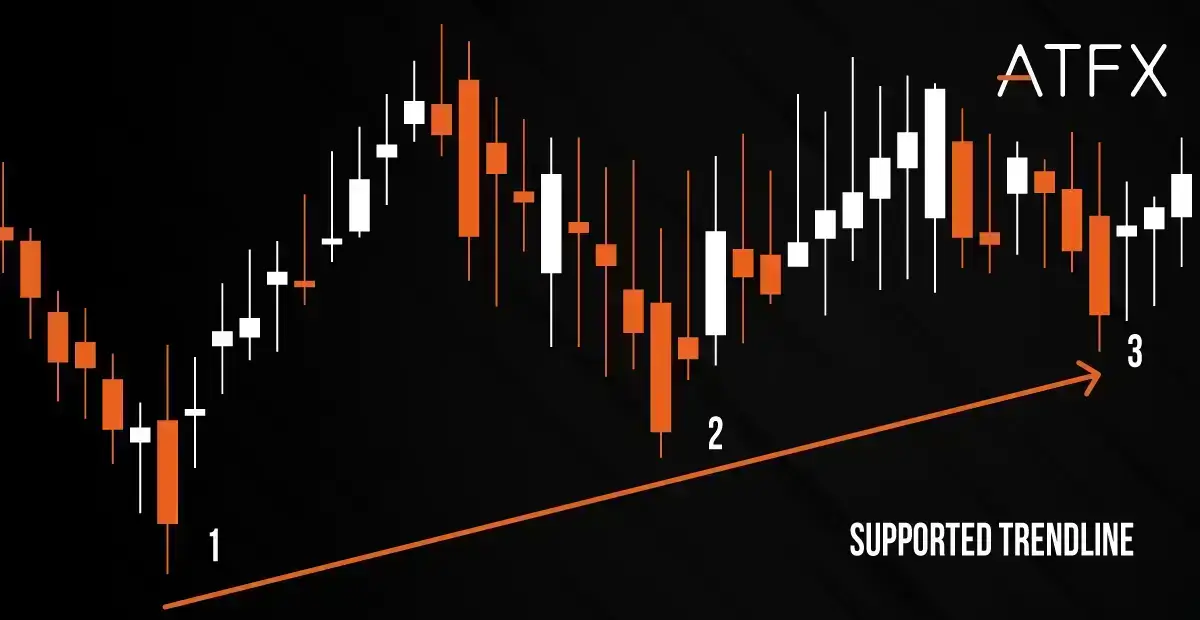

4. Trendline Trading:

Trendlines are drawn between significant highs and lows on a price chart. A trader typically aims to enter a trade when the price touches the trendline.

5. Channel Trading:

Channels are formed by drawing 2 parallel trendlines around the price. Traders usually aim to buy near the lower trendline (support) and sell near the upper one (resistance).

IV. 4 Pros and Cons of Trend Trading

Advantages of Trend Trading | Disadvantages of Trend Trading |

Profit Potential: If a trader can identify a strong trend and successfully ride it, there is substantial profit potential. | False Signals: Sometimes, what appears to be a trend may just be a short-term fluctuation in price, leading to false signals and potential losses. |

Simplicity: Trend trading strategies can be easier to understand and implement than some other strategies, making them suitable for both beginner and experienced traders. | Requires Patience: Trends can last for an extended period, and significant profits usually require waiting for the trend to fully play out. This can test a trader’s patience. |

Risk Management: Trend trading usually has clear levels where traders can place stop-loss orders helping them manage their risk well and exit when the trend reverses. With proper stop-loss orders in place, traders can effectively manage their risk by setting predetermined levels to exit the trade if the trend reverses. | Lagging Nature: Trend trading strategies are often based on technical analysis indicators, which can lag behind the current market price. By the time a trend is identified, it may be late to take the trade. |

Versatility: Trend trading can be applied to any market (stocks, forex, commodities) and in any timeframe (short, intermediate, long). | Dependent on Market Conditions: Trend trading strategies work best in markets that exhibit strong trending behaviour. In markets that are range-bound or highly volatile, these strategies may perform poorly. |

V. Case Study: Successful Trend Trading

Consider the story of legendary trader Paul Tudor Jones, who successfully used trend trading during the 1987 stock market crash. Recognizing the signs of a severe downtrend, Jones shorted the market, resulting in significant profits when the market plunged.

His story is a testament to the power of trend trading and a reminder that it requires skill, patience, and rigorous analysis.

VI. 3 Main Market Indicators for Trend Trading

Market indicators are statistical measures used by traders to forecast price movements. They can be separated into 2 primary categories: leading indicators, which aim to predict price movements, and lagging indicators, which confirm trends.

Here are some of the most commonly used indicators in trend trading:

1. Moving Averages (MA):

Moving Averages smooth out price data by creating a constantly updated average price. This helps to filter out the “noise” from random price fluctuations. The 2 most common types are the Simple Moving Average (SMA), which averages the prices over a specified period, and the Exponential Moving Average (EMA), which gives more weight to recent prices. When the price is above the moving average, it signifies an uptrend; when it’s below, it indicates a downtrend. A Moving Average Crossover, where a shorter-period MA crosses a longer-period MA, often confirms a new trend.

The 5 to 20-period moving averages are considered the fast, and 50-period and above MAs are considered slow.

If the fast period moving average crosses above the slow period, then it signals an uptrend. In contrast, if the fast period cross below the slow period MA, it typically signals a downtrend.

2. Relative Strength Index (RSI):

The RSI is a momentum oscillator that measures the speed and change of price movements. The RSI is a number between 0-100 used to identify overbought or oversold market conditions. When the RSI is above 70, the market is regarded as being overbought and due for a pullback or reversal. Conversely, if it falls below 30, the market is considered to be oversold and due for an upward bounce. However, in a strong trend, markets can remain overbought or oversold for long periods.

If the RSI is above 70, it means overbought, get ready to sell, whereas if the RSI is below 30, it means oversold, get ready to buy.

3. Moving Average Convergence Divergence (MACD):

The MACD is a trend-following momentum indicator that shows the relationship between 2 moving averages of an asset’s price. The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA. A nine-day EMA of the MACD called the “signal line” is then plotted on top of the MACD line, which can trigger buy and sell signals. Traders may buy the security when the MACD crosses above its signal line and sell (or short) the security when the MACD crosses below the signal line.

If the green bars end and a red bar appear, and the MACD line is below 0, it means to get ready to sell. In contrast, if the red bars end and a green bar appear, and the MACD line is above 0, it means to get ready to buy.

ATFX provides software platforms such as the MetaTrader 4, which offers advanced charting capabilities and a range of technical indicators to assist traders in their analysis.

Traders have access to various tools, but it’s important to remember that no indicator is perfect. Every technique has its merits and faults, and using multiple forms of analysis together with a well-crafted trading approach is recommended.

VII. Conclusion

Trend trading is a potent strategy that, when employed effectively, can offer substantial profits. The key to successful trend trading is identifying strong trends, accurately timing entries and exits, and managing risk diligently. It’s crucial to remember that while the trend can be a trader’s friend, markets can shift quickly and unexpectedly. Thus, continuous learning, discipline, and adaptability remain vital ingredients in the pursuit of successful trend trading.

Start Your Trend Trading Journey with ATFX

Harness the power of the MetaTrader 4 platform with its advanced charting tools and key market indicators. Learn and grow with ATFX’s comprehensive training materials and practise risk-free with a broad range of financial products.

Don’t just dream of becoming a successful trader – start living it! Open your demo account today with ATFX and make your first move in the dynamic world of trend trading.