歐洲央行議息會後,重申貨幣政策保持彈性,不會排除年底前考慮加息,言論提振歐羅,兌美元由1.11反彈至1.14水平。歐羅反彈,美元曾跌至95邊緣。隨後美國公佈一月非農就業數據理想,較預期(15萬人)及上月(19.9萬人)增加至46.7萬人。一月失業率為4%,較上月3.9%微升。另外,平均時薪月率和年率分別上升,其中年率升幅明顯報5.7%,較上月4.7%及預期5.2%增長。美國就業數據改善,市場注視聯儲局加息步伐,美元從三星期低位回升,但仍未能收復96關失地。

料美隨時再為期油發聲

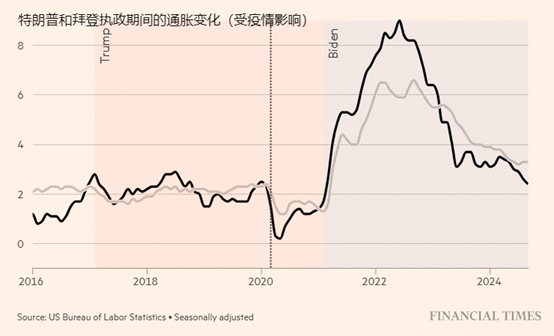

週四公佈美國一月CPI及首領失業救濟金人數被受關注,其中CPI年率預期為7.2%,核心CPI預期升至5.9%,如結果達到預期,將會是美國40年來通脹最高水平。隨時觸動美國政府及聯儲局聯手行動為通脹降溫。市場普遍預期,聯儲局為壓抑通脹,加息步伐和幅度將會提升,估計三月份聯儲局將會宣布加息,而幅度可能升至0.5%而並非0.25%。相關信息可能從同日FOMC票委、克利夫蘭聯儲主席就美國經濟和貨幣政策前景講話時透露或指引。若更多數據和信息支持美國加息步伐加快,美元將有望重拾升勢,初目標指向96.20或重返97關。技術上若一月份低位94.6失守,下行趨勢將可能展開或下探93.78。

美國政府與全球持續通脹高企的最大原因直指國際油價暴漲所至,近期美國期油和布蘭特期油分別升上90美元以上創七年高位,相信美國拜登政府隨時再度發聲,借壓抑油價的言論對抗美國通脹高企問題。若國際油價被成功打壓,對加拿大元將有直接影響。近期油價持續高企,美元兌加元重上1.28前遇阻,倘若油價回落後美元兌加元打開1.2832阻力,將會上望1.2962。反之,若油價持續上升,美元兌加元或再下試1.2562或1.2502支持位。