Tuesday’s trading session brings inflation figures for the European and Canadian economies.

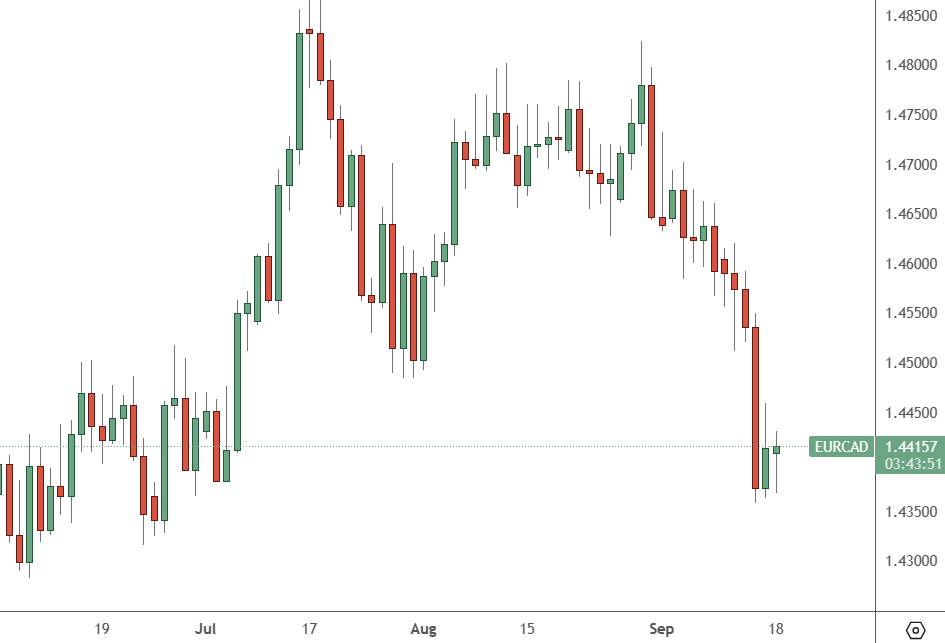

EURCAD: Daily Chart

EURCAD clumped last week after the surprise rate hike by the ECB. The pair now trades at 1.4415.

Higher oil prices were also a big factor in the Canadian dollar’s gain last week. The price of oil jumped above $90 as traders continued to price the latest production cuts from Saudi Arabia and Russia.

The two big energy producers had planned to cut production into the end of September but have extended that to the end of the year. There are also other factors driving crude prices higher, despite a weakened global economy.

Tomorrow sees core inflation released for the European economy, but it is a final reading and may not stray too far from the 5.3% reading expected. The European Central Bank surprised traders last week with another 25-bps interest rate hike.

The European Central Bank raised interest rates by a quarter of a percentage point to 4% on Thursday and hinted it was done with its protracted campaign of rate hikes to tame stubborn inflation.

The central bank has now raised its interest rate at 10 consecutive meetings, taking it to the highest level ever since the euro currency launched in 1999.

Based on its current assessment, key interest rates “have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target,” the bank said in a statement. ECB President Christine Lagarde defended Thursday’s decision, saying: “I think it will reinforce progress towards the target; we’re determined to get there, to that 2%.”

The ECB expects inflation to “still remain too high and for too long,” she said. “But inflation has declined, and we want it to continue to decline and reinforce that process,” she added.

Tomorrow brings more focus on inflation, but this time in Canada, with the release of core inflation and the country’s main inflation rate. Core inflation is expected to be at 3.2% year-on-year, while the headline rate is expected to be 3.8%. Analysts have said that the BoC may be finished with its own interest rate levels at the current time.