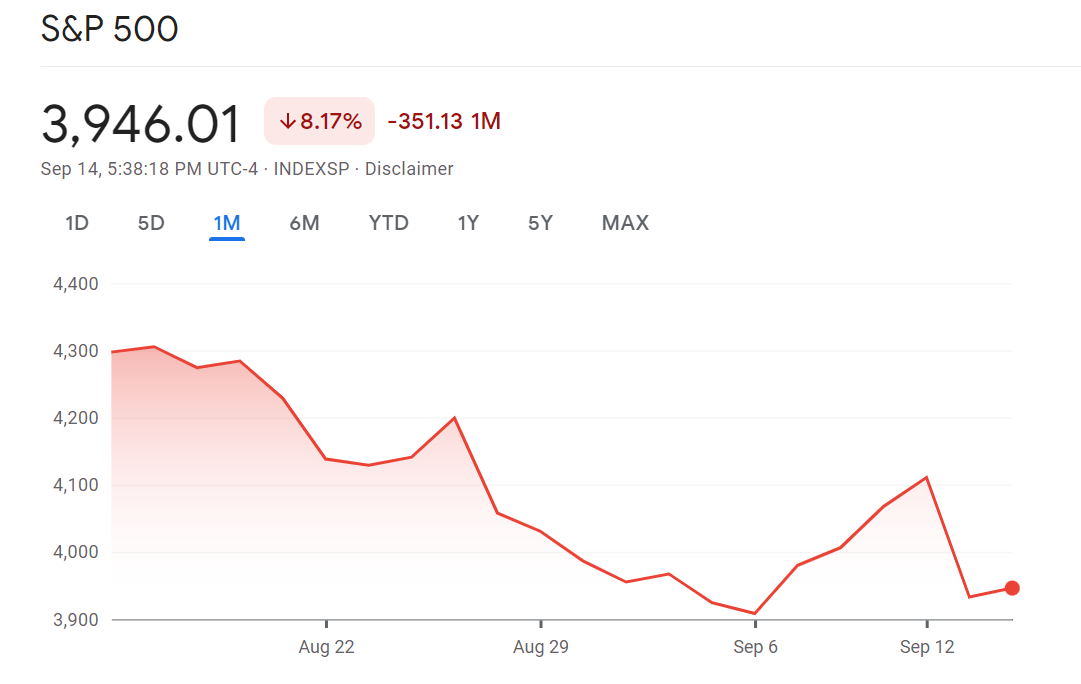

Recently, US stocks have been fluctuating. The August US CPI data showed that the headline and core CPI prints were higher than expected, making the Fed’s swap transactions price in a September rate hike of 75 basis points. After the news release, the three major US stock indexes closed lower. The Dow Jones index fell 3.9%, the Nasdaq index fell about 5.2%, and the S&P 500 index fell 4.3%.

The US stock market has currently priced in a 75 basis point rate hike in September, but what makes the market uneasy is the possibility of a 100 basis point rate hike. If the Fed finally chooses to raise interest rates aggressively to combat rising inflation, US stocks may fall again. At the same time, macroeconomic news also determines the trend of US stocks. This week’s August annual PPI data rose 8.7%, lower than the expected 8.8%, reflecting the decline in energy prices has cooled inflation slightly. After the data was released, US stocks regained stability.

On the other hand, investors need to be cautious about the high valuations of US stocks, which are likely to be adjusted lower in the future. For example, the current S&P 500 price-earnings ratio is 17 times, which is not a low valuation. Moreover, if there is a recession in the future, most companies will lower their profit expectations, which is likely to have a significant impact on the US stock markets. Therefore, the upcoming economic data is a top priority for investors in US stocks to monitor. As for September, I believe that the stock market has already started to digest the potential impact of the Fed’s aggressive interest rate hikes. Therefore, unless the interest rate hike exceeds 75 basis points, I believe it will not significantly impact the US stock market performance.

On the other hand, investors need to be cautious about the high valuations of US stocks, which are likely to be adjusted lower in the future. For example, the current S&P 500 price-earnings ratio is 17 times, which is not a low valuation. Moreover, if there is a recession in the future, most companies will lower their profit expectations, which is likely to have a significant impact on the US stock markets. Therefore, the upcoming economic data is a top priority for investors in US stocks to monitor. As for September, I believe that the stock market has already started to digest the potential impact of the Fed’s aggressive interest rate hikes. Therefore, unless the interest rate hike exceeds 75 basis points, I believe it will not significantly impact the US stock market performance.

In terms of sectors, the energy sector has accumulated significant gains since the beginning of this year. However, with the advent of the peak oil demand season in winter, the risks of fuel shortages and continued increase in electricity prices mean that energy stocks still have room to rise, despite the current oil price being relatively high. Oil prices had fallen sharply earlier, but many leading energy companies chose to pass on the higher profits to investors through special dividends and stock repurchases. In addition, the price-to-earnings ratio is lower than the market’s overall P/E ratio, so there is still some upward potential.

Financial stocks are also a key focus among investors since interest rate hikes tend to widen their net interest margin on loans, which helps financial stocks increase their profits. Generally speaking, financial stocks are the biggest beneficiaries of interest rate hikes. However, investors must also pay close attention to the negative impact of interest rate hikes on the financial industry, especially investment banks, whose business tends to slow down. Recently, Goldman Sachs broke the news that it was about to lay off about 100 people. Due to the rising financing costs for enterprises triggered by the interest rate hikes, the number of IPOs has dropped sharply, resulting in a sharp decline in the revenues of its investment banking division. The trend may continue to drag down the overall profits of related companies.

Both the Dow and S&P 500 have been rising since September. The market had expected inflation data to turn higher, but the results were better than expected. As a result, there will be significant differences in US stock market trends in the future. However, some market participants believe that if energy prices continue to fall in the future, the inflation pressure will gradually decrease, which is beneficial to US stocks.

However, investors cannot ignore downside factors from a critical point of view, especially given that fears of a US recession may rise with the aggressive pace of interest rate hikes, challenging the stock market outlook. The US CPI will likely remain high during the winter peak energy use period. If the CPI data does not fall as expected by the market, especially during the current situation where the core CPI may not fall but rise. The Fed may maintain its hawkish policies for longer, which will not be good news for the stock market.