The Russian-Ukrainian conflict and the Federal Reserve’s Tighter Monetary Policies have further increased borrowing costs, exacerbating concerns about lower consumer demand. Tonight, the US Durable Goods Orders for April are expected, and the market is focused on the fact that this month’s forecast fell more than half to 0.5% from the previous 1.1%. Still, the durable goods order rate excluding shipments is expected to rise by 0.6%. So what does it mean for the US economy and the US dollar outlook if durable goods orders expand as expected?

Durable goods orders data reflects the market’s current economic conditions and the manufacturing industry’s future production commitments. When durable goods orders fall sharply, it tends to reflect weakness within the manufacturing industry, which leads to an increase in the unemployment rate, causing the US economic performance to become more vulnerable. Conversely, durable goods orders tend to rise when the economy is booming.

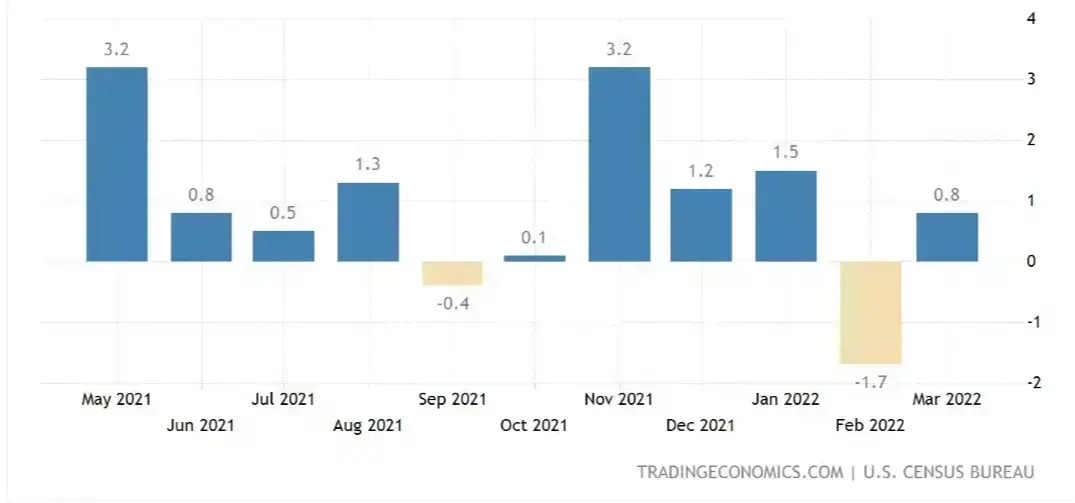

As for the March data, US durable goods orders rose 0.8% (preliminary) after a 1.7% decline in February, but the lowest gain since February 2021. In addition, US plant orders rose 2.2% month-on-month in March, exceeding market expectations. The figures reflect a more robust performance of capital expenditures in the US in March and the continued strong market demand.

However, yesterday’s preliminary US Markit Manufacturing PMI for May was 57.5, a three-month low, indicating a declining amount of business activity. Sub-data showed that the index of outstanding orders had increased mainly due to the continued shortage of raw materials, the delay in suppliers’ delivery, and the increase in interest rates and production costs. In addition, as US inflation reaches a 40-year high, the Fed has curbed inflation by raising interest rates, increasing the risk of a US economic recession.

Real GDP in the US fell at an annual rate of 1.4% in the first quarter of 2022, well below expectations of 1.1% growth, which exacerbated the current expectations of slowing US economic growth or even a recession. Furthermore, some economists have expressed great concern about the current interest rate hiking policy, which will increase investment costs and further stifle economic growth. This is also reflected in the sharp decline of the forecast for durable goods orders, reflecting poor performance of US business investment in new equipment during the quarter. However, it will also be necessary to see which aspect of new orders, such as aircraft, industrial equipment and other durable goods, fell sharply compared with the previous month and whether there was an overall decline.

On the other hand, economists expect the US economy to return to moderate growth in the second quarter and beyond, mainly due to continued growth in consumer spending, which rose 0.9% quarter-on-quarter in April.

As for the future trends of the US dollar, investors need to pay close attention to the release of the latest Fed meeting minutes, combined with the changes in manufacturing and durable goods production, orders, prices and other key indicators, to have a comprehensive look at the macroeconomic trend.

Forecast

The US dollar’s future remains unclear, as the dollar index recently ended its rally, recording its biggest weekly decline since January, and refreshing the intraday lows near 102.60. The release of serial indicators towards the year end have become crucial in forecasting the economy’s future direction. It will also clarify the dollar’s subsequent movements. If the data signals a weakening of the overall economic trend, it may also continue to drag the dollar lower. In addition, due to the conflict between Russia and Ukraine, the sanctions standoff between Western countries and Russia is still ongoing. Suppose the Fed indicates that it will maintain a more aggressive interest rate hike policy in the latest meeting minutes. In that case, these factors will increase the market expectations for the US dollar’s excellent performance in future.