Want to learn how to trade the USD/JPY forex pair? You’re in the right place! This guide explains everything – from the basic steps to smart strategies. We use easy examples and clear numbers to help you understand this crucial pair. Let’s start your USD/JPY trading journey together.

Table of content

- What is USD/JPY trading?

- Understand why you should trade USD/JPY

- Understand the factors influencing USD/JPY

- Choosing a trading platform for USD/JPY

- Create your USD/JPY demo trading account

- Develop your trading strategies for USD/JPY

- Transition to live trading and place your first trade

- Always monitor your trades & update your trading strategy

- Understand and avoid common USD/JPY trading mistakes

Ready to practice USD/JPY trading without putting in real money?

1. What is USD/JPY trading?

USD/JPY trading is buying or selling the US Dollar (USD) against the Japanese Yen (JPY) in the forex market. Traders trade the USDJPY pair to make a profit. The USD/JPY price tells you how much Japanese yen you must exchange for one US dollar. Traders predict whether the USDJPY price will go up or down and make their trades based on their analysis and predictions. Learn more about what forex trading is & how it works.

2. Understanding why you should trade the USD/JPY

The USD/JPY is one of the ‘major’ currency pairs in the forex market and is widely favoured by traders for multiple reasons. Learn also: Is forex trading profitable?

A. High liquidity:

USD/JPY is a ‘major’ pair with high trading volume. This means you can easily buy or sell it without impacting its price. Learn more about the 10 most traded foreign currencies in forex market.

B. Low spreads:

High liquidity leads to low spreads (the difference between the buying and selling price). This reduces your trading costs.

C. Economic and geopolitical events:

Big events in the U.S. and Japan can cause large price movements. Traders can profit if they predict these movements correctly.

D. Market hours:

The forex market is open 24/5, but the Asian trading session (Tokyo) often offers unique opportunities for trading the USD/JPY due to higher activity. Learn why are forex markets open 24 hours a day.

E. Technical analysis:

The USD/JPY pair is widely analyzed using technical indicators. These can help predict future price movements.

F. High volatility:

The USD/JPY price can change rapidly. This can create opportunities for traders to generate significant returns.

The chart above shows the volatility of USD/JPY on a weekly timeframe.

3. Understand the factors influencing USD/JPY

Several factors can affect the USD/JPY price, fluctuating over time.

A. Interest rates:

The interest rates set by the Bank of Japan (BoJ) and the Federal Reserve (Fed) are the primary factor influencing the USD/JPY price. For example, if the BoJ keeps its rates steady while the Fed raises interest rates, this could make the USD stronger than the JPY, causing the USD/JPY price to rise. Learn more about how Fed rate hikes affect the forex market.

B. Economic indicators:

Economic reports such as Gross Domestic Product (GDP), the unemployment rate, and inflation data usually influence the USD/JPY price. Robust economic data from the US can make the USD stronger than the JPY and vice versa.

C. Political stability:

Political stability can play a significant role in influencing the strength of a country’s currency. Political instability or uncertainty in the US or Japan could lead to a decline in the value of their respective currencies.

D. Investor Outlook:

The mood or sentiment in the market, which is reflective of the collective investor outlook, can also impact the USD/JPY exchange rate. In situations of market turmoil or anxiety, investors often prefer purchasing more JPY due to its perceived safety compared to the US dollar, leading to a decrease in the USD/JPY pair.

E. Geopolitical events:

Worldwide events, such as trade disputes or changes in global relations, can greatly impact currency pairs. For example, the trade conflict between the US and China in 2018 resulted in the yen strengthening against the dollar due to its reputation as a safe-haven currency.

Learn more about factors that influence exchange rates in the forex market and 10 major participants in the forex market.

4. Choosing a trading platform for the USD/JPY

The choice of a trading platform can significantly affect your trading experience and outcomes when trading the USD/JPY pair.

A. Technical analysis tools:

Apart from understanding market trends, these tools can also help you formulate, backtest, and implement your own trading strategies. A platform like ATFX provides an assortment of advanced MT4 technical analysis tools and features for developing your own trading strategy. Learn why technical analysis is important in forex trading.

B. Customer service:

An efficient customer service team can quickly solve any issues you encounter, ensuring your trading activities face minimal disruption. ATFX, for example, offers exceptional customer service through various channels such as live chat, phone, and email.

Check out ATFX reviews.

C. Educational resources:

These resources improve your understanding of the forex market and offer useful insights and tips for effectively trading the USD/JPY pair. ATFX has a comprehensive learning centre with guides on forex trading, webinars, and regular market news updates.

D. Regulation:

A regulated platform must abide by the rigorous standards set by the regulatory authorities, providing extra reassurance about the platform’s reliability and the safety of your funds. ATFX, for instance, is regulated by the UK’s Financial Conduct Authority (FCA), one of the leading regulatory authorities globally.

Read more about ATFX regulatory compliance that keeps your trading safe.

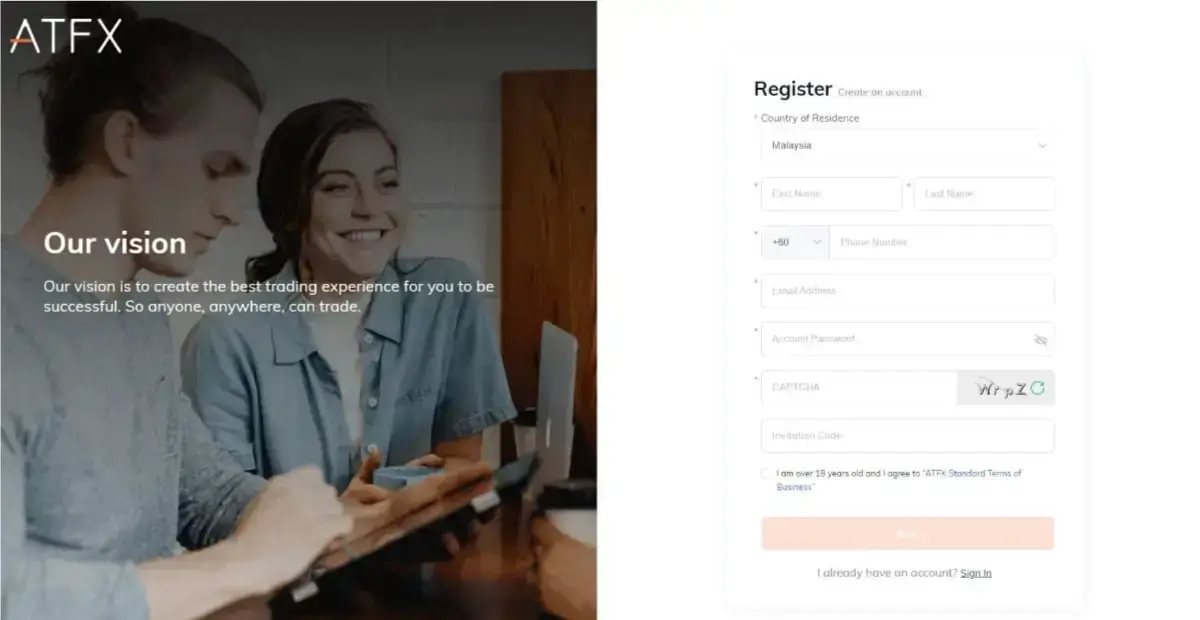

5. Create your USD/JPY demo trading account

To start, open a demo account on the ATFX website. This will let you practice trading the USD/JPY without risk, keeping your money safe.

After you sign up, you need to confirm your account. You do this by giving ATFX the ID documents they ask for. Remember, you don’t have to put real money into your trading account until you are ready. Learn how to trade forex for beginners.

A demo account lets you take your time learning about ATFX’s tools and features. This way, you can get used to how things work. It is all about ensuring you feel ready and confident when trading using real money. Use this chance to practice and build up your confidence before moving on to trading the USD/JPY with real money.

6. Develop your trading strategies for the USD/JPY

Different trading strategies can be used when trading the USD/JPY based on your risk tolerance, trading style, and market conditions.

A. Trend following:

This strategy involves identifying and following the existing trend in the USD/JPY pair. For example, if the trend is upward, a trader would buy the USD/JPY, expecting the price to rise further.

The chart above displays the USD/JPY trend during an uptrend, signified by multiple tests of the trendline that occurred throughout the period. Learn how forex traders use candlestick charts to analyze trends.

B. Breakout strategy:

This strategy is used when the price of the USD/JPY moves outside a defined support or resistance level with increased volume. A trader using this strategy would buy the pair when the price breaks above a resistance level and sell it when it breaks below a support level.

The chart above shows the USDJPY’s breakout from a recent support level, which was tested at least three times, signifying a key change in trend direction to the downside.

C. Swing trading:

This strategy involves taking advantage of price swings in the market. A swing trader would aim to buy the USD/JPY at a low point in its cycle and then sell it at a high point, or vice versa.

The chart above shows the USDJPY pair on a swing high towards the previous resistance level, but it failed to break above it, signifying a change in trend to the downside.

D. Carry trade:

In a carry trade, a trader borrows a currency with a low-interest rate (like the JPY) and uses it to buy a currency with a high-interest rate (like the USD). The aim is to earn the difference in interest rates.

E. News trading:

This strategy involves trading based on economic news and data releases that can affect the USD/JPY exchange rate. A new trader may, for instance, buy the USD/JPY ahead of positive U.S. economic data expecting the USD to strengthen.

F. Scalping:

Scalping involves making numerous trades within a day to profit from small price changes in the USD/JPY pair. It’s a strategy suited for traders who can commit the time and focus required to monitor the market closely.

Learn more about forex trading strategies.

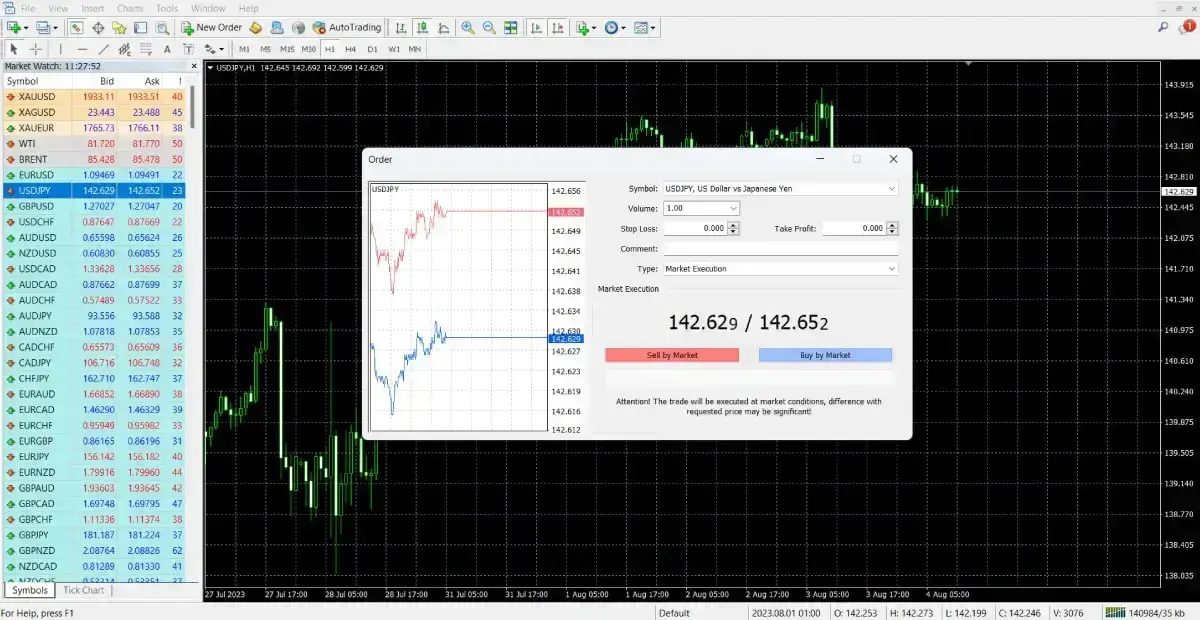

7. Transition to live trading and place your first trade

When you feel good about your trading strategy, you’ll be ready to use a live trading account with ATFX.

First, put some money into the account. This is your starting investment. When you start trading live, utilize the trading strategy and steps you’ve been practicing to manage risk. It is recommended to begin trading with a small amount of money. This will help to keep your risk low while you’re still learning about the fast-moving live market.

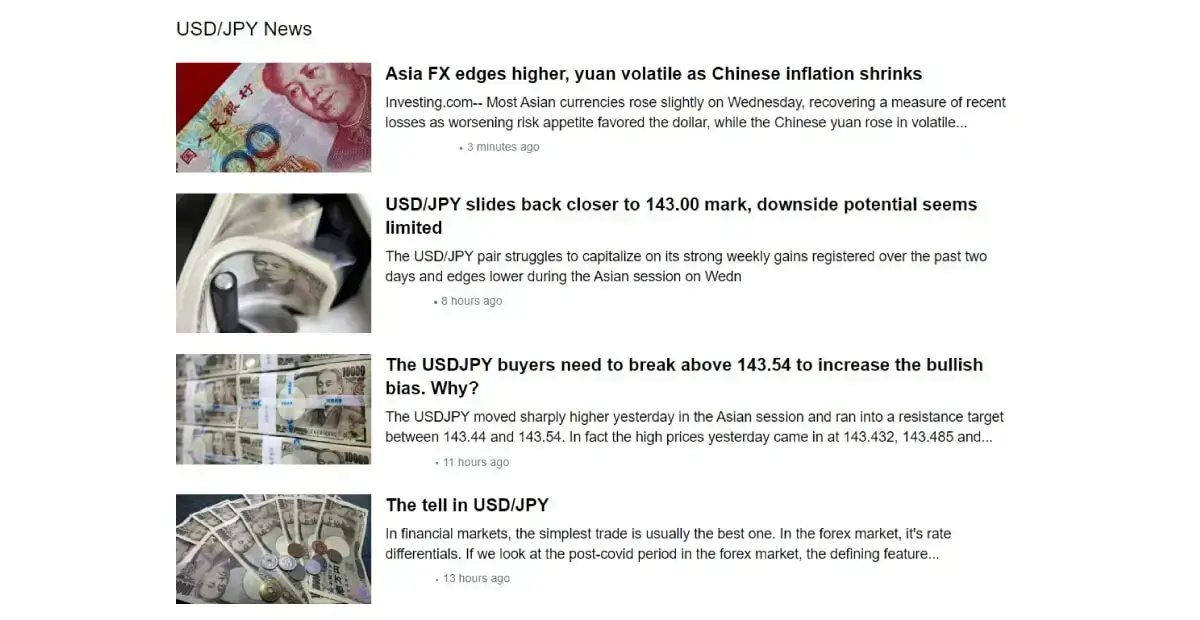

8. Always monitor your trades & update your trading strategy

Stay updated about changes in the USD/JPY pair using ATFX’s educational tools. Regularly visit our blog posts to stay in touch with the newest market news. Also, check out our YouTube channel for useful trading tips and understanding.

Checking how your trades are doing is very important. Always ensure you monitor the progress of your trade and observe how the market is developing. It may be necessary to adapt your trading plan in response to market conditions and your personal growth as a trader. Achieving long-term success as a trader requires continuous learning and the ability to adjust to market changes.

9. Understand and avoid common USD/JPY trading mistakes

A. Overtrading:

Traders sometimes make too many trades based on emotions, leading to losses. Stick to your trading strategy; don’t let your feelings take over.

B. Ignoring economic news:

Economic events can greatly affect the USD/JPY pair. Keep up with important news to avoid unexpected losses.

C. Over-leveraging:

Leverage lets you control big positions with small capital but can lead to major losses if misused. Use leverage wisely and understand its risks. Learn why is leverage high in the forex market.

D. Trading without a plan:

Impulsive trading or trading without a plan can lead to excessive risk. Always trade as part of a well-planned strategy.

E. Lack of education:

By knowing the basics of forex trading and the USD/JPY, traders can avoid making costly errors. Spend time learning about forex trading and the USD/JPY pair.

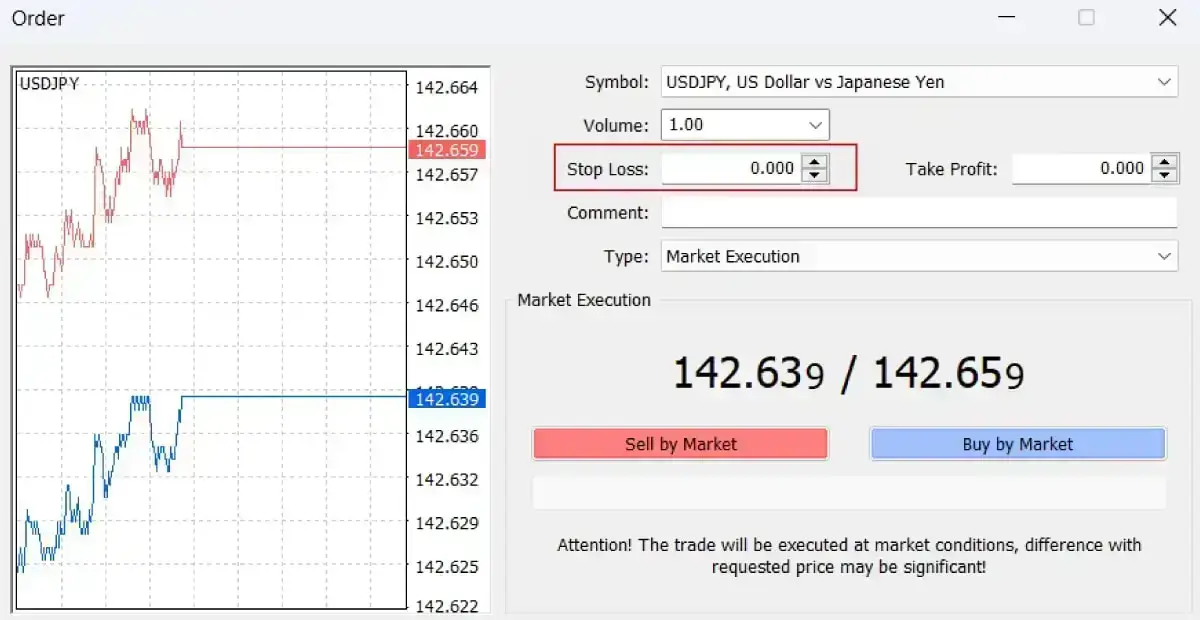

F. Not using stop-loss orders:

Stop-loss orders limit losses if the market moves against you. Always use them to control risk.

Ready to practice USD/JPY trading without putting in real money?

Ready to dive into USD/JPY forex trading? Sign up for a free demo account with ATFX to sharpen your skills. ATFX not only provides a platform for USD/JPY trading, but it also offers numerous other financial products. Its robust trading platform lets you experiment with diverse strategies and gain knowledge from the broker’s guides and educational resources. Don’t miss this chance – grab your free demo trading account today!